The giant 2024 Unity Gaming Report has been released. It is dedicated to trends in game development. If possible, we will briefly tell you about the main thing from the study.

The study is divided into five thematic parts. Each of them focuses on a particular thesis.

The first thesis: "Developers use AI tools to save time"

62% of the companies surveyed by Unity noted that they use AI in their workflows. Most of them said that working with AI allowed them to improve their operations.

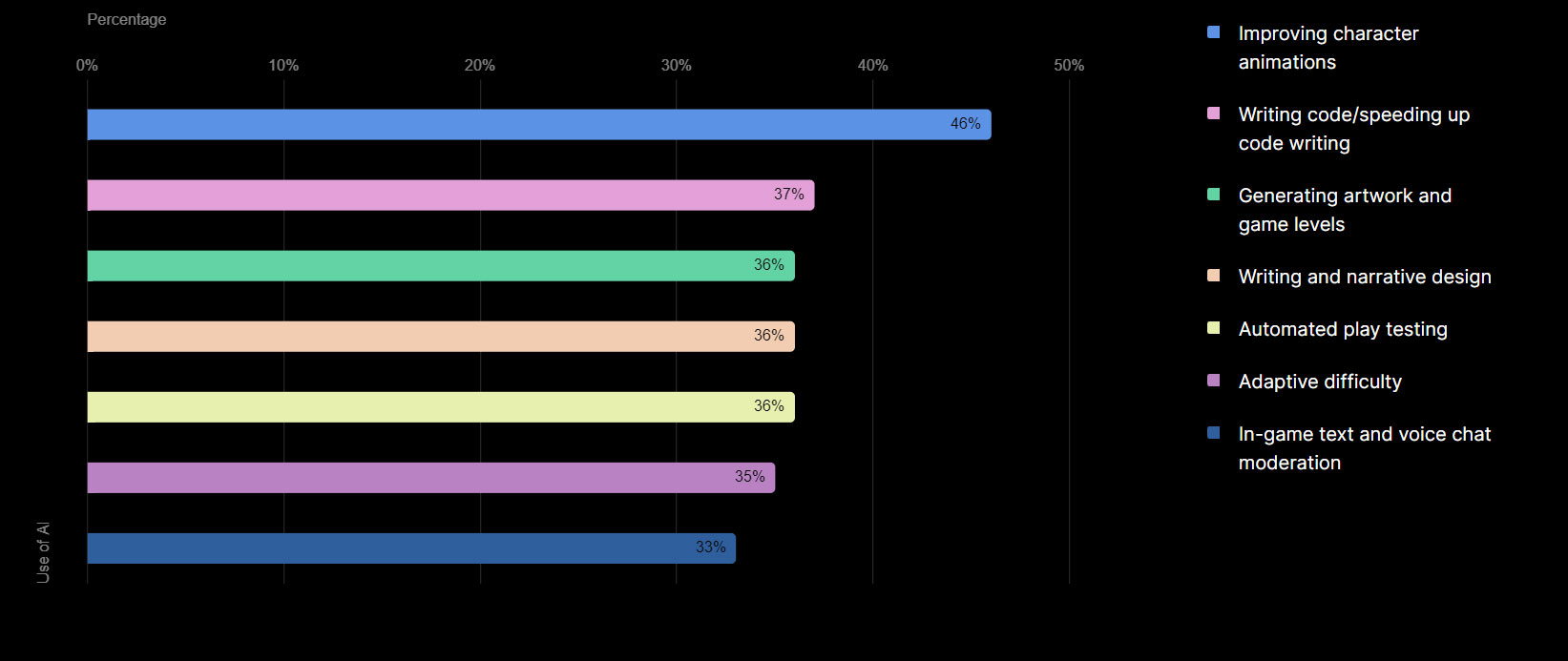

AI is used in completely different scenarios. For example, AI solutions are most often used when working on character animation and when writing code.

The most common scenarios for using AI in game development

Most of the teams that resort to AI explained that they use such tools primarily to speed up prototyping and save time when working on concepts.

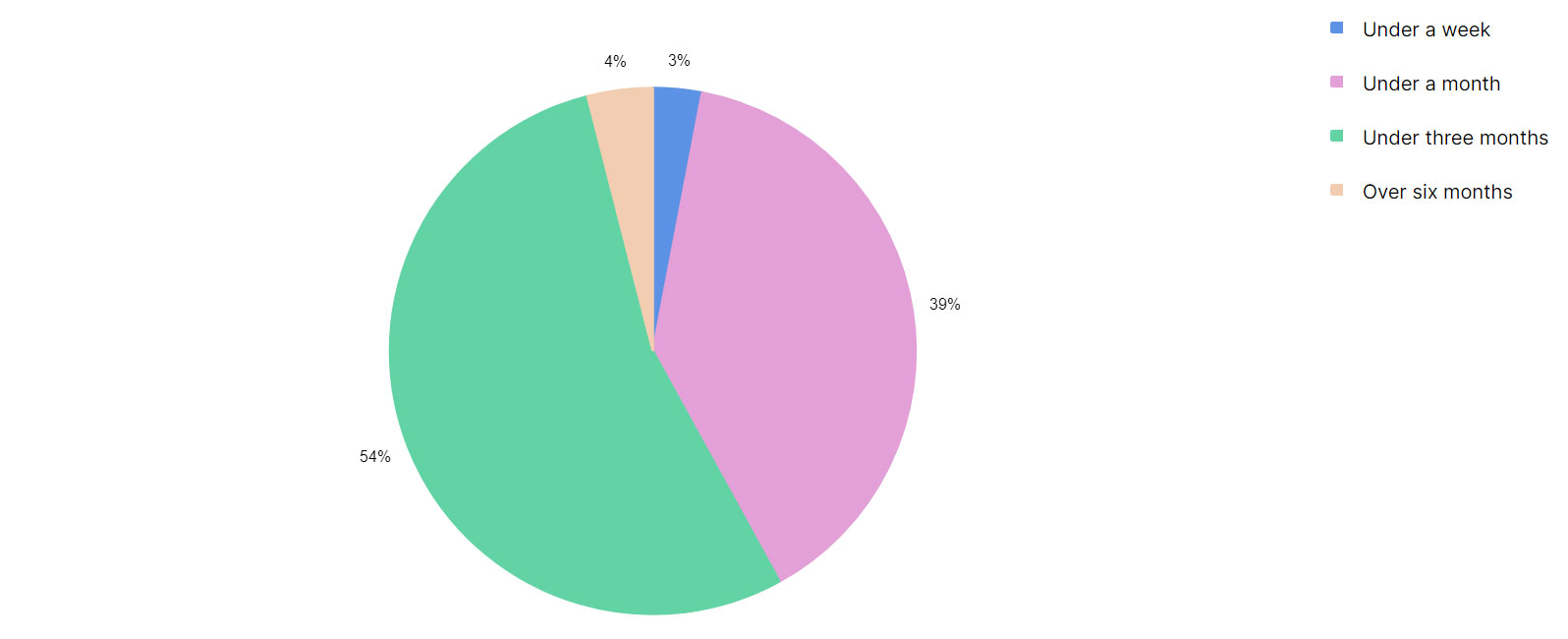

At the same time, prototyping does not last very long for 54% of the respondents — less than three months, and for 39% — less than a month at all.

Duration of prototyping in game studios

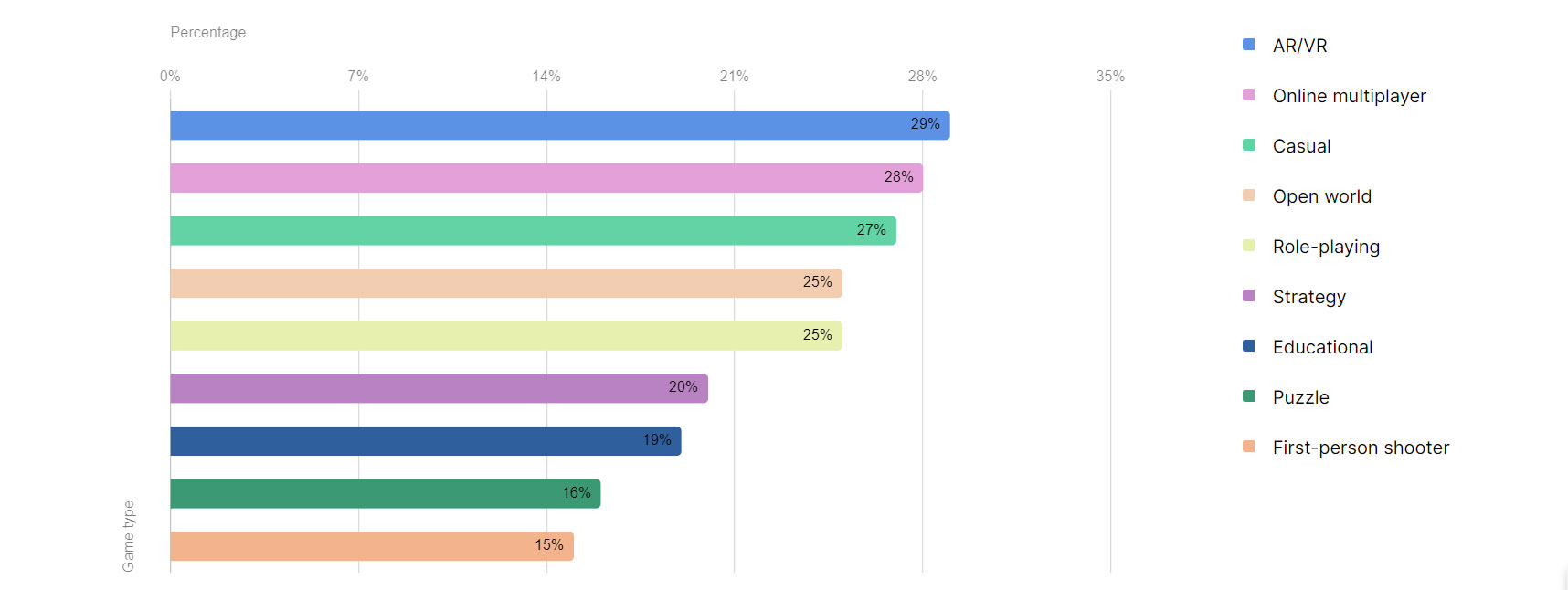

Developers of AR/VR games are most actively using AI tools. Also in the top three most active users are those teams that work on projects with online multiplayer and casual products.

Vertical distribution of games that used AI in their development

Thesis two: "Studios diversify revenue channels"

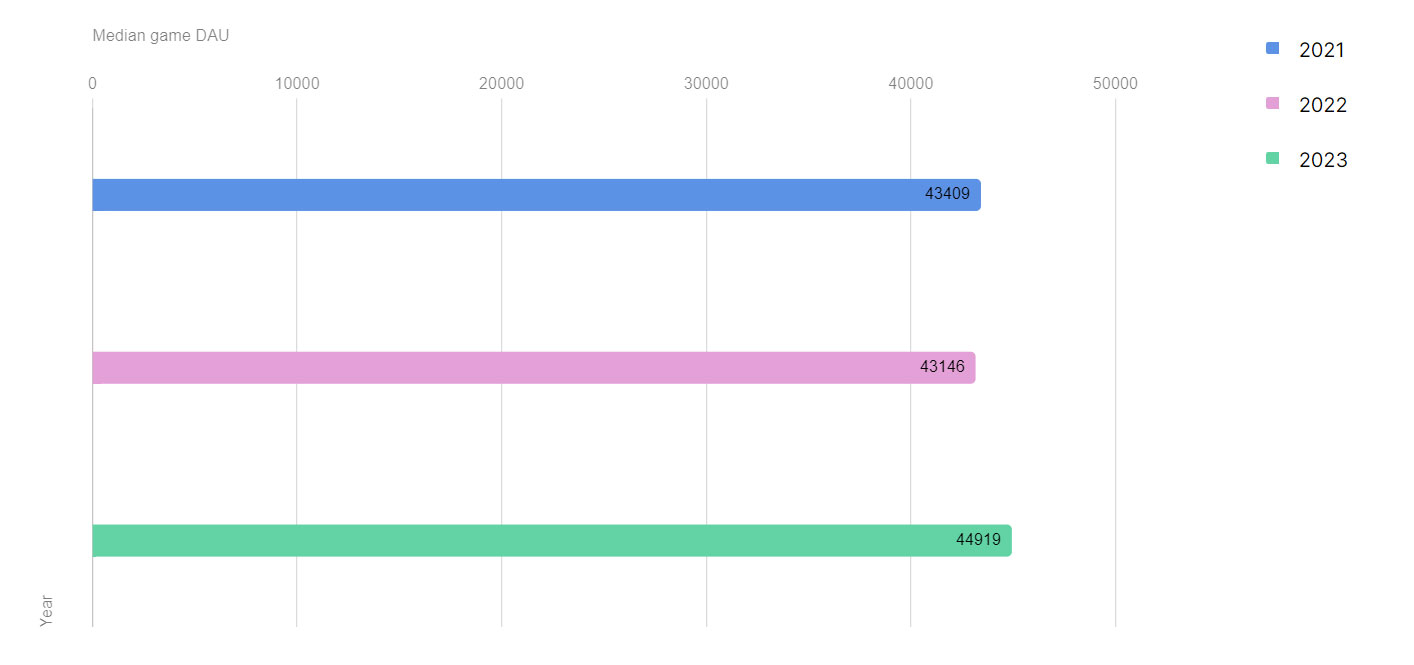

The report approaches this conclusion from afar. The authors of the study begin with the fact that the median gaming DAU in mobile is growing. In 2023, it grew by 4.1%.

Dynamics of the median gaming DAU (2021-2023)

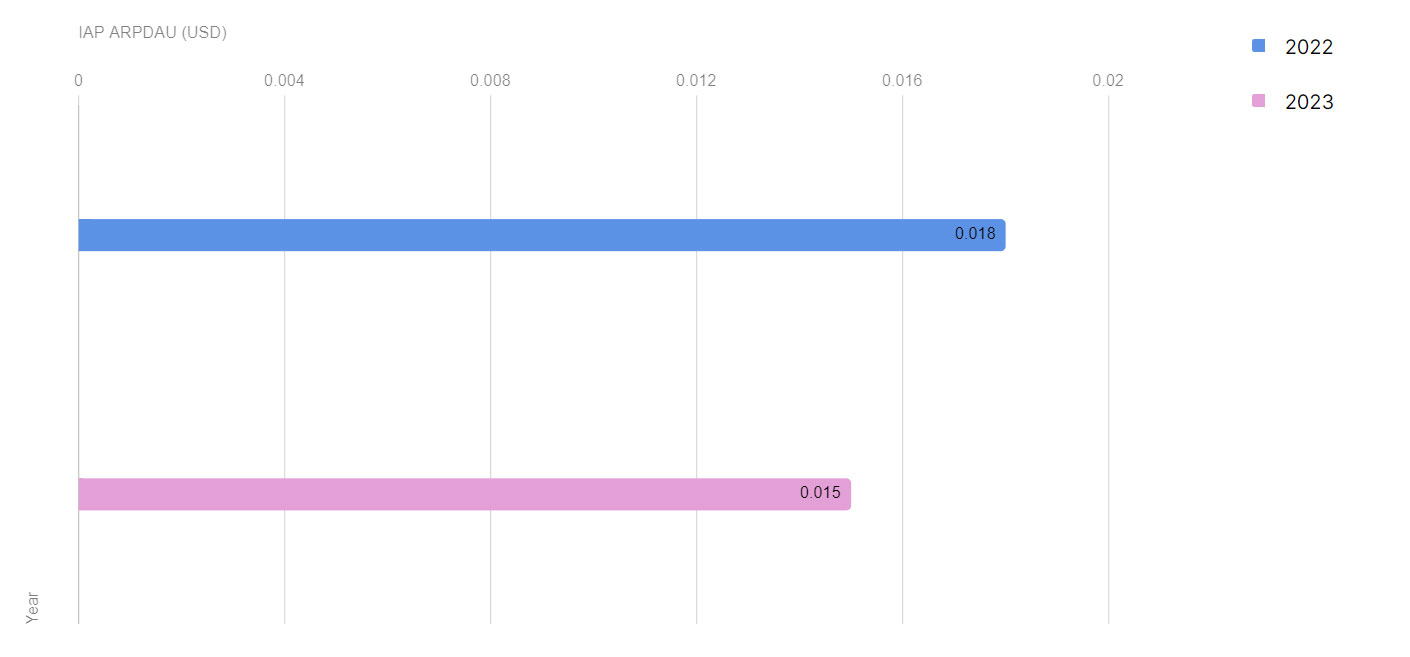

At the same time, the retention and IAP drops. The latter is significant. Over the past year, ARPDAU from micropayments in mobile games fell by 13% compared to the same in 2022.

Dynamics of IAP ARPDAU (2022 — 2023)

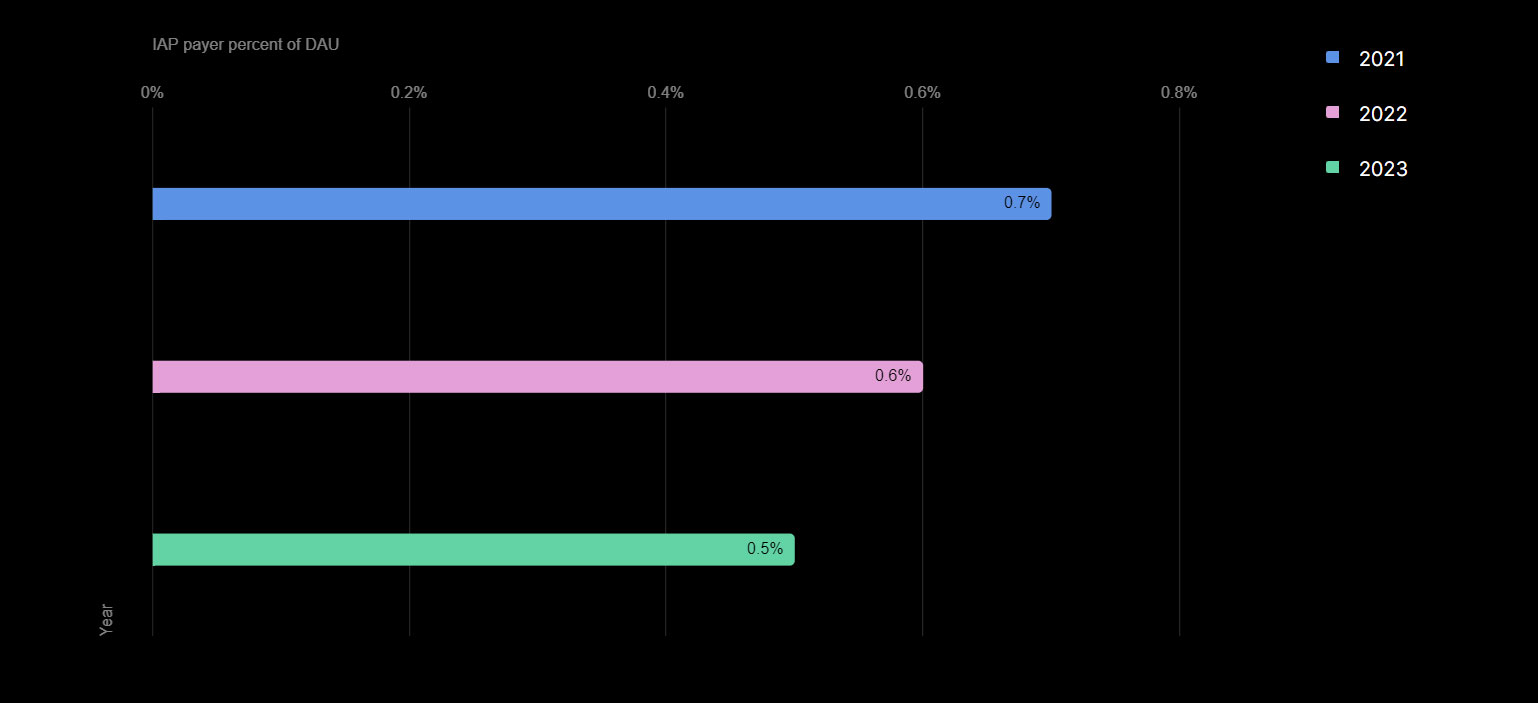

The share of the paying audience is also decreasing. If in 2021 the share of paying users from the total DAU was 0.7%, and in 2022 it was 0.6%, then by the end of last year it was already 0.5%.

Dynamics of the share of paying players from DAU (2022-2023)

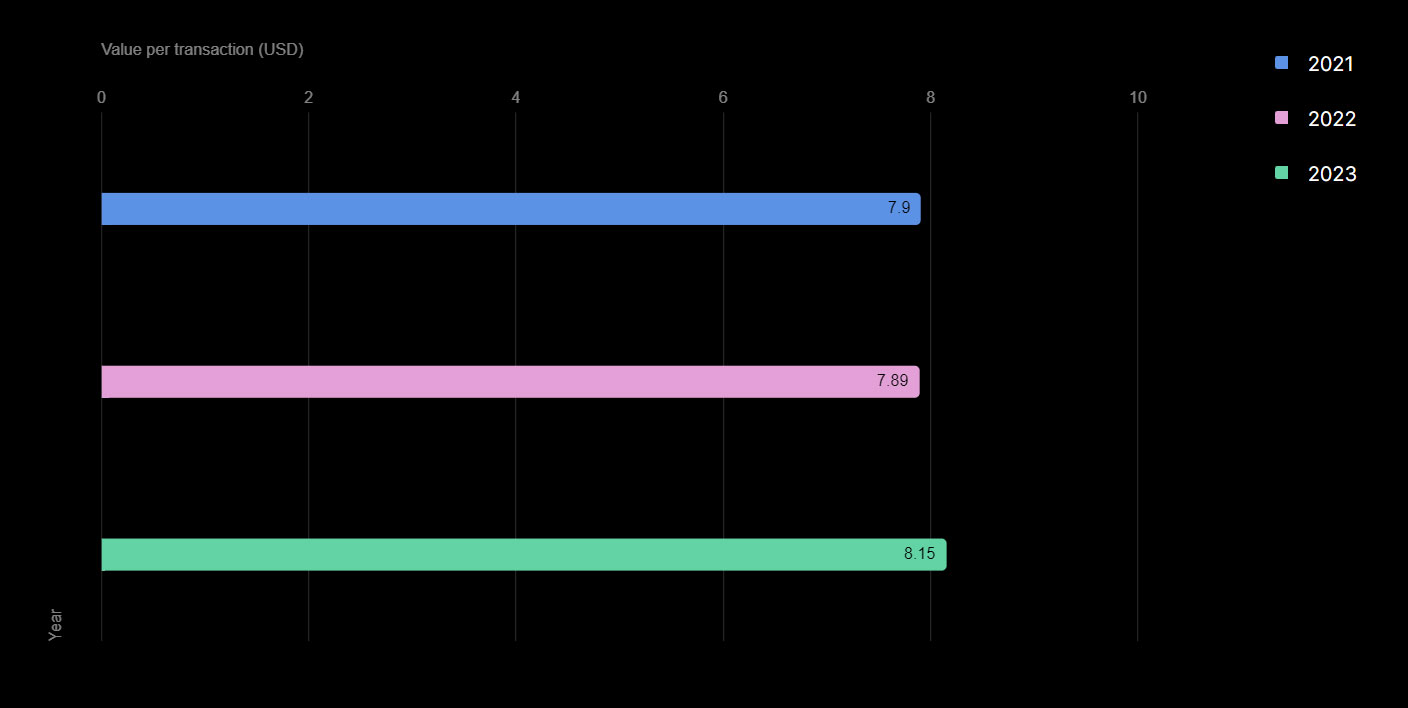

But the average number of transactions per paying player has remained stable for the third year in a row (1.46), and the size of the average transaction is growing.

Dynamics of the average transfer value in games (2022-2023)

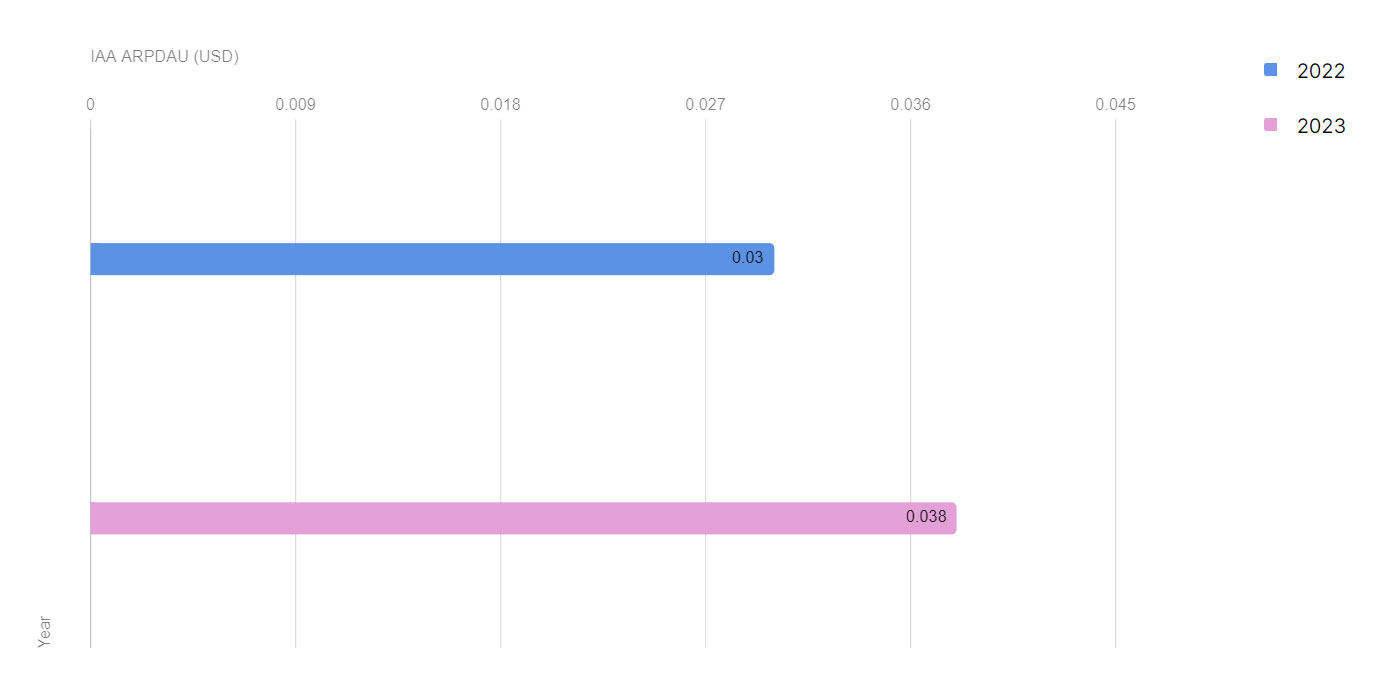

Against the background of falling revenue from micropayments, advertising revenue is growing. In 2023, it increased by 26.7% to $0.038.

Dynamics of the average advertising revenue per user (2022-2023)

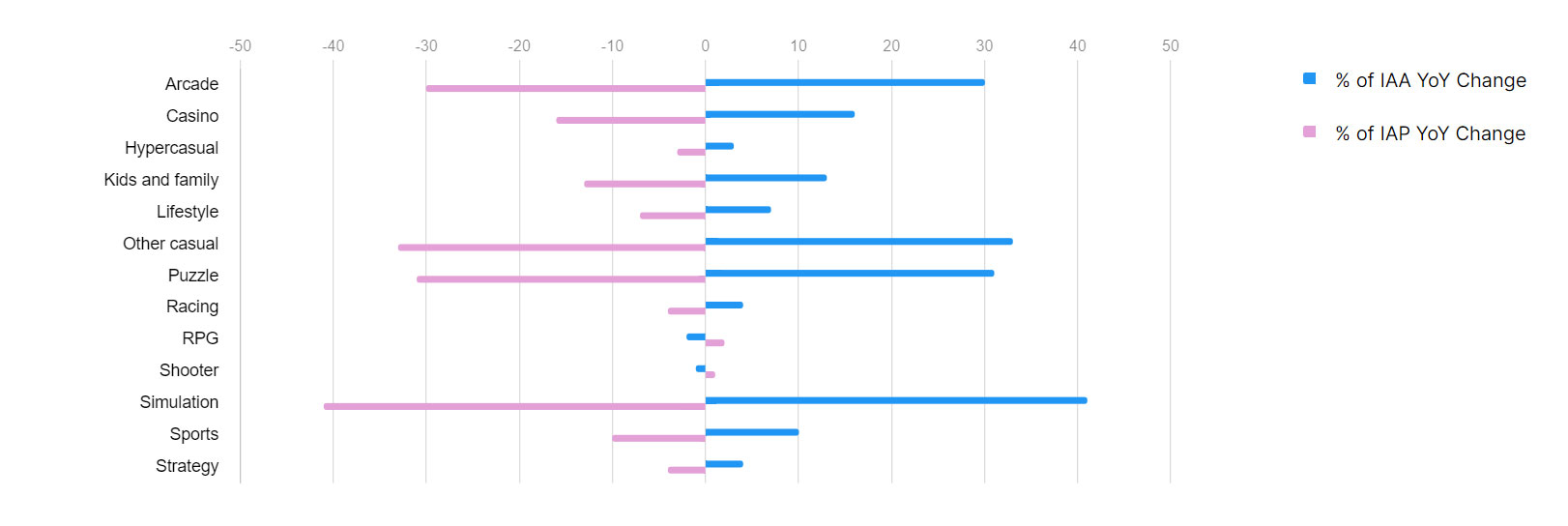

When broken down into genres, it can be seen that at the end of last year, most genres had revenue from IAP falling and advertising (IAA) growing. Among the exceptions are only role—playing games and shooters. On the contrary, their revenue from advertising was falling, but it was growing from micropayments.

Dynamics of IAP and IAA revenue by game genres (changes in 2023)

Against the background of this situation, Unity believes, game studios are diversifying their monetization strategies, wanting to be able to earn money immediately from both payments and advertising.

Thesis three: "Game studios — regardless of size — publish games on an increasing number of platforms"

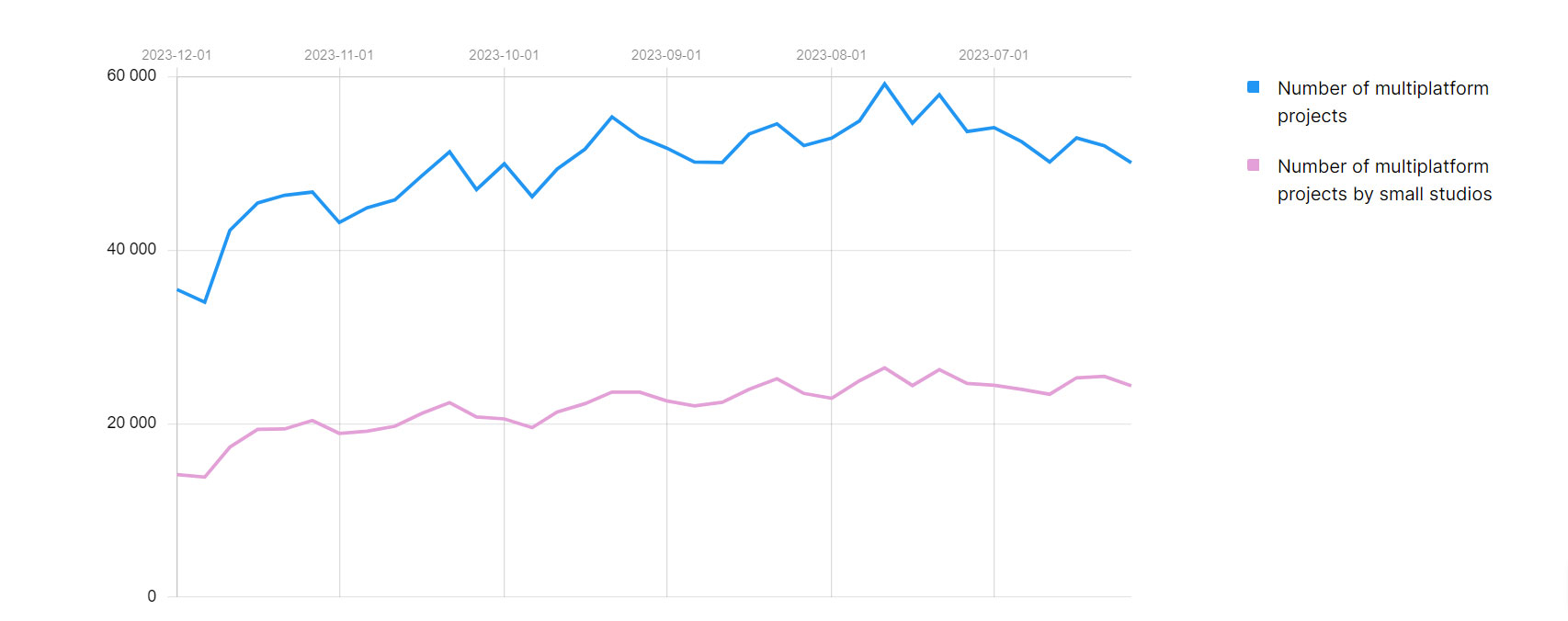

Over the past year, the share of multiplatform games (that is, presented on different platforms) has increased by 40%. The growth also affected indie teams (by such Unity means any studio whose number is less than ten employees).

Dynamics of multi-platform game releases (2023)

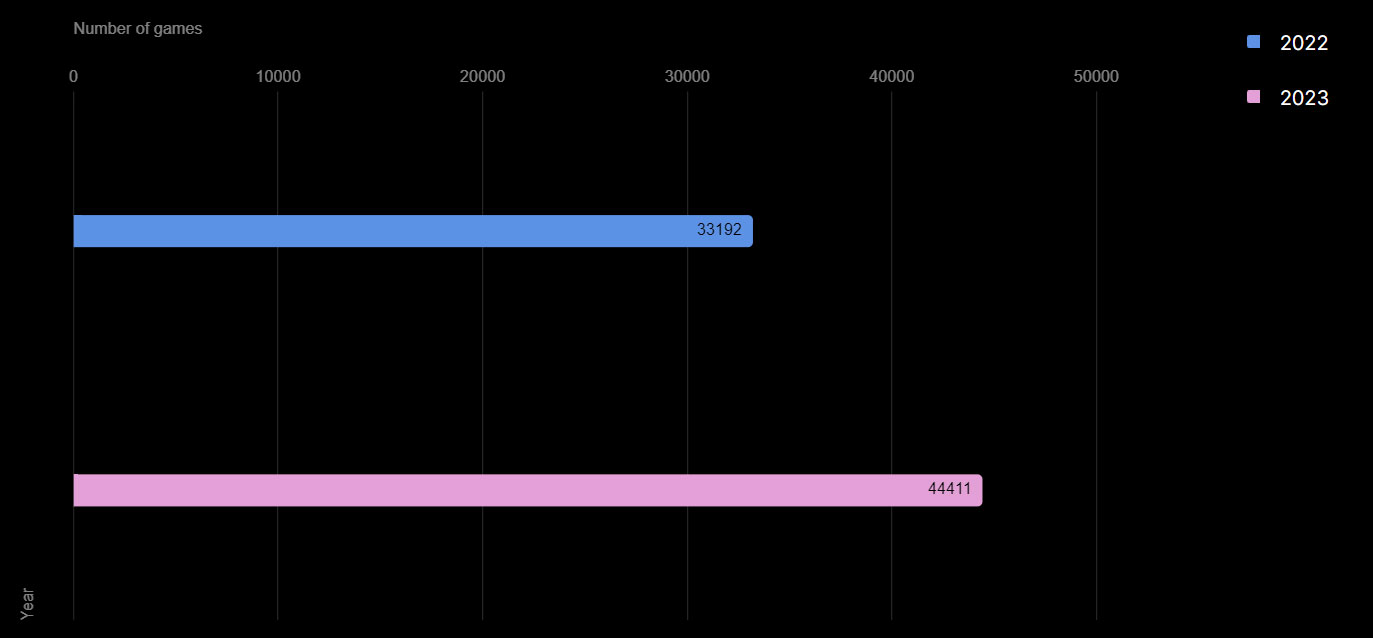

In particular, the number of games launched on three platforms has increased by 34%.

Dynamics of game releases available on three platforms at once (2022-2023)

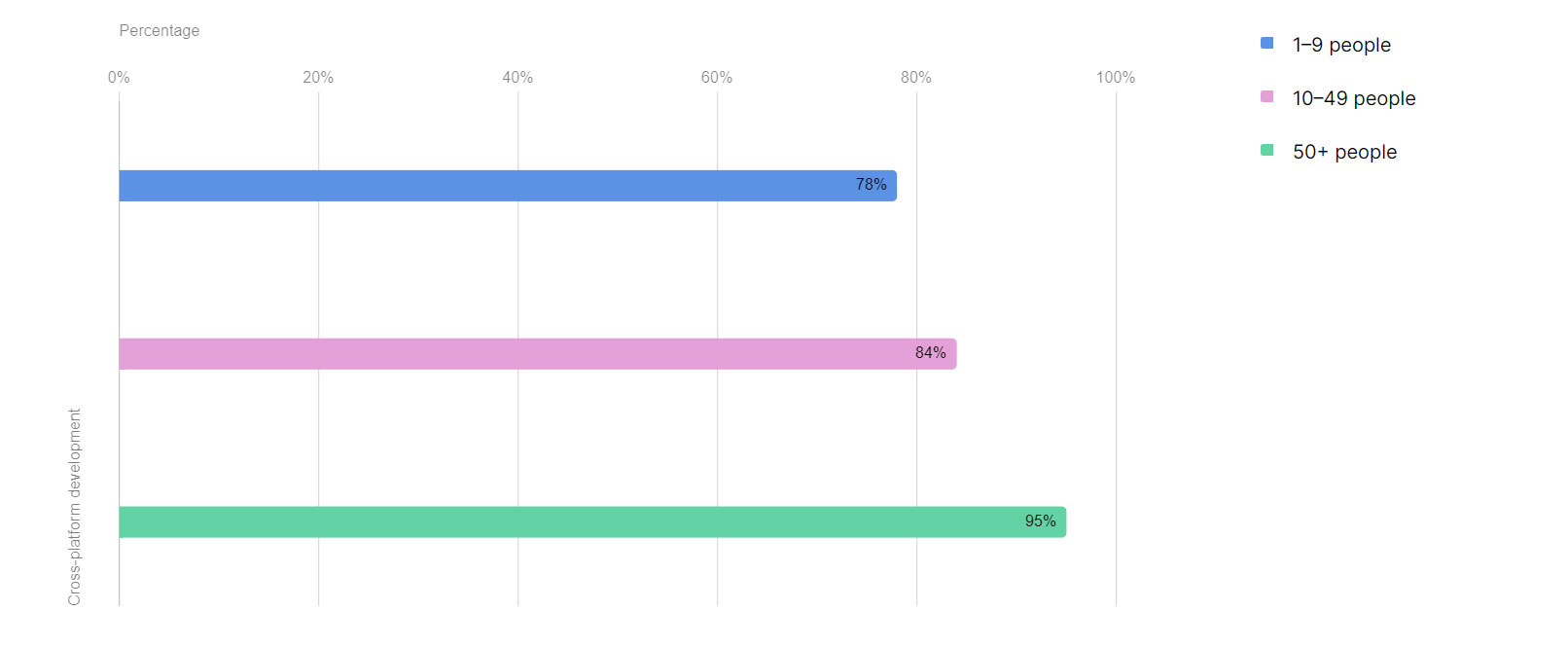

Most teams create games with crossplay support (saving game progress regardless of the platform and the ability to play online with users who play the project on another platform).

Segmentation of cross-game development teams by number

The fourth thesis: "Multiplayer is a priority for developers, despite its complexity and high cost"

Mobile games with multiplayer functionality have an average of 40.2% more MAU than mobile games without it.

Therefore, it seems logical that 62% of Unity developers surveyed are developing games that support multiplayer.

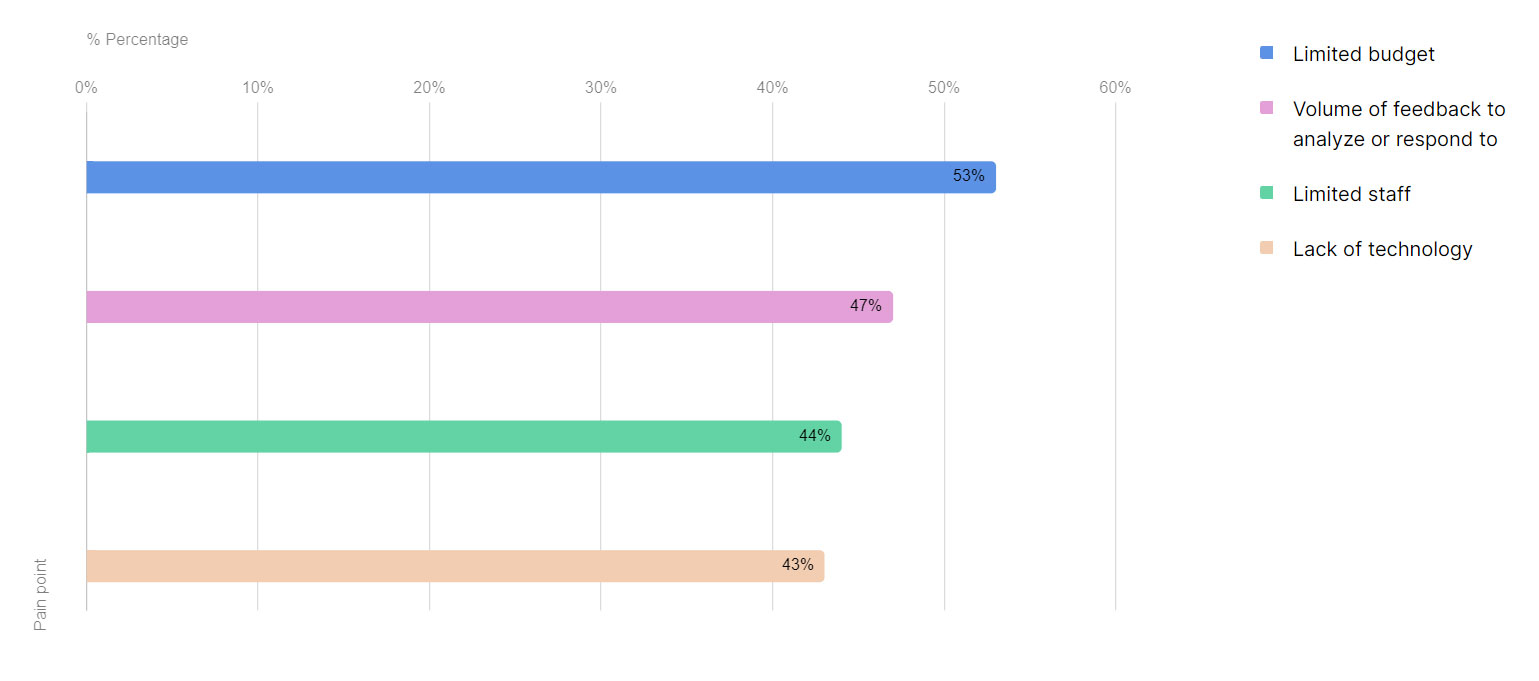

At the same time, the main headache of those teams that are engaged in multiplayer games is a limited budget. 53% of such teams complained about this.

The main problems in the development of multiplayer games

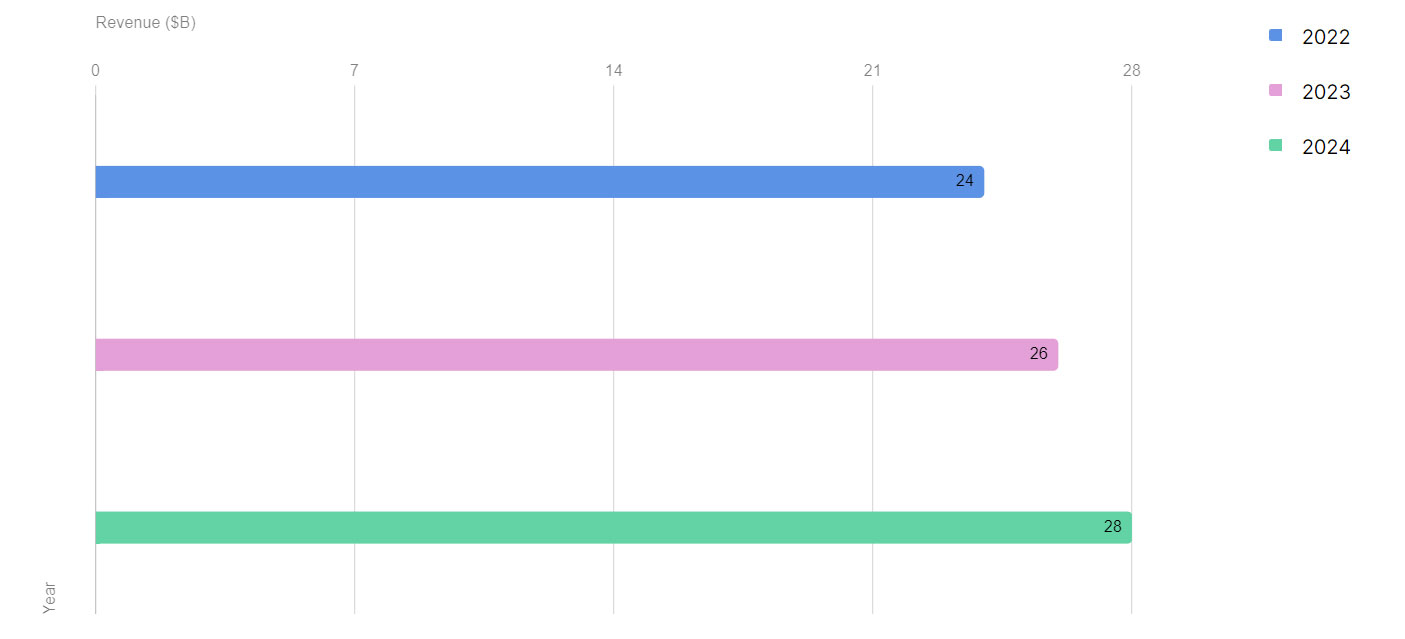

But this is unlikely to stop the trend for the development of such games, because the total revenue of such projects is growing year by year. In 2023 alone, their revenue increased by 10%. Here, however, Unity shares not its own figures, but Statista data.

Revenue dynamics of multiplayer games (2022-2024)

Thesis five: "The industry creates strong brands by increasing engagement"

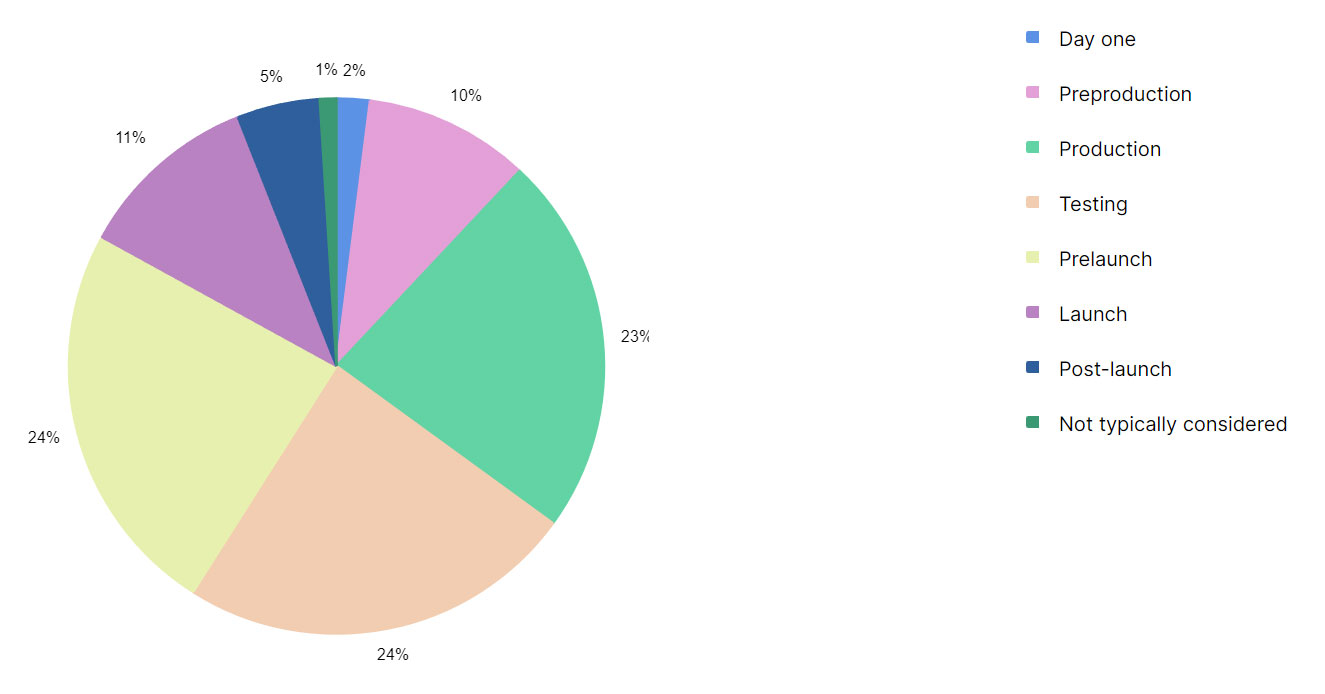

By getting involved in Unity, first of all, they mean the developers' bet on LiveOps. A significant part of the interviewed teams are engaged in LiveOps already at the stage of development of the game itself and immediately before launch.

The stages at which game developers begin to prepare LiveOps

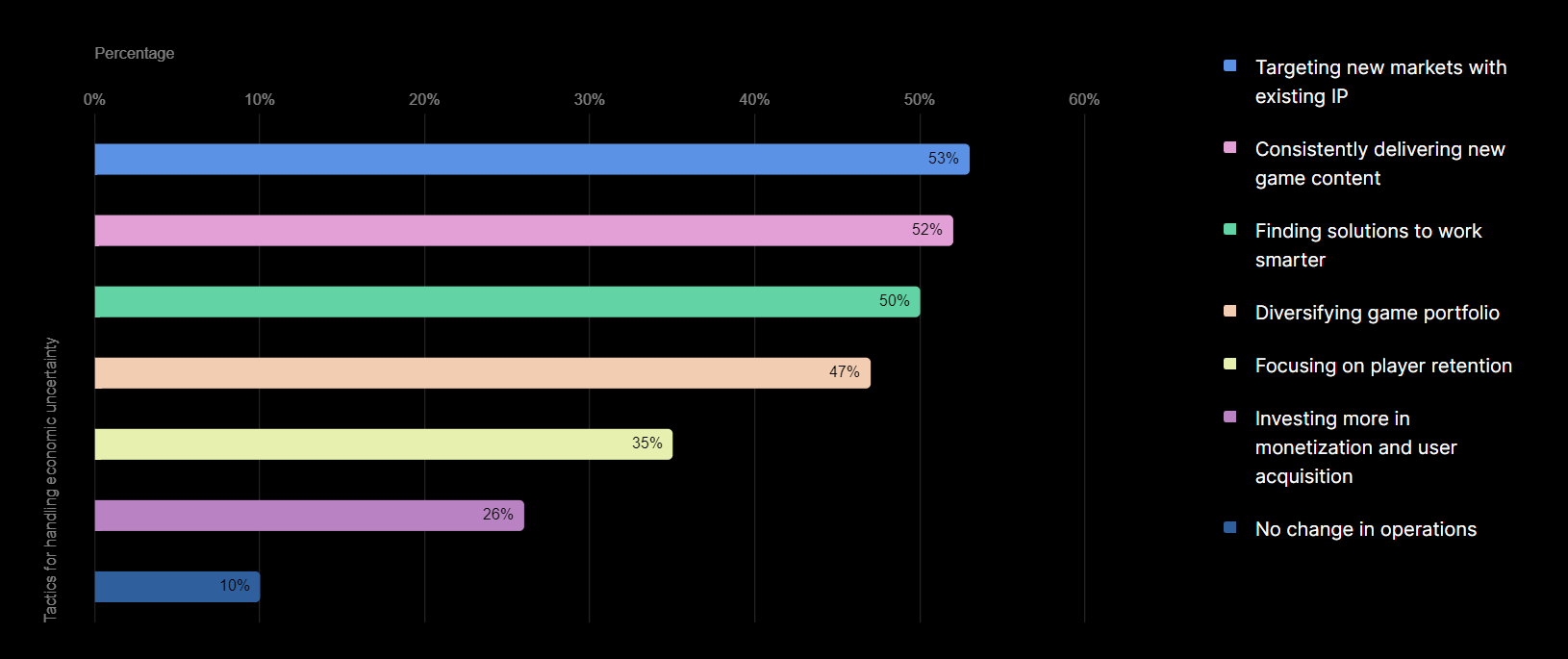

LiveOps is also one of the two most popular risk reduction tools. A more popular way is to reach new markets with a product under a popular IP.

Risk management tools

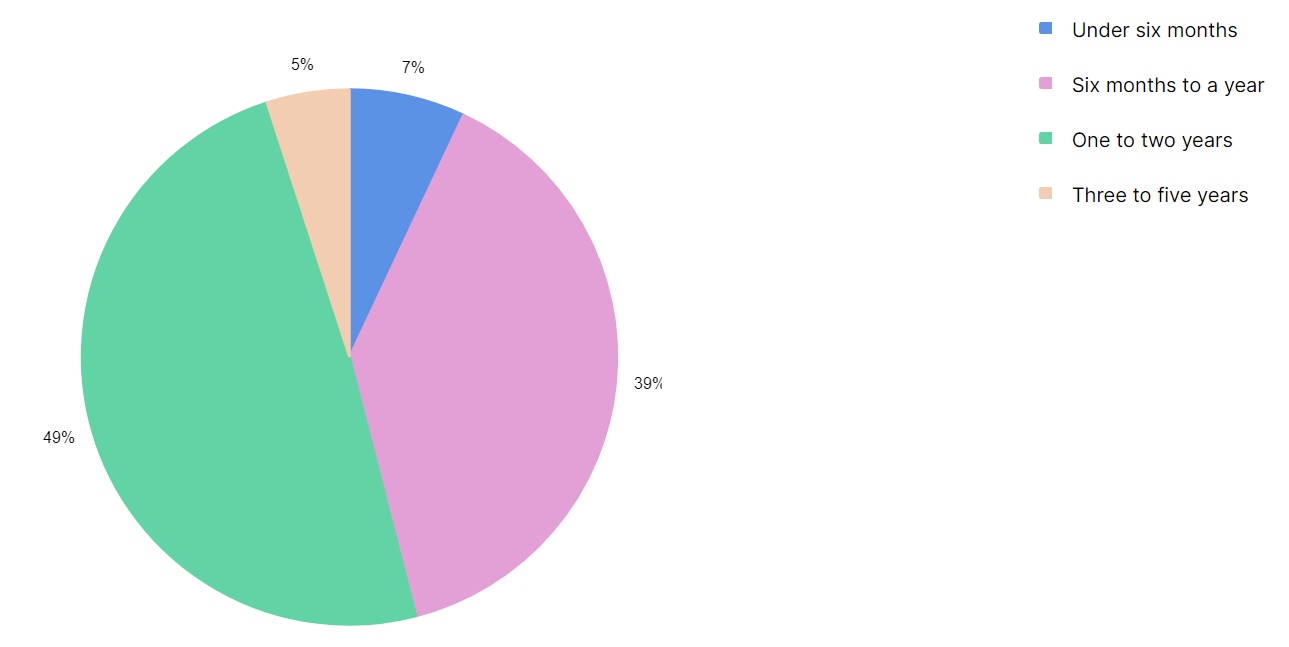

As for the duration of support, in almost half of the cases, teams have been supporting games for about two years.

Duration of game support

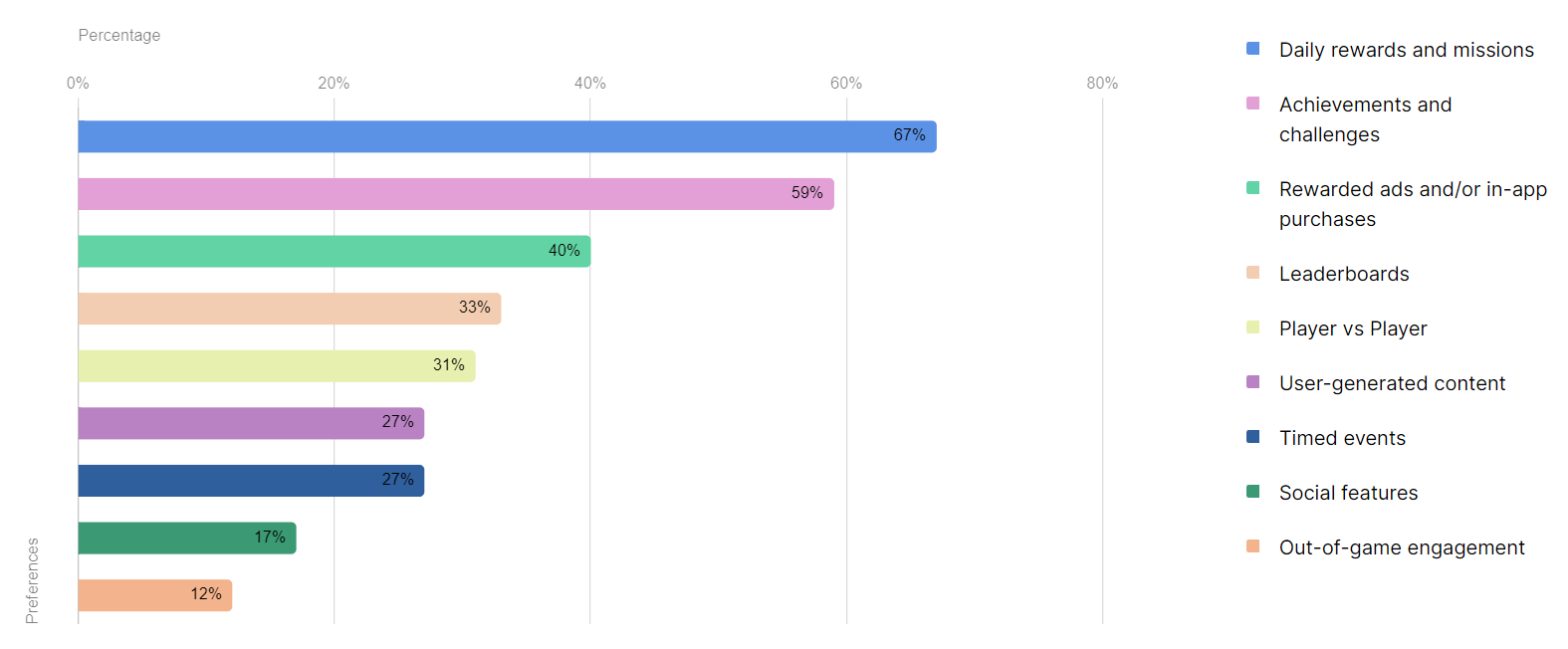

Daily rewards and missions are considered a key engagement tool in most gaming teams. 67% of developers use them.

The most popular engagement tools and LiveOps

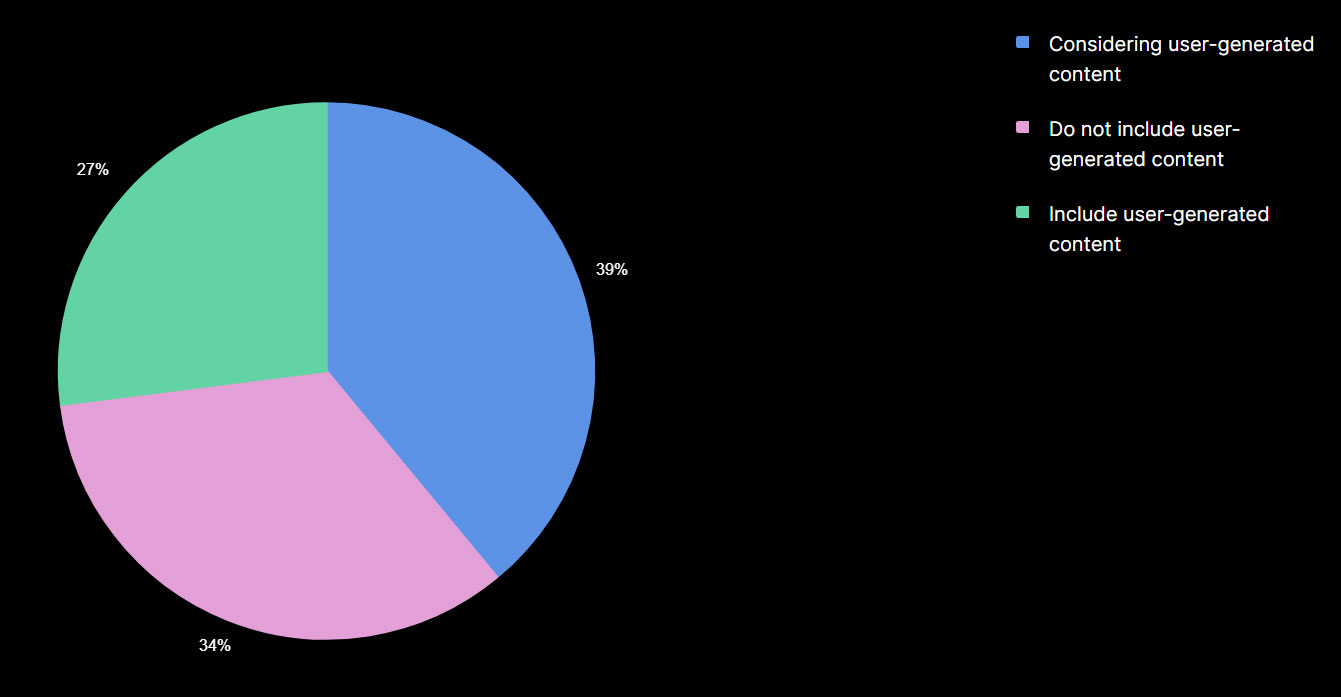

Plus, user-generated content has become a hot topic for many developers. Many of the interviewed teams have either already decided to use it, or have already implemented it.

Using UGC content in games

Based on these and other data (the full version is available at the link at the end of the publication), Unity experts come to the following five conclusions regarding 2024:

- In the gaming industry, the use of AI will become the norm;

- Mobile game studios will continue to expand on PC and consoles;

- Demand for augmented reality games will increase;

- developers will continue to search for new business models and sources of income;

- cloud services will become an integral part of games, and it is thanks to them that studios will be able to improve their efficiency.

About the methodology

One of the key problems of the study is the large number of data sources. Some were pulled from the Unity Engine, Unity Cloud and ironSource (from the games that use these tools), some from various surveys of respondents by Unity itself (in total, data from four surveys were used, the number of respondents in which ranged from 7000 respondents to only 120 respondents), and some were taken from open sources. Because of this, the whole work lacks consistency.