What's happening in the hyper-casual games market (hereafter HC games) at the moment, shared Sergey Martinkevich, Publishing Lead at Azur Games.

Sergey Martinkevich

With the middle of the year behind us, it's a perfect time to talk about new trends and features in the HC market, specifically — the departure from the traditional understanding of the genre, the emergence of hybridcore, and the rise of IAP monetization. As usual, we'll discuss this with graphs and figures.

First, let's talk about the continuation of the main trend of 2023.

New titles demand more attention and resources. Studios are striving to release high-quality products right from the start and invest substantial resources in polishing with long-term operation in mind. The requirements for visuals, technical aspects, progression, and feel are increasing. This greatly affects the genre.

A few years ago, HC games needed just a couple of components like mechanics and visuals to succeed. Not anymore. Game cycle, progression, visuals, technical aspects, smoothness, and the number of animations — everything needs to be top-notch.

More and more HC games are utilizing complex physics, ragdoll effects, VFX effects, detailed animation, and unique shaders. Gameplay is becoming more complex and may include several parallel progressions implemented in different mechanics.

As a result, it's becoming harder to distinguish classic hyper-casual, hybrid, and even casual games. Therefore, the term hypercore is more frequently mentioned in discussions rather than the now-familiar hybrid. Likely, this means that in the future, separate analysis of HC will have to cease and it will largely need to be considered jointly with new casual titles.

Now, let's move on to the graphs.

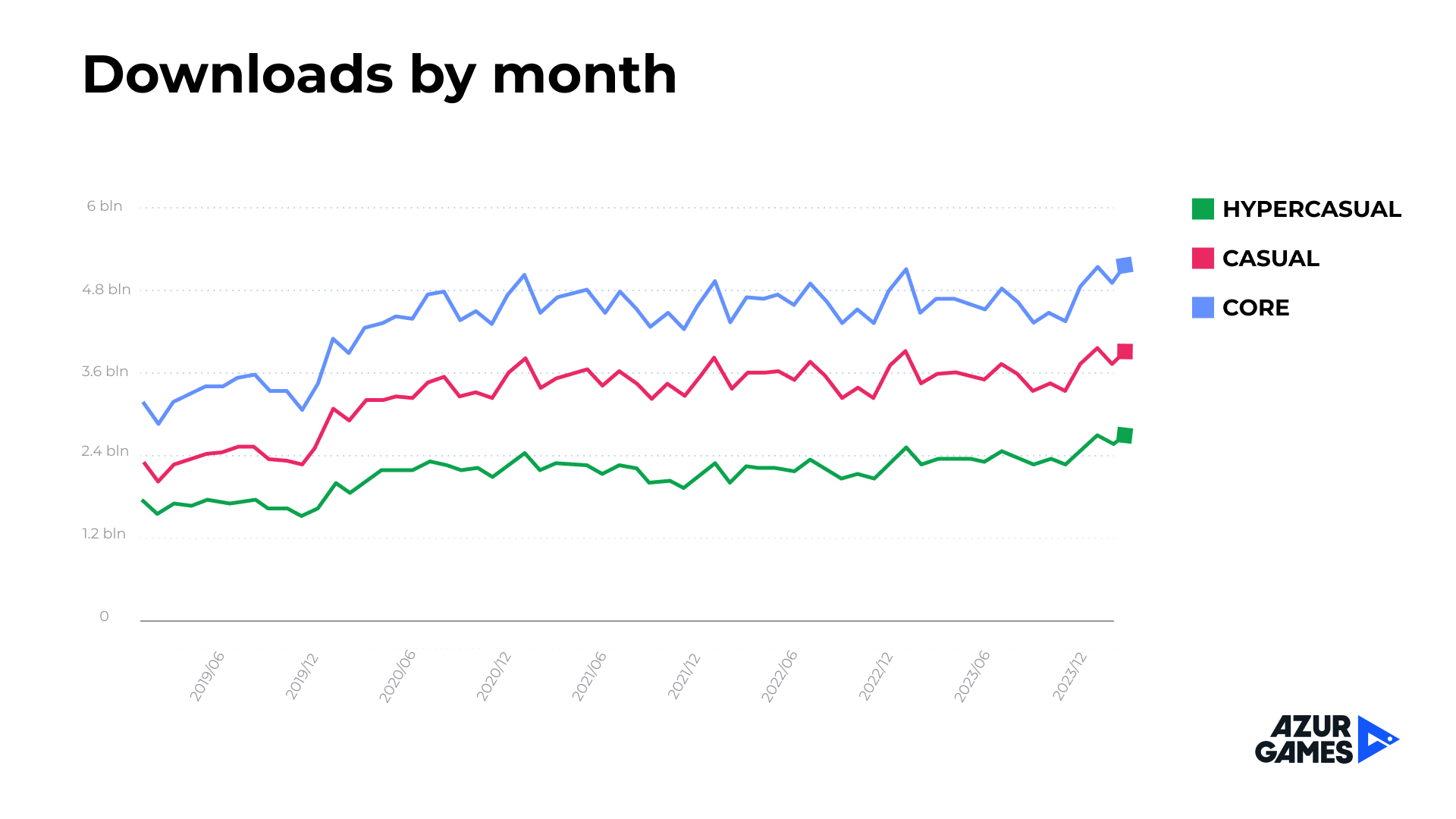

Market Volume

Good news — it’s on the rise again.

It’s difficult to explain otherwise how, despite crazy competition, even very old titles continue to live and grow in revenue. This is partly due to the market growth.

In the previous report, we observed a plateau which, in the face of competition and falling eCPM, didn’t look very promising. Now, the market is clearly sending positive signals.

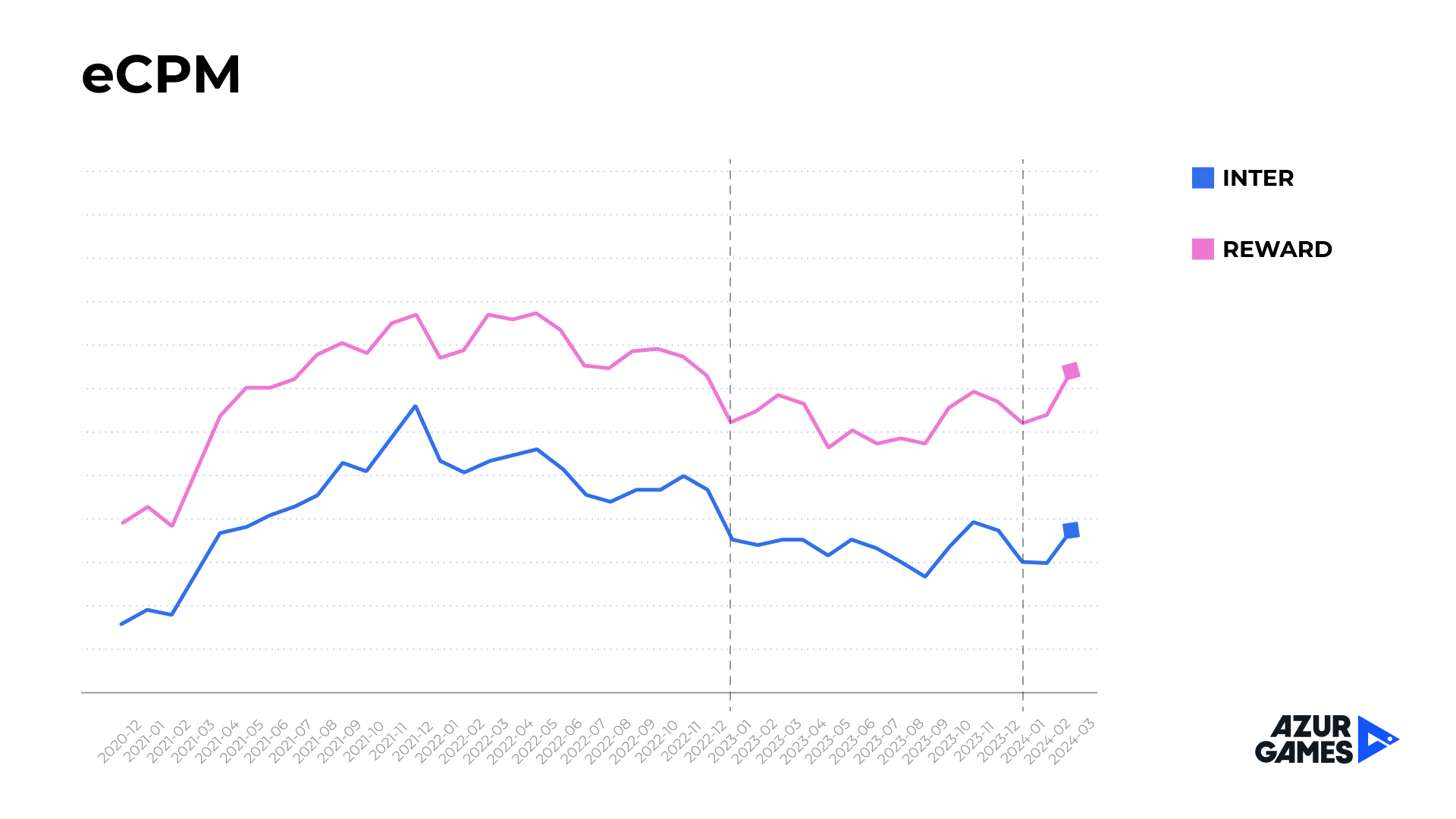

eCPM

A similar situation occurred — in the middle of last year, there was a clear downward trend. This is based on our internal data without specific figures, but showing the approximate position of many major publishers. As I mentioned in previous reports, eCPM is a kind of market health indicator. And this growth at the end of the graph is very encouraging.

Market growth, eCPM growth — all of this indicates positive expectations. It could even be said that the "bottom" after the pandemic has been passed, but let’s be cautious. However, if more is being paid for a thousand impressions, it is economically driven. There is competition, people watch ads and purchase products.

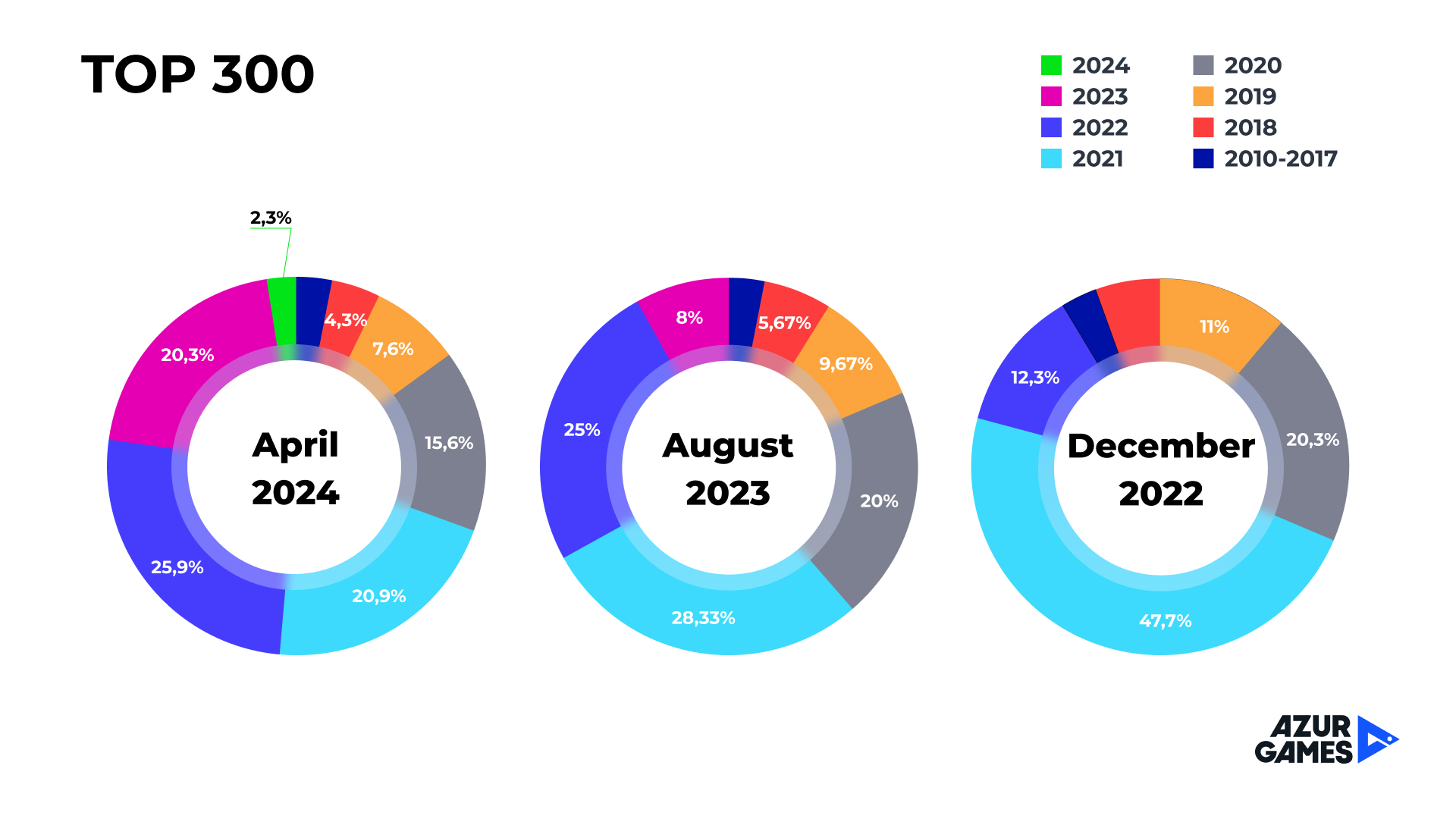

Top 300

These are very important graphs that deserve special attention. When we previously mentioned that creating a new hit in the HC niche is becoming increasingly difficult, it didn’t mean there will be no more hits. Looking at the graphs over the last three years, you can notice: the largest share of the top 300 is always occupied by projects that are two years old.

In other words, hits do not immediately gain high status. If a few years ago an HC game could become a hit almost immediately after release, now it has to go through a long journey, including many iterations, to achieve success.

The market is moving towards long-term project operation.

This fundamentally changes the requirements for the technical components of new HC projects. At the start of development, it is necessary to lay down an architecture that allows the game to be developed over the years, adding new modules, mechanics, features, and so on.

Let's move on to specific genres.

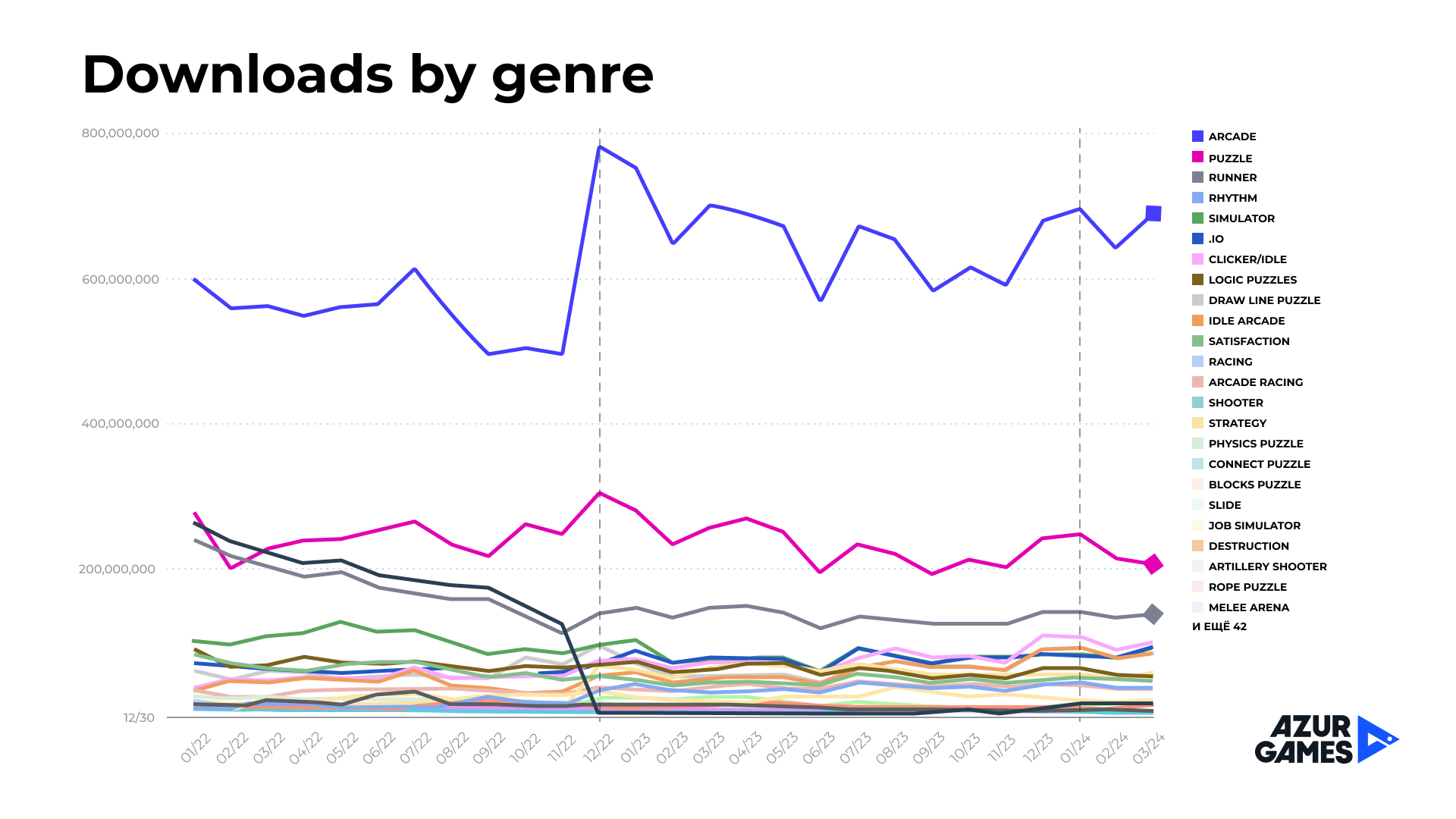

Installations by Genres

The general picture resembles a plateau, but an upward trend is visible in Arcade. The picture closely resembles the eCPM graph and also evokes optimistic expectations.

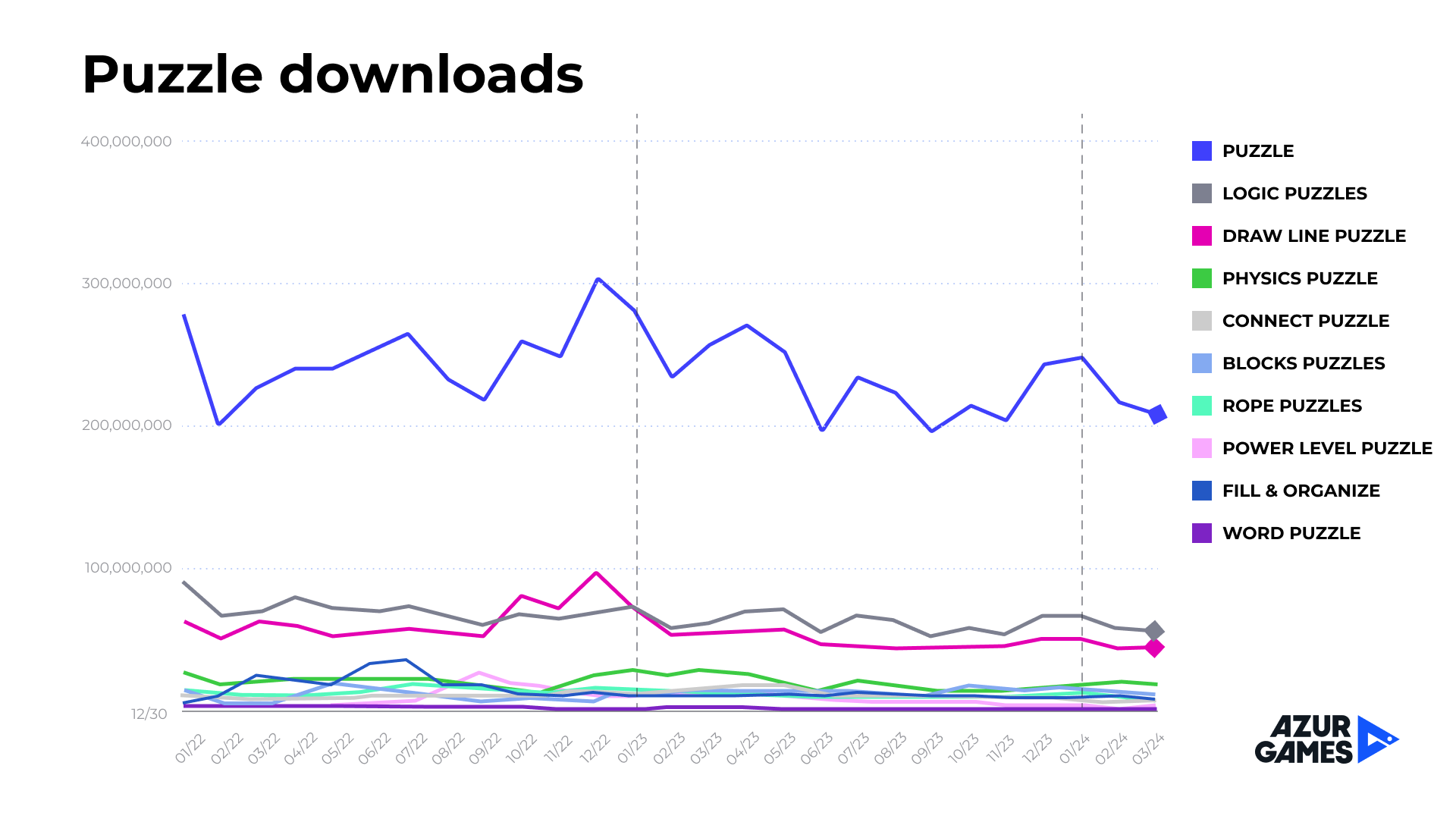

Puzzles

The sub-genre has undergone rethinking. It has become normal for it to have several gameplay cycles (each with its own progression). This has led to analytical services moving some hyper-casual puzzles into the Casual category. For example, this was the case with Hexa Sort.

Looking at the overall dynamics of the sub-genre, it seems to be striving to reach a plateau. However, it is important to note that several hits — the same Hexa Sort — for the reason mentioned above may no longer be recorded in the HC niche. Thus, their success is not shown on the curve, although it exists.

The fact that it has become increasingly difficult to categorize games into one direction or another is a good reason to reduce the separation between HC and casual in the future.

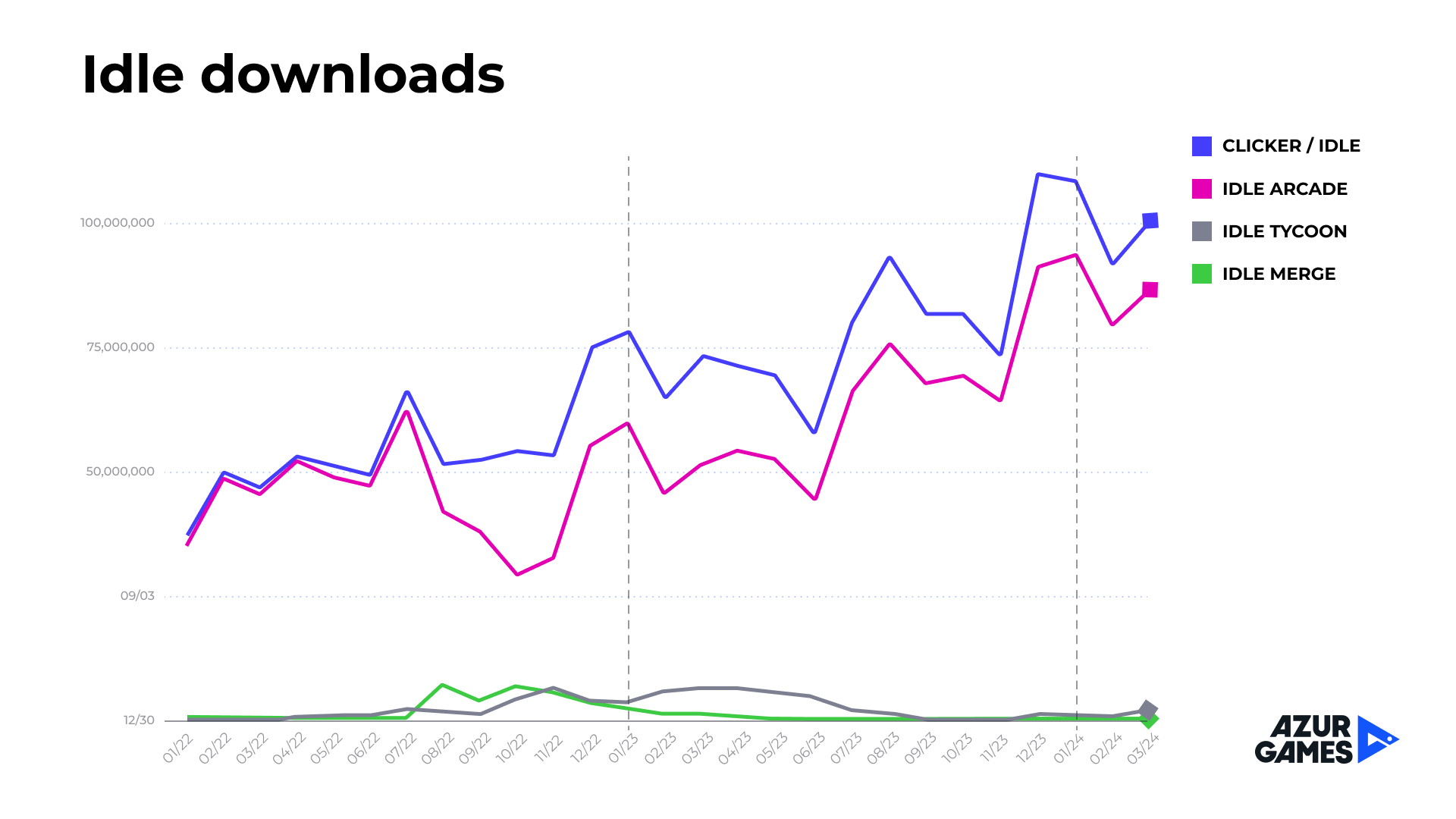

Idlers

They have been frequently mentioned over the past couple of years, and it is always emphasized that they are a very promising genre.

If judged by the dynamics of recent months, this seems to hold true. The sub-genre is rapidly growing in volume.

However, working in the niche has become more difficult. It is currently very competitive.

Only a game that, in addition to a strong player cycle, has several additional complex mechanics and mini-games impacting the main progression, can now aspire to success.

For instance, in Idle Outpost, in addition to the classic idler gameplay, there is a combat mechanic and a loot search mode.

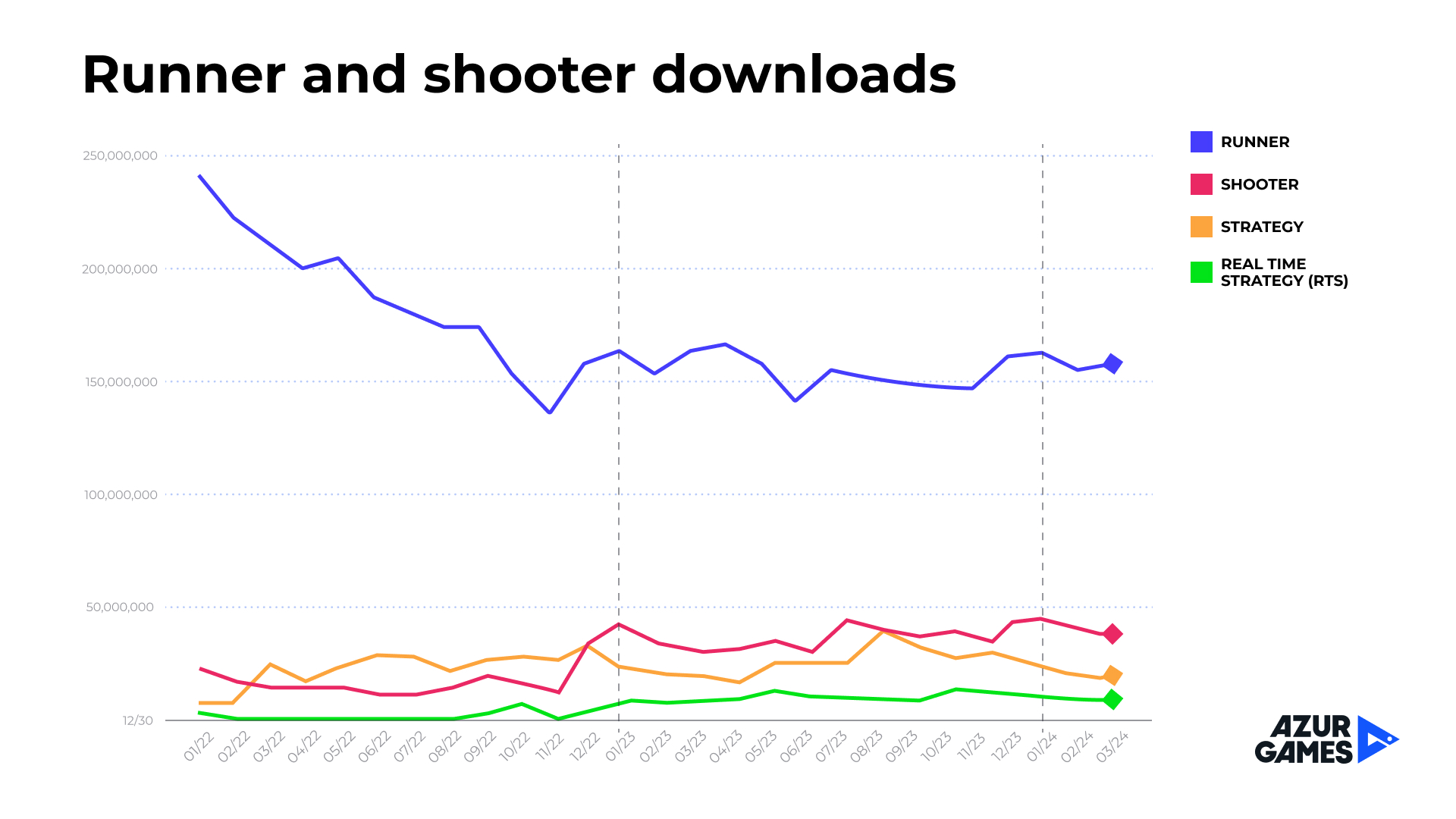

Runners and Shooters

The picture hasn’t changed much recently. The only thing that can be said is that they are still strong working genres. Although they are at a plateau, in a growing market, this is not bad.

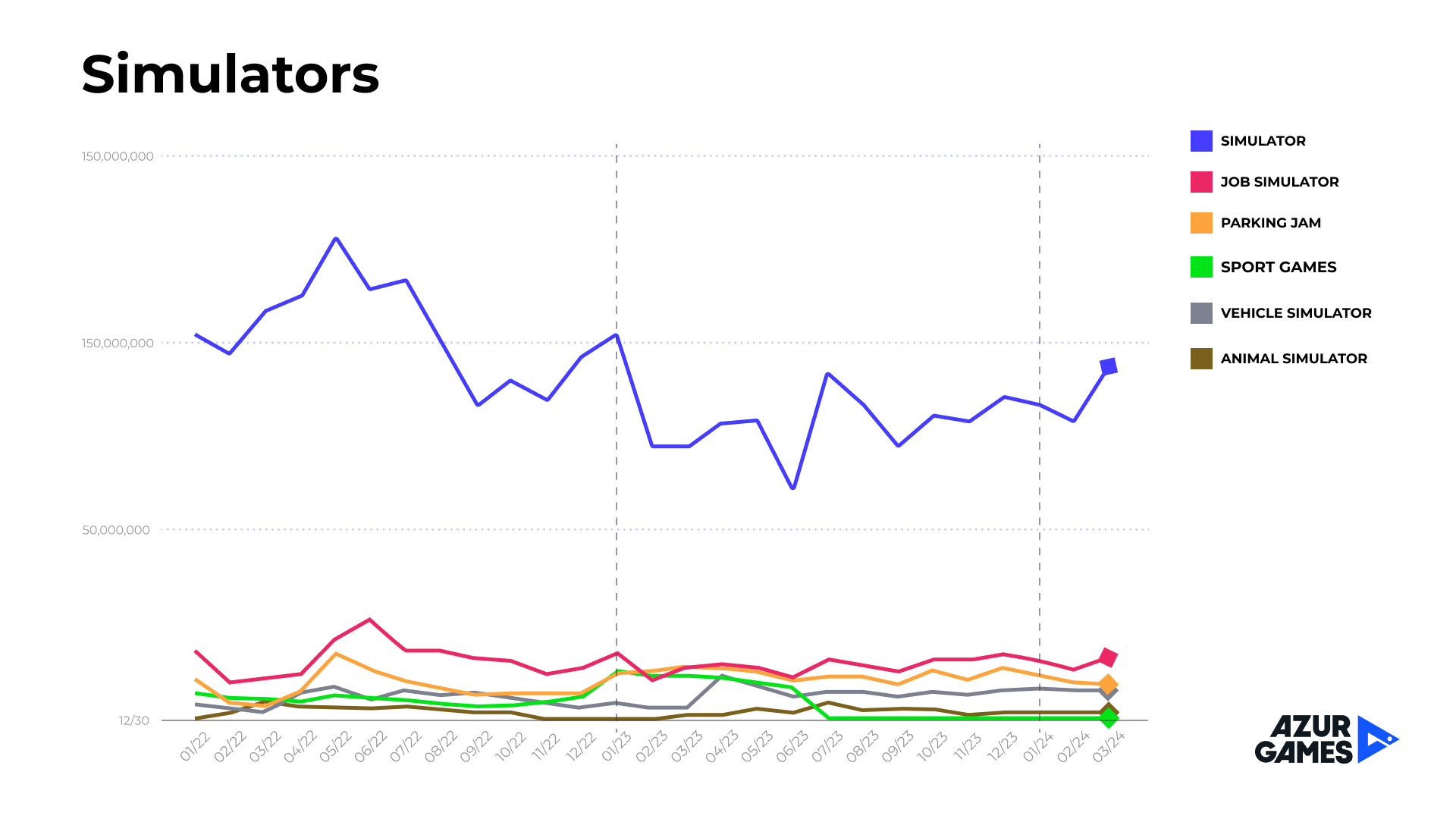

Simulators

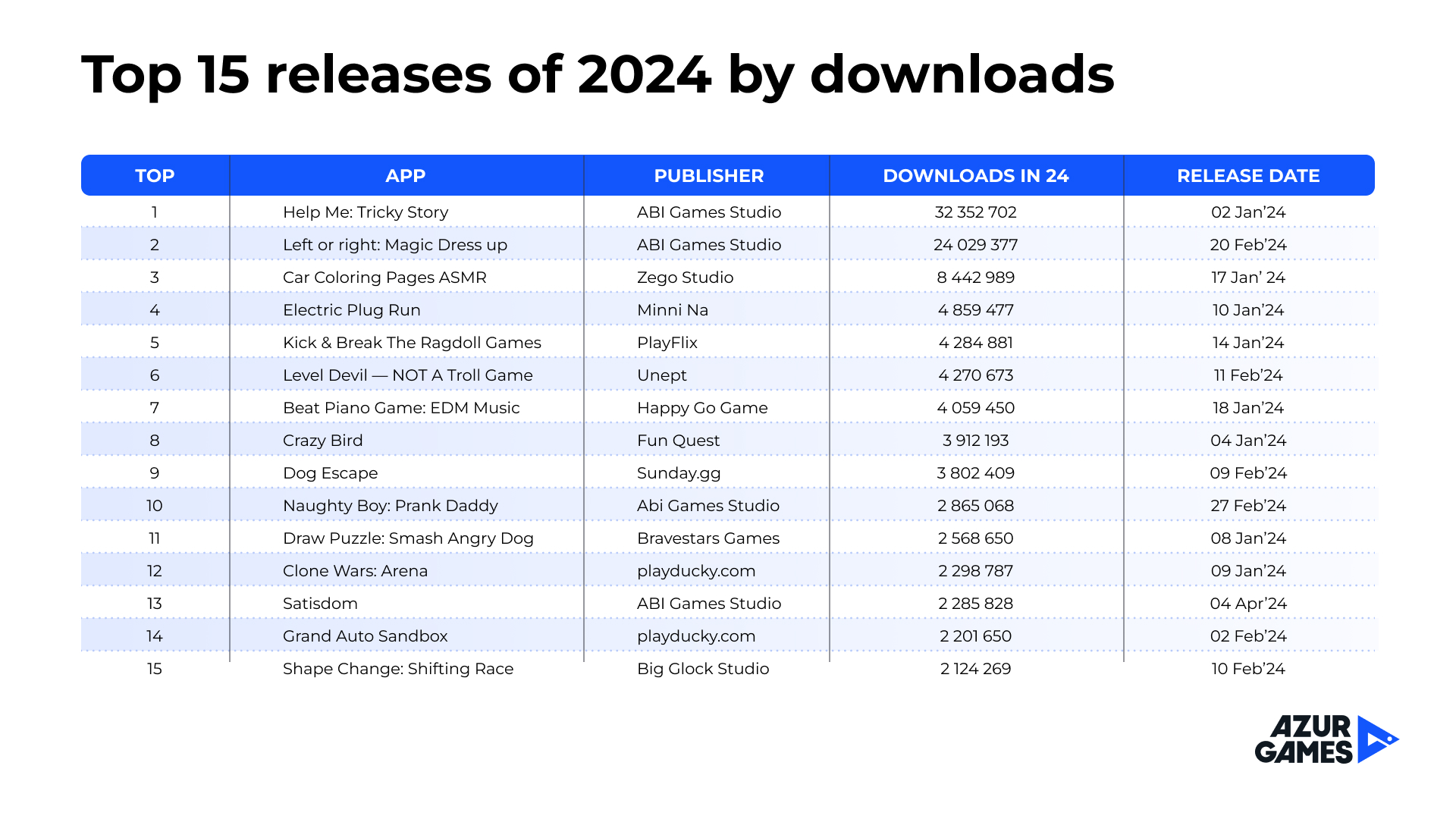

The sharp jump at the end is associated with the emergence of a new hit — Left or Right. This is one of the top releases of this year. The game received over 25 million installations. This growth is exactly what we see on the graph.

If titles appear that have a significant impact on the overall genre indicators, it might indicate that the genre is being reinterpreted. Within these reinterpretations, old titles don’t realize the full potential of the niche.

The feature of simulators is that they can organically incorporate a large number of mechanics. And it is these projects that showcase themselves the best.

Simulators are a good genre for teams ready to experiment. Having a large number of different HC mechanics can be an alternative to complex core balance work. Importantly, the quality and feel of these mechanics must be higher than they were in HC a couple of years ago.

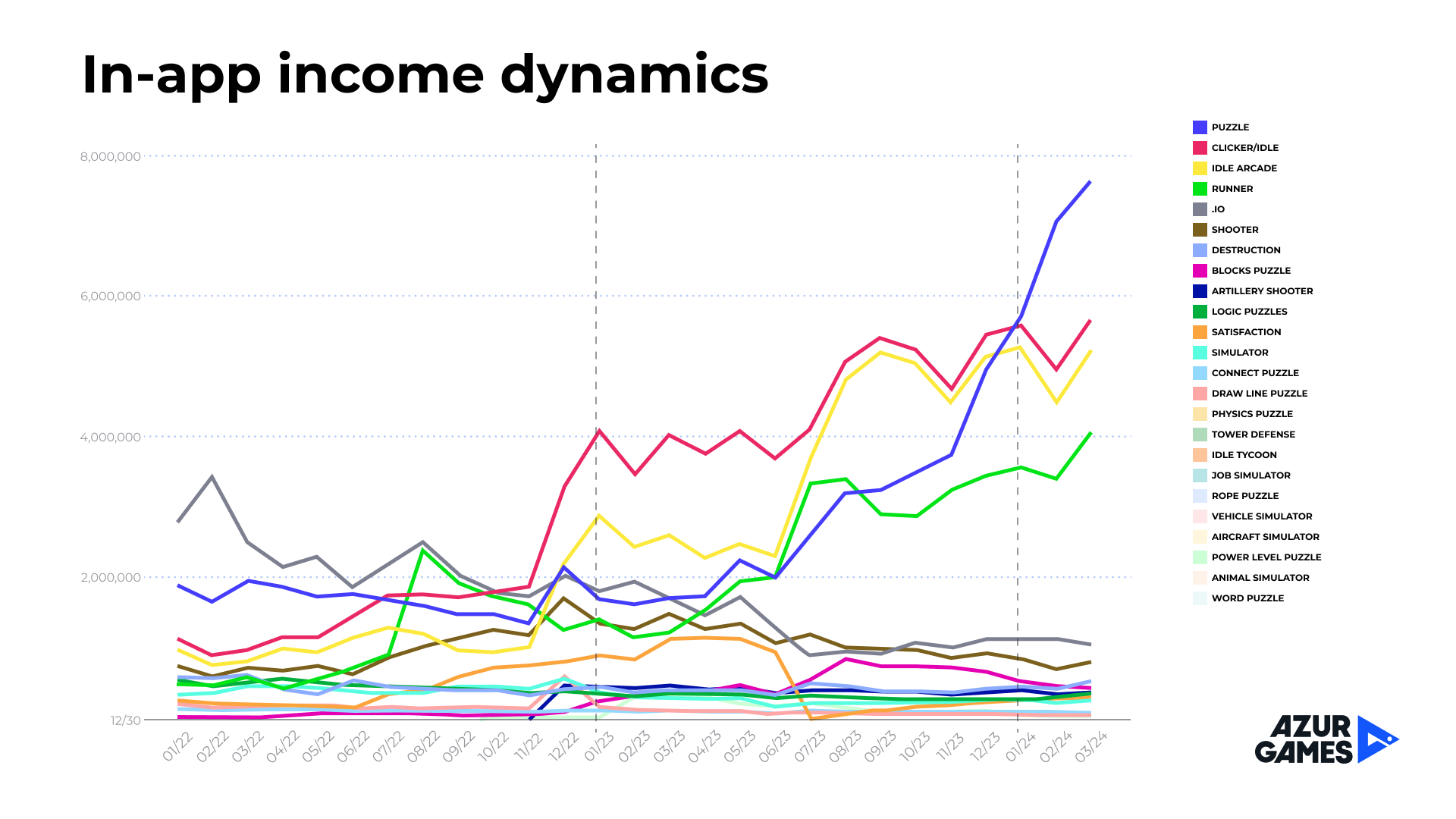

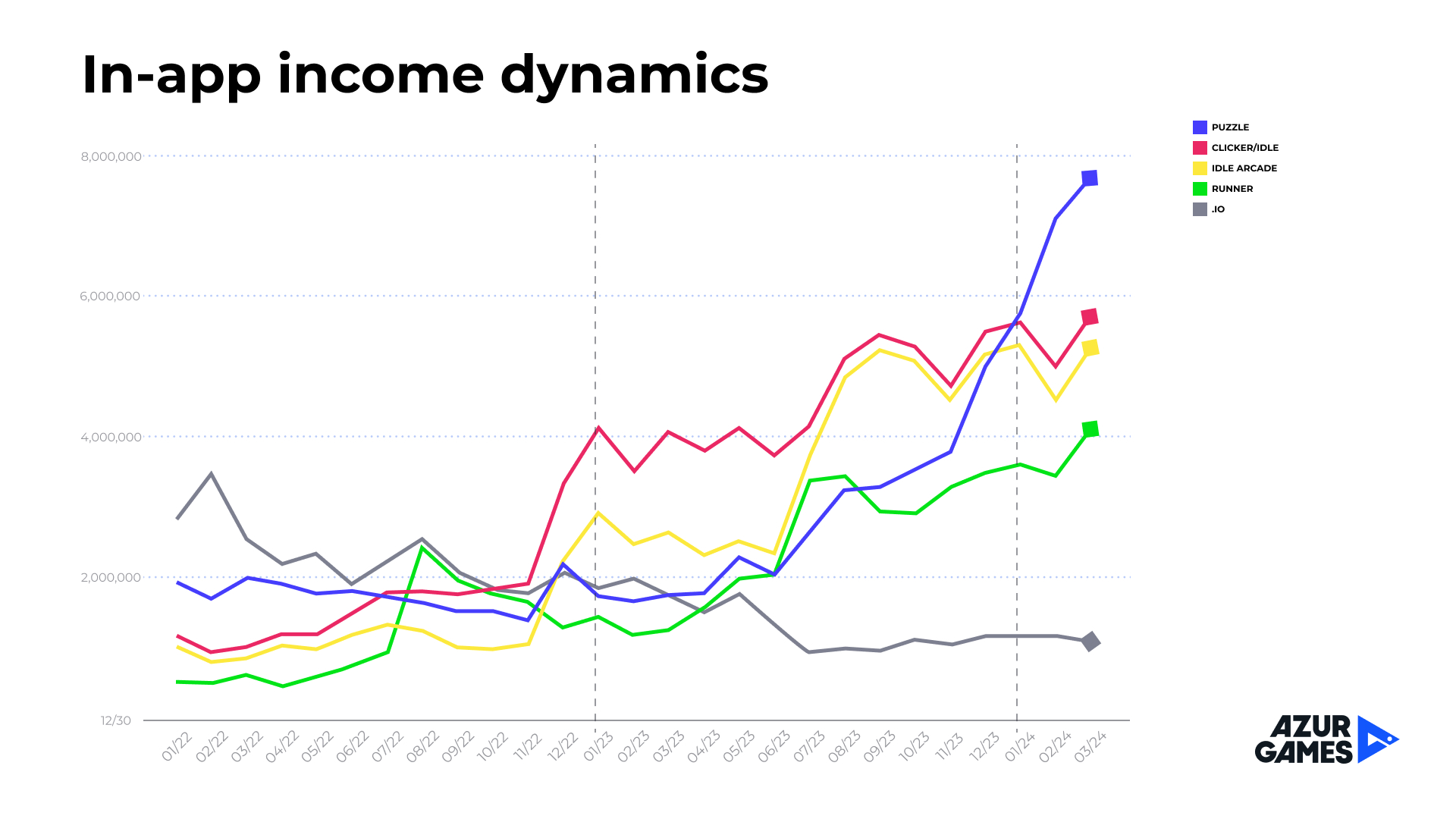

IAP Monetization

IAP monetization continues to break into HC. A year ago, it accounted for up to 10% of revenue, in some cases reaching 20% of a project’s earnings, now — up to 35%.

For developers, this means a more meticulous approach to balance. For example, it is worth reducing the number of rewarded ads per day to control in-game scarcity. If there’s too much hard currency, there’s either nowhere to spend it, or spending it breaks the balance completely. Precise tuning now greatly distinguishes a classic hyper-casual from hypercore.

The top genres by monetization:

Top 15 Releases of 2024 by Downloads

Let’s not forget about new releases. Top projects continue to appear on the market and they are essential for deconstruction within the team to find points for your own growth.

In Conclusion

Hyper-casual is not dying. That's encouraging.

Moreover, even relatively simple projects occasionally hit it big. However, if you are interested in a long-term successful project, you’ll have to invest in architecture, mechanics, and balance.