The analytical company Newzoo has published a large-scale study on the state of the PC and console games market at the beginning of 2024. We share the key points from it.

At the beginning of the study, Newzoo analysts noted that:

- a significant number of the most successful titles of the past year relate to cross-platform releases;

- premium titles can cannibalize the time and revenue of game services;

- The service model of monetization is a business that can be called something like a "zero—sum game" (a competition in which one side's gain is equal to the other's loss).

Then they went on to talk about the numbers.

PC and console games earned 93.5 billion dollars last year

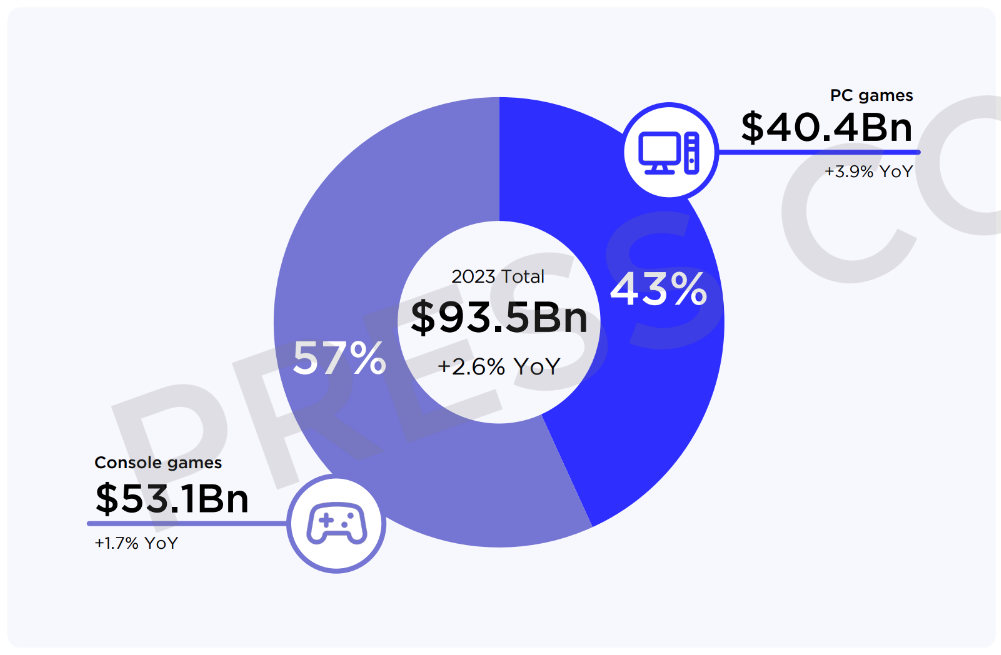

Over the past year, the PC and console gaming market grew by 2.6% to $93.5 billion. The main driver of growth was the PC games market, which grew by 3.9% in 2023.

Distribution of PC and console games revenue for 2023 by platform

Half of this amount came from premium sales. Micropayments generated a third (in the USA and the UK).

Distribution of PC and console game revenue for 2023 by type of monetization (* — subscriptions mean in-game subscriptions, not revenue from subscription services)

This is also true in terms of individual games. For example, Diablo IV collected most of the cash register from retail sales, and not from microtransactions.

Despite the success of several premium blockbusters without micropayments, the share of so-called recurrent (recurring) revenues continued to grow in 2023.

Revenue from PC and console games will grow slowly in the coming years

You should not expect significant revenue growth from PC and console games in the next two years. The growth rates will be lower than those that the market demonstrated before the pandemic.

Dynamics of sales of PC and console games (2015-2026)

If from 2015 to 2021 the cumulative average annual growth rate (CAGR) was 7.2%, then from 2023 to 2026 it is projected at 2.7%. Analysts call the key drivers of future growth:

- increasing the user base of consoles;

- the release of the next console from Nintendo;

- an extensive library of products on consoles.

The user base of PC and console games is also growing more slowly

Speaking about the expansion of the user base, Newzoo notes that growth is slowing down here too. If before 2021 the CAGR of the console audience was 8.9%, and the PC audience was 4%, now it has fallen to 3% and 1.6%, respectively.

Dynamics of the PC and console games user base (2018 — 2026)

The study notes that this will inevitably affect the ability to organically grow the audience.

Each new game has to compete with Fortnite and Roblox

Competition is getting tougher in the current conditions, because new titles are forced to fight for users with evergreen and long-released service games that represent uninterrupted content pipelines.

If you look at the list of games with the highest MAU by the end of 2023, the average age in it is more than seven years.

Top 10 MAU games in 2023 by platform

Therefore, one of the key theses of the study sounds as specific as possible: "Every new game has to compete with Fortnite and Roblox." Despite its advanced age, the MAU of these titles can still show double-digit growth when major updates are released.

Dynamics of MAU Fortnite and Roblox in 2023

Moreover, the fact that these two games are increasingly relying on UGC, being essentially platforms, allows them to leave the rest of the game services far behind them, which cannot offer a comparable amount of content.

There is a drop in the time spent in games

Since the end of the lockdown, the average quarterly playing time has fallen by 26% (that is, in the fourth quarter of 2023, a quarter less time was spent in games than in the first quarter of 2021).

Average number of gaming hours per quarter (2021-2023, PC, Xbox, PlayStation)

Players are spending more and more time in old games

61% of all playing time in 2023 was spent in games that are more than six years old. Only 23% of the time was spent on games that are less than three years old (here — on games that were released in 2023). In general, players prefer to spend more and more time on old releases from year to year.

The distribution of hours spent in games between games released at different times

According to analysts, this is another confirmation of the thesis that it is now more difficult than ever to create a game that can hold the attention of users for a long time.

Most of the playing time is spent on only a few dozen projects

Only 66 titles accounted for 80% of the time spent in games in 2023.

Only five titles, five key blockbusters are responsible for 27% of the time spent in games: Fortnite, Roblox, League of Legends, Minecraft and Grand Theft Auto V.

Top 5 MAU games released more than six years ago

Also, a solid share of the time — 15% — falls on the so—called annual releases - games, whose new part is released every year (among them — Call of Duty: Modern Warfare, EA Sports FC, NBA 2K, Madden and MLB The Show).

Top 5 annual MAU releases released in 2023

New games, which cannot be attributed to annual releases, accounted for only 8% of all game time in 2023. The main premium hits accounted for 3.5%: Diablo IV, Hogwarts Legacy, Baldur's Gate 3, Elden Ring and Starfield.

Top 5 new MAU releases released in 2023

If we take the above 23% for 100% (it is called new game playtime in Newzoo, that is, the game time spent on new releases), then the following turns out:

- Only 48 titles account for 90% of the game time spent on new releases;

- the remaining 10% is divided among other 1400 titles, which are taken into account by analytics;

- Only 16% of the game time spent on new releases was spent on premium games;

- 73% of the game time spent on new releases was spent on paid game services (for example, Call of Duty: Modern Warfare and Diablo IV).

Distribution of time spent in new games by type of monetization

The situation with revenue is similar. 90% of the money earned by new games was for only 43 titles. 59% of which are paid game services (10.8% are FIFA and EAFC, another 10.4% are NBA2K).

Distribution of revenue for new games by type of monetization

Experts also told about the following observations:

- The number of publishers responsible for 80% of the gaming MAU is decreasing;

- despite the reduction in the time spent in games, the average number of titles played by users per month does not change significantly from year to year;

- the announcement and launch of remakes can significantly affect the MAU of the original titles;

- Launching TV or movie adaptations increases the MAU of the games they are based on by an average of 35%.

The full version of the original study can be downloaded here.