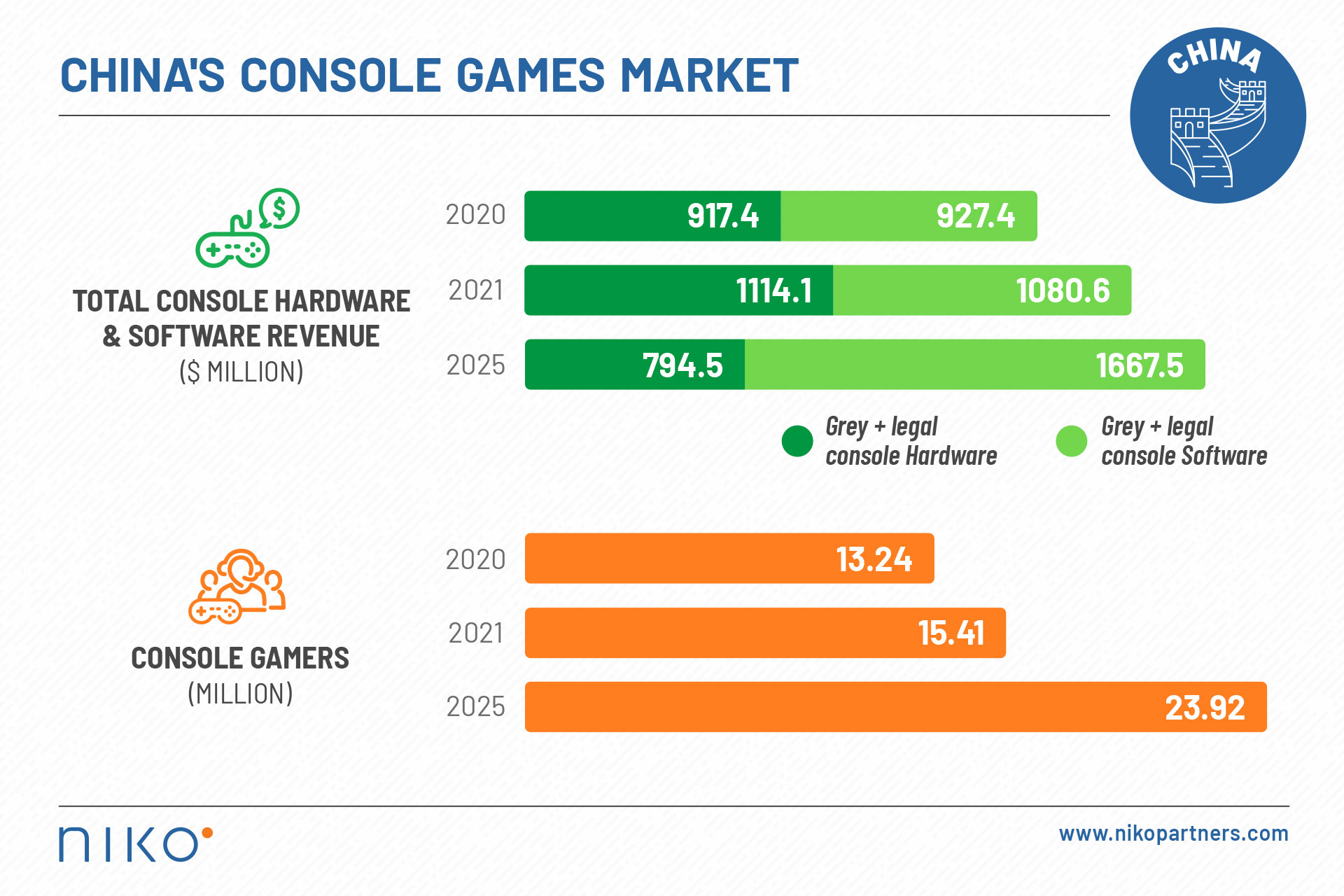

Consoles account for a small share of the Chinese gaming market compared to other platforms. However, their popularity will only grow, according to Niko Partners. According to analysts’ forecasts, by 2025, the revenue of the Chinese console market will approach $ 2.5 billion. We are talking about sales of both legal and gray products.Console market revenue and the number of gamers in China for 2020, 2021 and 2025

Key data from the report

The total revenue of the console market (sales of games and hardware) reached $1.84 billion last year.

- Analysts expect it to reach $2.46 billion by 2025 with an average annual growth rate of 5.9%.At the same time, iron sales will decrease from $917.4 million in 2020 to $794.5 million in 2025.

- Revenue from games, on the contrary, will increase from $957.4 million in 2020 to $1.667 billion in 2025.The peak of iron sales will be for the current year — $ 1.11 billion.

- This is primarily due to the launch of new consoles and high sales of Switch. Nintendo legally entered the Chinese market ahead of competitors, and its console remains the most popular in China.The audience of consoles in China will also increase greatly — if 13.24 million people played on them last year, then in 2025 the number of users will already be 23.92 million.

- This is primarily due to the entry of current-generation consoles into the Chinese market.The total share of the console market in five years will grow by only 0.2 percentage points and will amount to 4.9% of the total gaming market in China.

- Sales of console games by 2025 will account for 2.9% of sales of all games in China.Thus, consoles will still be far from the most popular platform in China.

- For comparison, Niko Partners previously predicted that the turnover of the mobile and PC gaming segment in China will amount to $55.1 billion by 2025.At the same time, console players are a fairly solvent audience.

- The average revenue per console user in China will grow from $84 in 2020 to $91.3 in 2025. Analysts attribute this to an increase in spending on games, in-game purchases and various services.According to Niko Partners, the growing popularity of gaming subscriptions in China will lead to an increase in the revenue of platform holders.

- But free-play games and cloud gaming will affect the revenue growth of developers.