What is the market of games in the merge genre, who are the leaders in it and how much do they earn? The answers to these and other questions are in the study conducted by the editorial board App2Top.ru based on the AppMagic database.

The genre of merge games is more than 10 years old. Like any genre, it has experienced ups and downs. Each time he changed quite a lot both in terms of rules and in terms of meta. At the same time, the basic principles of its core mechanics remained the same: when merging, identical objects do not disappear, but turn into some other.

The first game with this mechanic — Triple Town — was released in October 2010. Now it is difficult to talk about the great commercial success of the title (there is not enough data), but it was noticed. As a result of 2011, many publications called Triple Town the best social and indie game.

Triple Town. The game has not changed since its release.

She also had clones. For example, in Russia in 2012, “Democracy” from the Belarusian Neskin Games was very popular (we will mention this studio later today).

“Democracy”. Today the game is published by another publisher, and it looks noticeably different.

In the last couple of years, the genre has once again experienced a boom in interest from mobile game developers. Including from domestic teams actively trying themselves in this niche.

Against this background, we have prepared a study on the database, kindly provided by AppMagic, in which we focus on the following points concerning the niche:

- classifications of subgenres in the merge niche;

- analysis of the situation in each of the subgenres.

Subgenres of games in the merge genre

If desired, many subgenres can be distinguished in the niche. But not all of us are considering. For example, we do not take into account Merge Numbers, which includes the minimalistic hits of Threes! and 2048, which were among the most popular mobile titles of 2014 (Apple in particular called Threes! game of the year).

Threes! and 2048. Original and clone. The first one has sunk into oblivion, the second one is still heard. The story of their confrontation deserves a separate story.

Let’s just note that Merge Numbers is a large niche of mainly hypercausal projects. As of today, AppMagic records 226 relevant titles in the niche. But only 5 of them manage to generate more than 2 million installations per month.

In this paper, we have focused on three subgenres responsible for the cash register of the entire direction. This:

- merge-3;

- merge-2;

- strategic merge.

Merge-3

Mechanics description

At least three items are required to merge. The more items you merge, the more you get a bonus.

The essence of core gameplay on the example of Merge Dragons

The meta is built around discovering and clearing new territories, as well as collecting resources. Energy replenished over time is spent on many actions.

Such games, as a rule, have a bright cartoon picture, an isometric perspective, a fantasy setting, and the plot is formal.

This trend in the merge genre can be conditionally called Turkish. The way these games look and how they work was laid down by Gram Games in its Merge Dragons.

Merge Dragons

Actually, Merge Dragons continues to be the main project in the niche since its launch in softlonch in November 2016.

Figures by niche

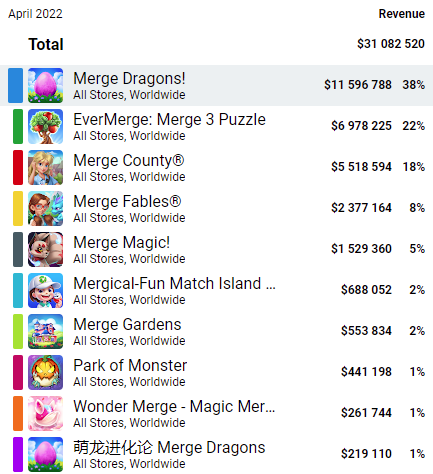

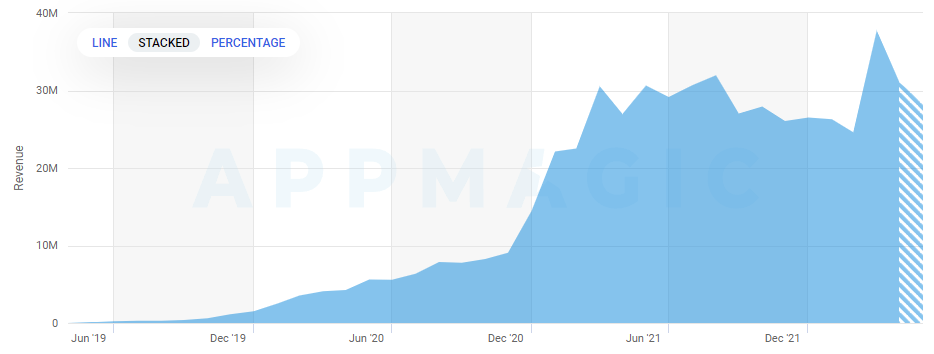

AppMagic has 86 current projects related to the merge-3 subgenre. At the moment, the total monthly revenue of the niche is $ 30 million. In other words, its annual turnover can reach $360 million.

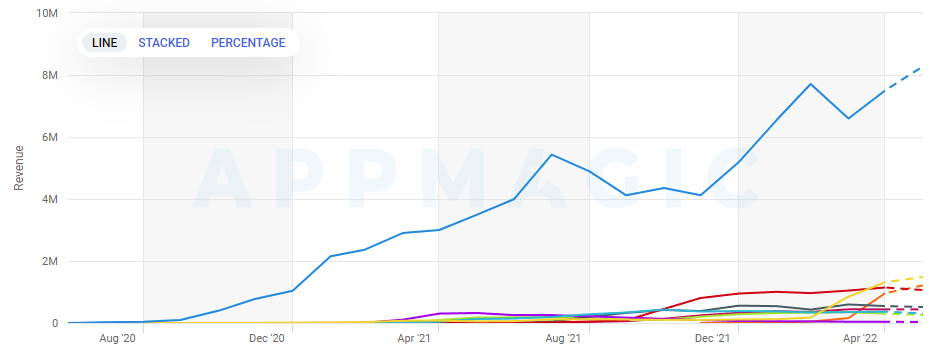

Revenue dynamics of the highest-grossing merge-3 projects

In the top 10 niche games, there was a place for three blockbusters at once (projects with earnings of $ 5 million per month). In addition to them, there were two titles on the chart with a relatively high box office (from a million dollars a month).

Top 10 of the merge-3 subgenre

However, it is important to understand that the revenue of 80% of the games of the subgenre per month does not exceed the $100 thousand mark. As for the top, it is not formed by simple players. From the top 10:

- three games — from Gram Games;

- three games are for Chinese teams.

6 out of 10 current niche leaders came out before the spring of 2020.

Top Games

There are three unambiguous leaders:

- the already mentioned Merge Dragons from Gram Games with a monthly box office of $ 11.5 million;

Merge Dragons has set not only the mechanics of the entire subgenre, but also a bright visual style common to it

- EverMerge from Big Fish Games (the developer of the game was Neskin Games, which has been engaged in this genre for the past ten years), earning about $ 6.9 million a month;

EverMerge

- the rising Chinese hit Merge Country from Microfun, which in March earned $ 4 million a month, and by the end of April reached the threshold of $ 5.5 million.

Merge Country is one of the first in the niche to move away from the fantasy setting in favor of a realistic one, but retains the cartoon graphics of competitors

The success of Merge Country, which was released in November 2021, demonstrates that it is still possible to enter a niche. And even on not very large volumes of attracted traffic. The total downloads for the entire time of the project operation do not exceed 5 million.

Dynamics of Merge Country sales and downloads in the world (the blue line is installations, and the blue line is the cash register)

Another thing is that the traffic was most likely well targeted. Plus, the game itself monetizes users very well. This is especially true for the American audience, where the game earned $ 12 million in five months for an audience of 1.5 million people.

Merge-2

Mechanics description

To merge, you need two identical items. The items required for obtaining are set by quests.

The essence of core gameplay on the example of Merge Mansion

Free space on the field is usually very limited to items without a pair. The player receives new items from boxes and chests with a timer.

The field in such games is not isometric, but two-dimensional. A realistic setting is used, and the plot plays a more important role than in merge-3.

The action of the game is not limited only to the playing field for combining items. Within the meta there are interactive areas for research.

In Merge Mansion, quests are set through the environment. For example, a bush interferes with the heroine in the location. For his haircut, she must get a pruner as part of the core gameplay

The subgenre can be called Finnish, since it was formed by the Helsinki Metacore in Merge Mansion. And this is the only blockbuster in the niche.

Figures by niche

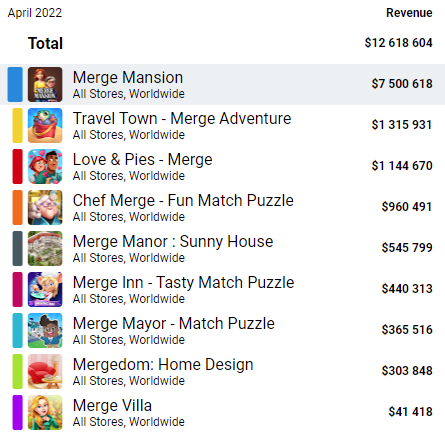

AppMagic has 176 relevant projects related to the merge-2 subgenre. At the moment, the total monthly revenue of the niche is $13 million. Its annual turnover can reach $156 million.

Revenue dynamics of the highest-grossing merge-2 projects

The problem is that almost two-thirds of this amount is accounted for by one game. The already mentioned Merge Mansion. If we start from monthly earnings, then no other game comes close to its level of $ 7.5 million.

Top 10 of the merge-2 subgenre

In the top 10, only three projects, besides Merge Mansion, earn more than one million dollars a month. That’s how much they have after deducting the share of stores and tax deductions.

Moreover, to get into the chart of a game in this genre, it is enough to earn a little more than $ 100 thousand per month. A very low threshold, indicating a large number of projects with problematic monetization in the segment.

Out of 174 active projects in the genre, only 8 projects earn more than $ 100 thousand per month. Most of the earnings do not exceed the $10 thousand mark.

So it turns out that merge-2 is a much more complex direction than merge-3. There is more competition, more projects, but games in the niche earn less.

Top Games

In fact, only Merge Mansion could be done here. Still, the lag of other titles from it is too significant.

- Merge Mansion from Metacore with a monthly box office of $7.5 million;

Merge Mansion has set a realistic setting, but not all clones strive to repeat its visual

- Travel Town by Magmatic Games with earnings of $1.3 million;

Travel Town

- Love & Pies from Trailmix with earnings of $1.1 million.

Love & Pies

By the way, Metacore is now a one-game company. Its turnover for 2021 amounted to €58 million. At the same time, she finished it in a deep minus. Its loss amounted to €60 million. And the company’s management is not yet sure that they will be able to bring the company to a plus by the end of 2022.

Strategic merge

Apart from the finally formed (primarily due to numerous clones) niches merge-3 and merge-2, there is a group of merge games designed for completely different audiences.

AppMagic now conditionally calls them Strategy Merge. And among them there are two directions:

- 4X-merge — merge with a meta of 4X strategies in which the focus is shifted to construction and expansion;

- TD-merge — merge, whose core mechanics took a lot of the tower defense genre.

For simplicity, the first approach can be called Chinese, and the second — Korean.

The only representative of 4X-merge is Top War from Hong Kong-based Topwar Studio.

Top War: Battle Game. According to the screenshots, it looks like a clone of Boom Beach. And, yes, it is precisely this audience that it is aimed at

Despite the fact that the project has earned more than $ 500 million since 2019, having gathered an audience of 100 million people (the last figure is official data), it either did not get followers at all, or none of them could achieve minimal visibility.

In the project, at least two items are needed to merge, the items are divided into two types — buildings and troops, the first extract resources and produce troops, the second liberate the territory by fighting the enemy army.

Construction Core Top War: Battle Game

Today, Top War earns a little more than $30 million a month. Half of this amount falls on the Western market, half on the Asian market.

Top War: Battle Game Sales Dynamics

As for TD-merge, the pioneer here is the Korean Random Dice: Defense from 111%. It has gone as far as possible from the classic merge. Therefore, it can only be attributed to the genre with a big stretch.

In the framework of PvP battles, the player must unite his troops as soon as possible. Between sessions, decks are formed in the meta and fighters are pumped.

Random Dice

At the peak of popularity in 2020, Random Dice earned $10 million (at that time more than Top War had). The project has several clones.

The most popular of the latter is the domestic Rush Royale project from MY.GAMES, which has now overtaken the original in earnings. The monthly earnings of the title after deducting the shares of platforms and taxes are kept at $ 6 million.

Rush Royale

Figures by niche

The total monthly revenue of the strategic merge subgenre is $39.7 million. This is the turnover of merge-3 and merge-2 combined (well, almost).

That’s just, as in the case of merge-2, two-thirds of the amount falls on one game (Top War). The remaining third is for two more projects (Rush Royale and Random Dice).

In fact, there is no niche outside of these titles. It has yet to be formed. Although this may easily not happen.

Cumulative ARPU

In a separate chapter, we also decided to compare the total ARPU (here: revenue during operation, divided by downloads).

The leader are projects in the merge-3 subgenre. Merge Dragons and EverMerge have a combined ARPU of $9. The remaining projects from the top 10 have an indicator at the level of 3-5 dollars. Even projects from the second ten do not have ARPU less than a dollar.

Top 10 of the merge-3 subgenre for April, indicating downloads and ARPU

As for merge-2, even the leader of the direction does not have a large ARPU here. The peak for the subgenre — at Merge Mansion — is $3.64. Projects from the top ten ARPU are below the dollar.

Top 10 of the merge-2 subgenre for April, indicating downloads and ARPU

Speaking of strategies, it is difficult to talk about a whole picture here, because, as we have already noted, niches have not even really formed here. There are three major projects and that’s it. So here we will talk about the indicators of only the specified titles.

Top War has a cumulative ARPU of the project at $7.5. This is an average for the 4X genre (this is at the level of Lords Mobile actively buying up traffic).

As for Rush Royale, here the cumulative traffic is $2. This is a small figure both for the merge genre and for real—time strategy games (for example, Clash Royale has $4.8)

However, we note once again that the cumulative ARPU for us here is a conditional indicator. It is much more important here how much the purchased traffic costs companies, how much they remain in the black. For obvious reasons, it is impossible to talk about this without knowing the inner kitchen of each of the studios. However, as we have already noted, Merge Mansion with an ARPU of $3.64 is now officially sitting in the red.

Conclusions

- There are a lot of games in the merge niche, but successful clones outside the merge—3 subgenre are almost not found.

- As a rule, each of the subgenres has one major box office hit (the exception again is merge—3).

- The most earning merge — 4X-merge (more precisely, one single game in this genre).

- In merge-3, despite the strong competition, new asterisks continue to appear.

- Against the background of the financial difficulties of Merge Mansion and the very low ARPU of most merge-2 games, the interest that many companies show in the niche is unclear. We can only explain this by (a) the oversaturation of the match-3 games market (formed teams are looking for less saturated niches with a similar target audience, those niches where the expertise they have gained in match-3 can be useful) and (b) a loud story about how Supercell allocated large tranches of Merge Mansion.

- As for the strategic direction, this niche is being created right now. Another question is whether there will be a place for anyone in it at all, except for those who are currently processing this site as a pioneer. The story of Clash Royale and the same Merge Mansion shows that sometimes there is only room for one game in a niche.