Micropayments are a common practice on “big platforms” even in premium projects. At the same time, they are not helping the desktop and console market grow today. Why, — the analytical company SuperData told in its latest research.

According to analysts, micropayments at the end of 2018 accounted for:

- 85% of all revenue from PC games;

- 48% of all revenue from console games.

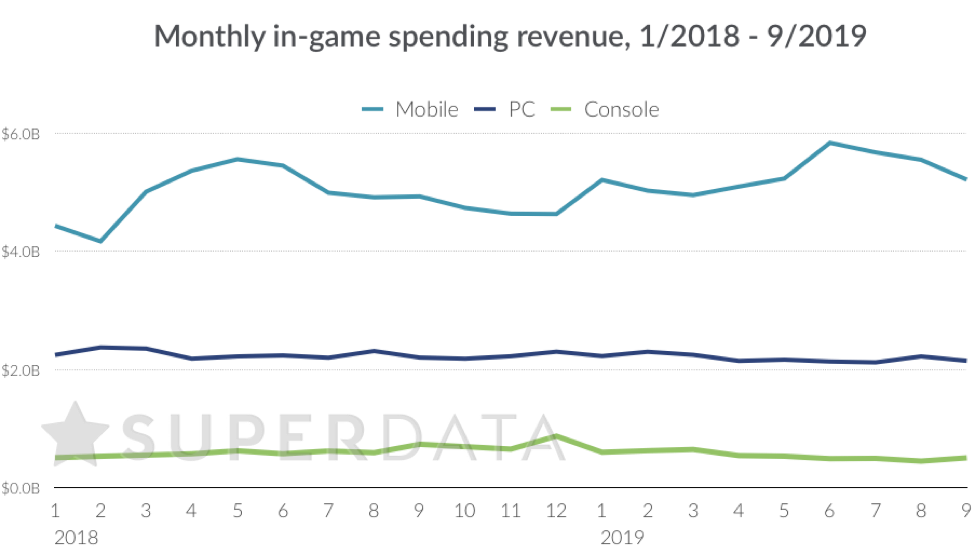

The problem is that the revenue from micropayments on PC has not been growing over the past two years, and on consoles it has been falling lately.

Revenue from gaming micropayments (January 2018 — September 2019)

SuperData identifies several factors that make PC and console games no longer able to increase revenue from micropayments.

1.

Players generally spend less on in-game content. Instead, they focus their attention (and their budget) on a smaller number of products.

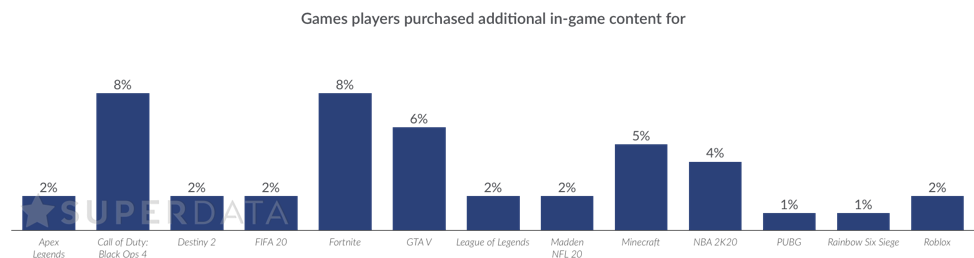

In other words, most of the amounts are deposited in a relatively small number of titles. For example, in September, 8% of transfers were made to Fortnite.

Distribution of revenue from gaming micropayments by title (September 2019, PC and console)2.

There is a reduction in the audiences of those games in which most of the players are paying. As a result, the number of transfers is falling, and with them the conversion to paying players.

Fortnite is again a great example here. In September 2018, the conversion rate on consoles and PCs was 30% and 36%, respectively. In September 2019, it fell to 16% and 10%.

3.

Additional content, which is designed to convert users into paying users, partially fails its task.

On the one hand, in the third quarter of this year, micropayments earned $6.5 billion on PCs and $1.4 billion on consoles. On the other hand, it is only 30% of the entire digital market. And this amount, according to SuperData, is not growing, even considering the appearance of powerful releases in the spirit of FIFA 20 and NBA 2K20, where the main emphasis is just on micropayments.

According to a survey of analysts, more than 50% of players do not resort to in-game purchases at all. All this means that original solutions are needed that will reach a new audience.

4.

Players are becoming more and more wary of the monetization solutions offered by developers.

When choosing a game, they often listen to the advice of family and friends (54%), social media (40%), as well as, of course, websites (36%) and forums (35%). In such conditions, they instantly find themselves aware of all the game “schemes” and may find themselves from getting acquainted with a game whose monetization is considered “predatory”.

Also on the topic:

- Gamers Spent $8.9 billion on digital versions of Games in September

- Digital video game sales Totaled $8.9 billion in August