On March 15, Unity published a study on the main trends in game development for the beginning of 2023. We wrote briefly about the report last week. In the current publication — in detail about him in Russian.

The report is called Gaming Report 2023.

At the beginning of the report, Unity says that it divides game studios into five types:

- indie (indie) — 1-9 people;

- medium-sized studios (midsize): 10-49 people;

- Lower Middle Segment Studios (LMM): 50-149 people;

- studios of the upper middle segment (UMM): 150-299 people;

- large studios: more than 300 people.

The report itself is divided into five chapters. Each is dedicated to a particular trend.

Trend one: indie studios are creating games faster and faster, and developers are working less and less

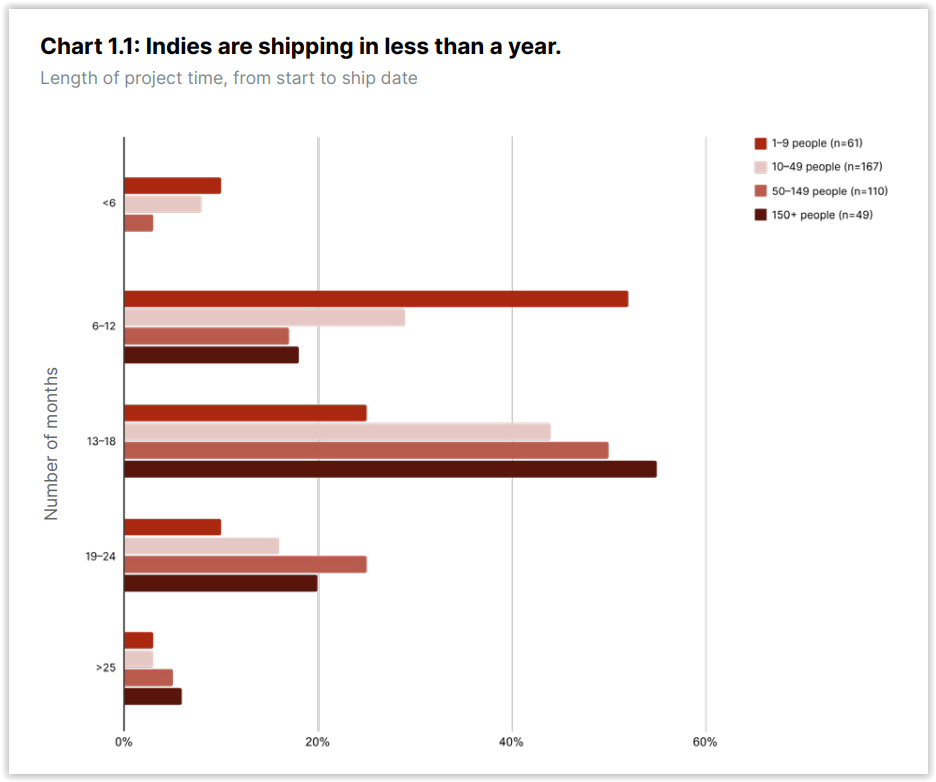

According to Unity, the times when indies spent five years on development have gone down in history. According to the information collected, 62% of indie studios and 58% of medium-sized studios take less than a year to develop and release a game from scratch.

The graph shows how many months it takes to develop games from studios of various sizes

Important: Keep in mind that most of the data provided by Unity is collected from mobile projects. Yes, the company itself does not make such a remark.

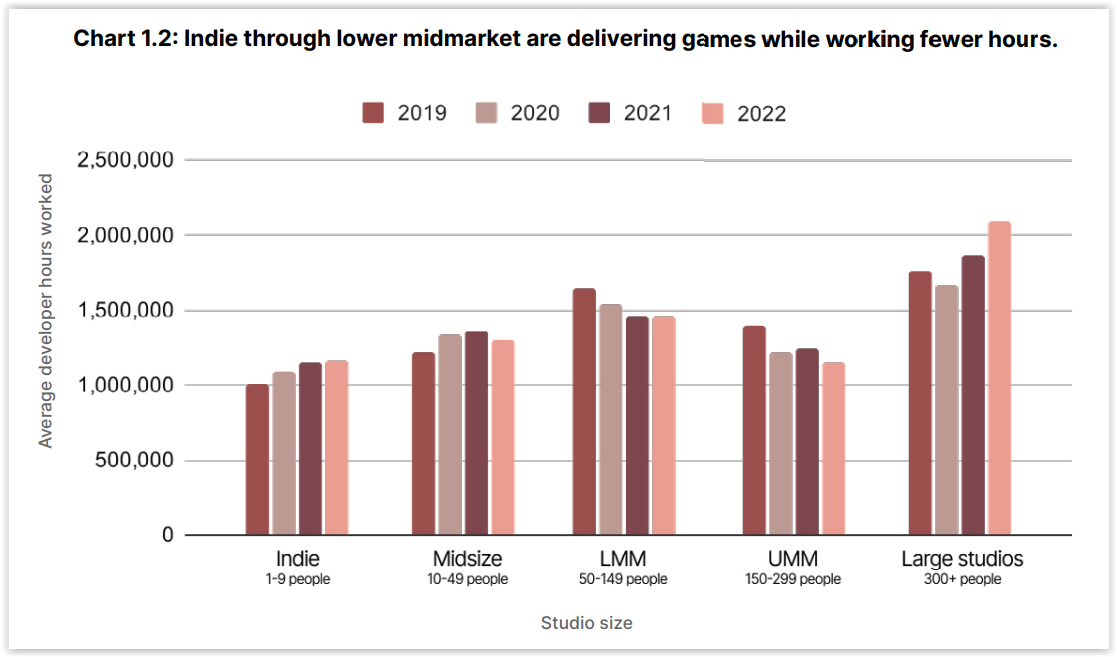

Unity specialists also found a 1.2% reduction in working hours for almost all game development groups. It is symptomatic that developers working in large studios, on the contrary, have significantly increased the number of working hours compared to previous years.

Dynamics of the number of working hours spent by company employees at work by year (segmented by studio type)

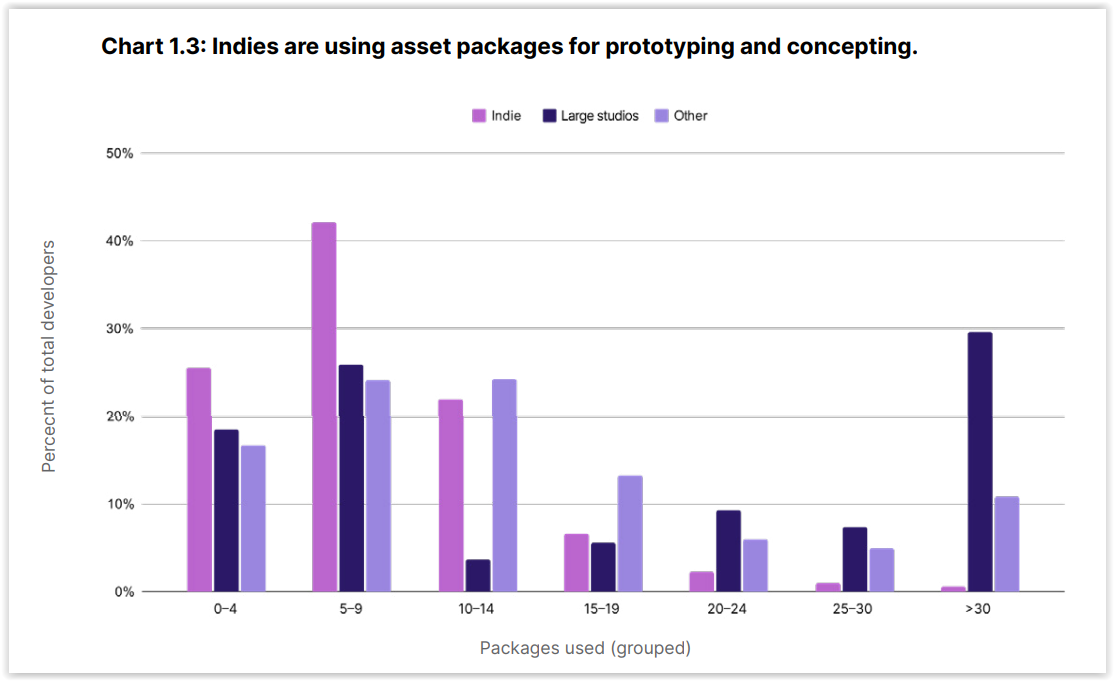

From the obvious: developers (both indie and working in large studios) they actively use ready-made third-party assets for prototyping. 62% of indie developers can use from five to 14 packages, and large studios – more than 30.

The prevalence of the practice of using assets among indie studios and large companies

The prevalence of practice does not depend on the type of projects. Similar figures are observed in teams preparing prototypes of VR and AR games.

Unity specialists insist, apparently wanting to advertise the Unity Asset Store, which does not need advertising, once again, that using ready-made third-party assets speeds up development. According to the data, those studios that are customers of the store bring the game to release 20% faster.

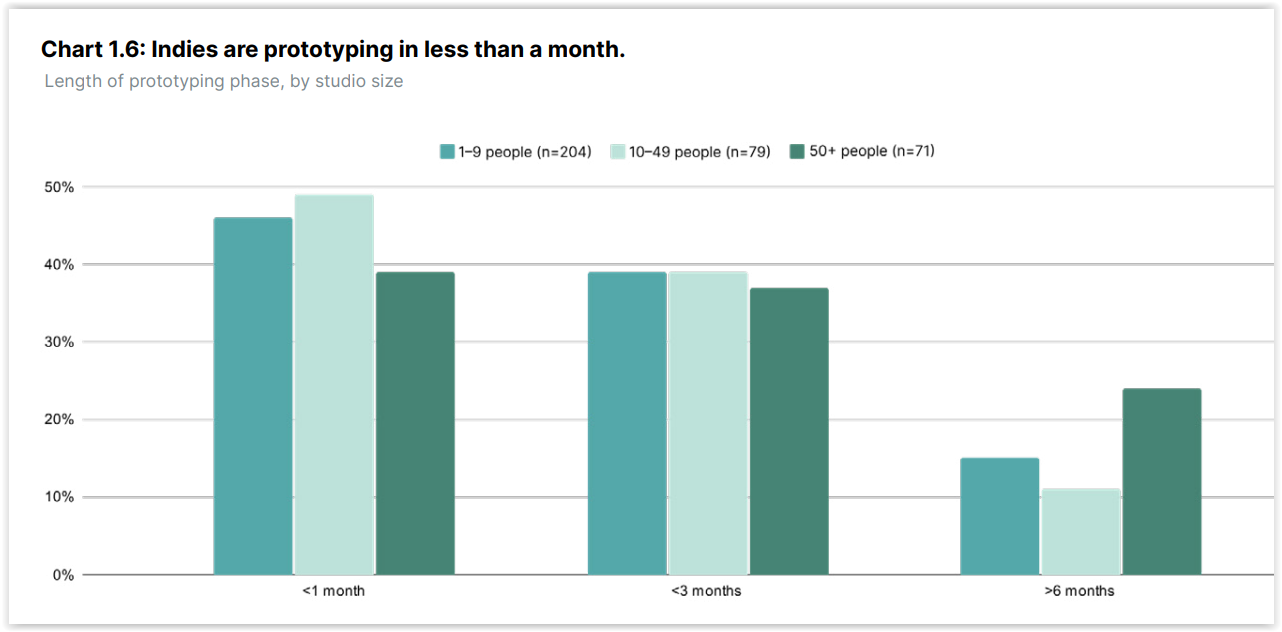

However, another fact is much more interesting: it takes less than a month for most game teams to prototype (46% of indie developers, for example, show this speed)

Duration of prototyping in studios of different sizes

The last thesis of the chapter is dedicated to DevOps. Unity claims that 69% of game studios resort to such services for the release of the game.

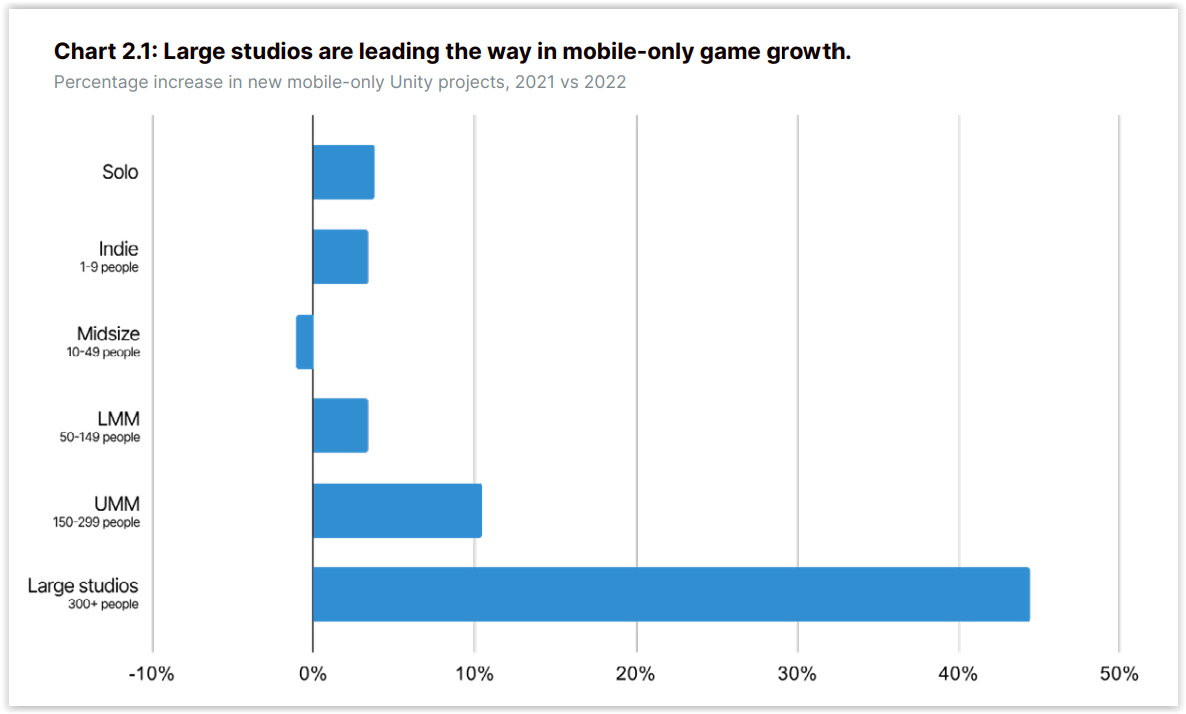

The second trend. Studios began to develop more games focused exclusively on mobile platforms (compared to 2021)

In 2022, studios of almost all types began to develop more projects marked “only for mobile”. Especially strong growth (by 44%) in large companies.

The graph answers the question: by how many percent has the number of projects in operation focused exclusively on the mobile platform increased in 2022 (the graph is segmented by type of companies)

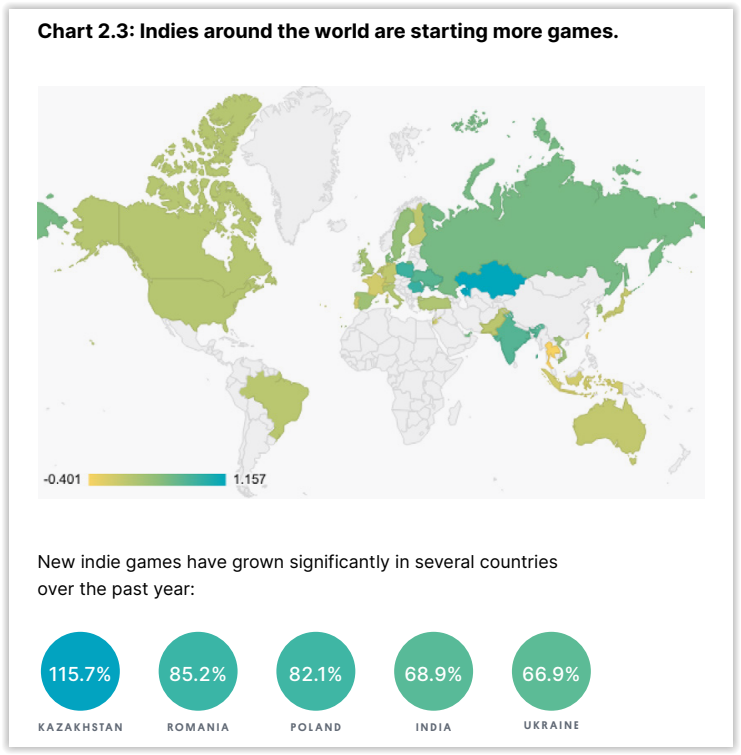

As part of the same trend, Unity specialists noted a significant increase in the number of indie teams in Kazakhstan (by 115.7%), Romania (by 85.2%), Poland (82.1%), India (68.9%) and Ukraine (66.9%). And if the reason for the increase in the number of Indies in Kazakhstan is clear, then in other regions it is less obvious.

Growth of indie games by country

The number of medium-sized studios in Turkey (by 260%), Norway (by 200%) and France (by 196%) also increased significantly. Here, unfortunately, also without explanation.

Growth of medium-sized studios by country

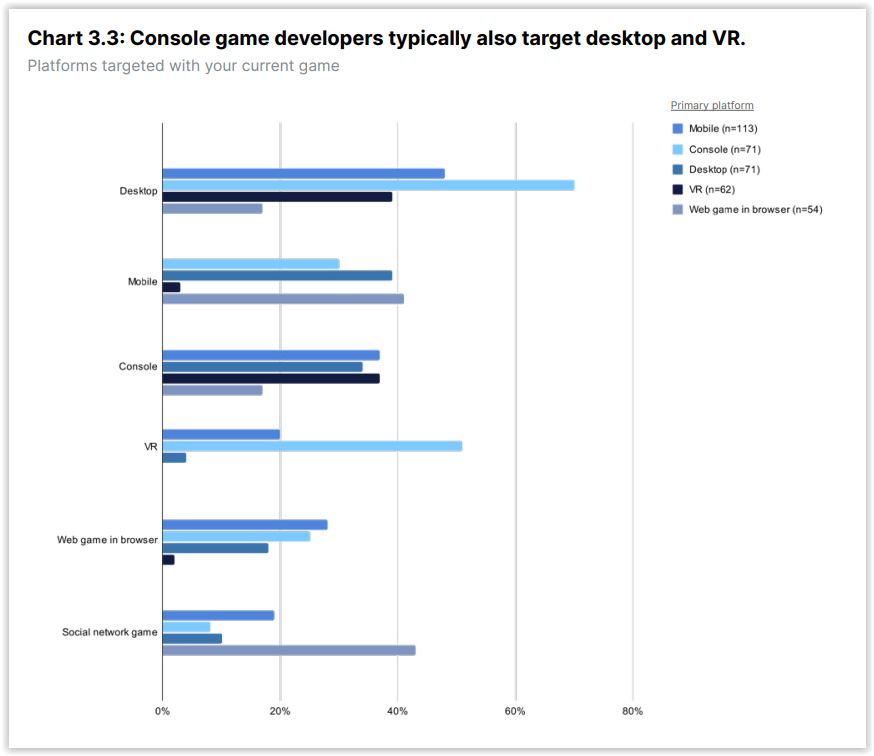

The third trend. Big studios are making more multiplatform games (relative to 2021)

Large companies had 16% more multiplatform titles in operation in 2022 than in 2021 and 110% more than in 2019. In general, by the end of 2022, they were developing about 8,500 similar projects.

According to a survey of 356 developers, studios that create games for consoles are more likely to also work on games for PC or VR. In 70% of cases, those companies that prepared the initial build for consoles are also focused on the desktop. 51% of developers who noted that they create console games are also working on VR products.

The graph is based on the answers of developers to the question for which platforms their current game is being prepared

In the same case, when teams postulate that they are working on a multiplatform project, they usually release the project on the desktop first.

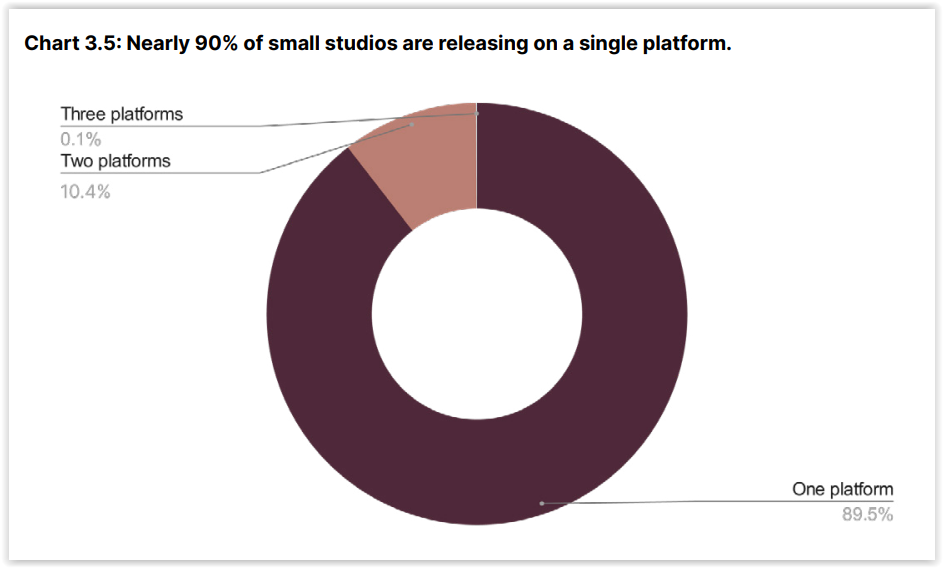

When it comes to small indie teams, they are usually limited to one platform.

Distribution of indie teams by the number of platforms that support their games

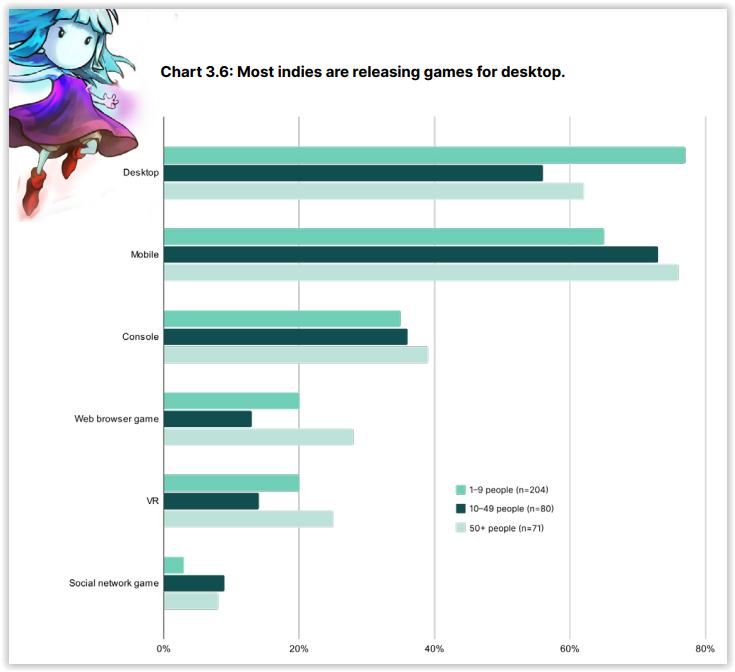

As a rule, this platform is a desktop. 77% of indie developers choose it as their main one.

Distribution of teams by the platforms they work with

The fourth trend. People started playing more (than in 2021)

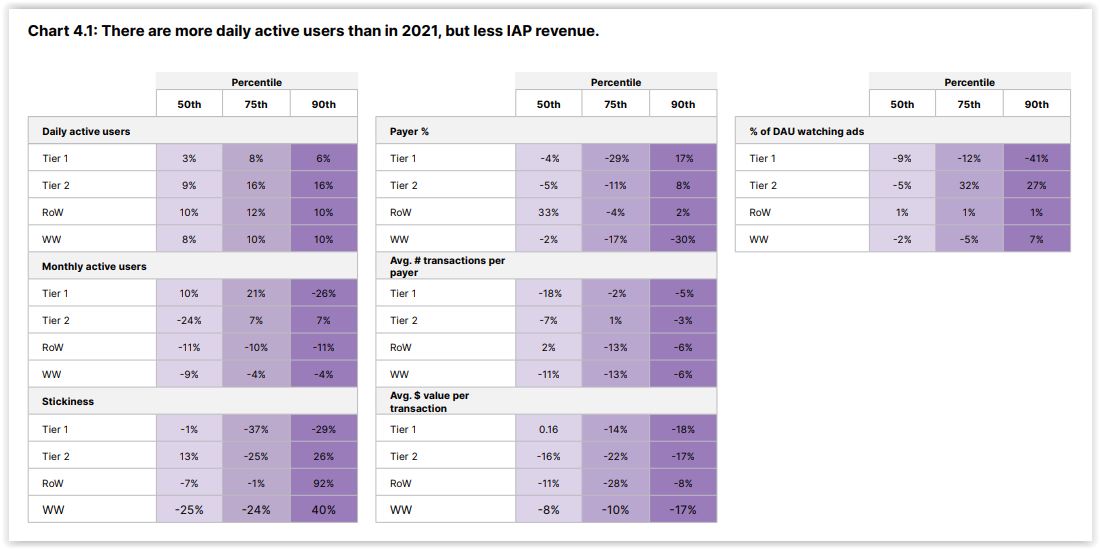

According to the collected data from games whose DAU is more than 1000, in 2022 the median game project:

- DAU increased by 8%;

- MAU fell by 9%;

- “stickiness” dropped by 40%;

- the number of paying players fell by 2%;

- the average number of transfers from a paying user fell by 11%;

- the average amount of the transfer decreased by 8%;

- The DAU of viewed ads fell by 2%.

Dynamics of mobile games business indicators in 2022 relative to 2021 (data segmented by region and percentile)

The benchmark for the median mobile project, whose DAU is more than 1000, in turn, is now the following:

- DAU = 5.5 thousand;

- MAU = 63.6 thousand;

- “stickiness” = 10.4%;

- DAU of viewed ads = 29.1%;

- average number of views per active viewer = 3.2;

- the share of paying = 0.3%;

- average number of transfers per paying player = 1.6;

- the average value of the transfer = $9.

Benchmark of mobile gaming projects (segmented by regions and percentiles)

As for the median values of retention in the world of mobile games, then:

- retention of the first day = 33.8%;

- seventh day retention = 8,7%;

- retention 30 days = 2.9%;

- average number of sessions per day = 1.2;

- average session length = 11.5 minutes.

Benchmark retention of mobile gaming projects (segmented by region and percentile)

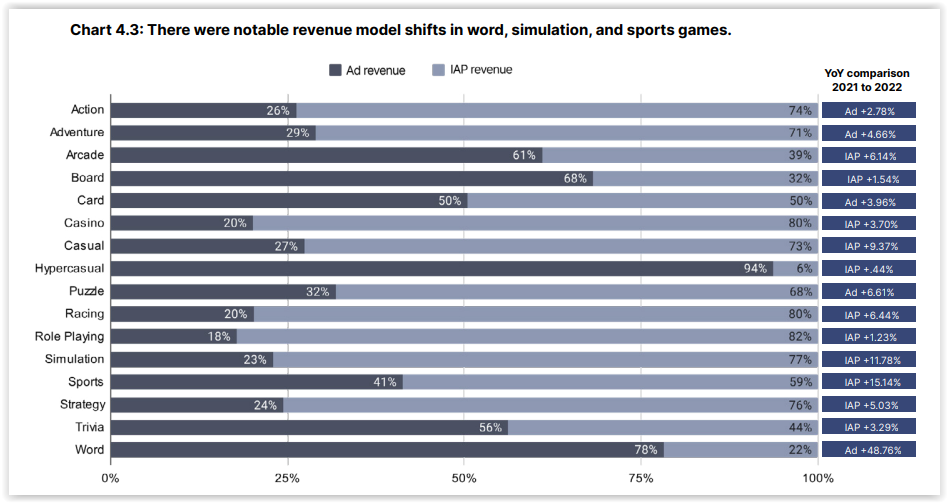

In a number of mobile genres, the distribution of revenue relative to the type of monetization has changed in 2022. The most obvious example is word games, which began to earn 48.76% more from advertising last year than a year earlier.

Revenue distribution in mobile gaming genres for 2022, indicating the dynamics relative to 2021

The fifth trend. The lifespan of games continues to grow

In 2022, the life expectancy of mobile games increased by 33% compared to the previous year. It’s about the median age of an average game project.

The main centenarians “on average in the hospital” are games in the genre of social casino, card projects and RPG, whose median age tends to a value of one and a half years.

Median age of mobile gaming products by genre

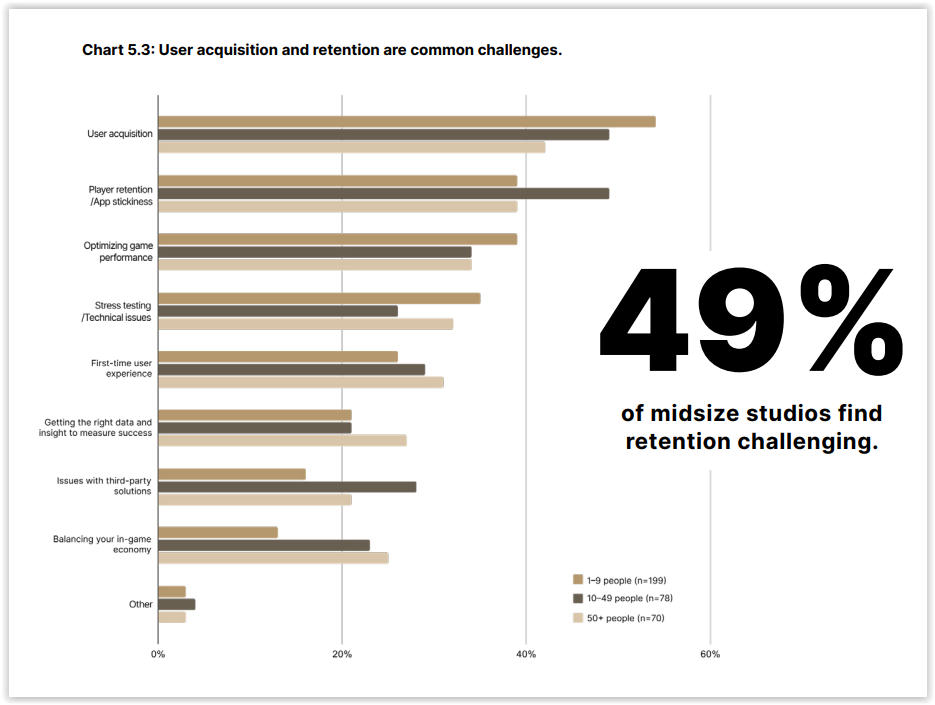

The main problems when working on mobile titles, developers call the purchase of traffic, user retention and, surprise, a stone in the garden of Unity itself, performance optimization.

Of the monetization tools whose popularity has grown significantly in 2022, Unity, based on the survey results, notes combat passes (the number of games using them has increased by 27%) and consumables (an increase of 21%).

Dynamics of the prevalence of monetization mechanics in mobile gaming products in 2022 relative to 2021

Methodology

The report was prepared on the basis of data obtained from 230 thousand developers using the Unity gaming platform to date and 423 thousand developers using the services of the advertising platform of the same name.

Important: Not all the information provided is based on this data. In some cases, Unity relied on the results of a survey of 356 respondent developers.

Trends of 2023

As trends that will be relevant in 2023, Unity at the very end of the study identified the following:

- the emergence of innovations against the background of an unfavorable economic situation;

- the emergence of more mobile AAA games from small teams;

- greater implementation of AI in game development;

- further growth in the popularity of hybrid-casual games (an increase in the number of hyper-casual projects with complex monetization);

- UGC as a factor in the growth of player engagement.

The full version of the study can be downloaded here: https://create.unity.com/gaming-report?exp=2023