The analytical company InvestGame presented a report on the situation on the gaming investment market for the first three quarters of 2023. Both in terms of the volume of transactions and their number, it turned out to be one of the most unsuccessful in the last four years.

The authors of the report are confident in the normalization of the market

Let's focus on the main thing from the report.

Private investment

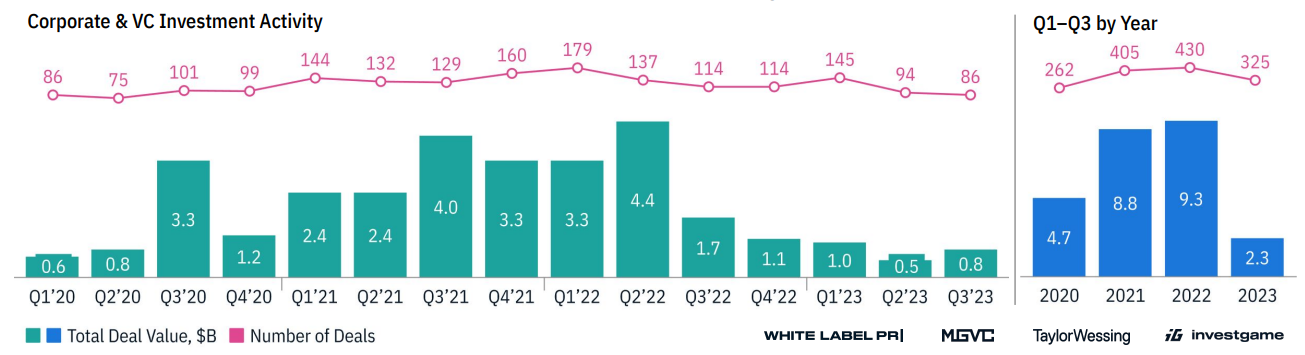

In January-September 2023, the total volume of investment transactions in gaming companies amounted to $2.3 billion. This is two times less than for the same period in 2020, and on average four times less than for the same period in 2021 and 2022.

Investments in gaming companies (January 2020 — September 2023)

The drop in volumes is explained primarily by the reduction of late-stage rounds. In the current realities, investors are increasingly doubting whether they will be able to make money on the exit.

At the same time, the number of transactions sank less significantly — by 23%. For understanding: if 430 private investments were made in the first three months of 2022, then in January-September of this year — 325.

According to analysts, the early rounds were less affected by macroeconomic factors. However, in general, investors have become much more selective in choosing recipients.

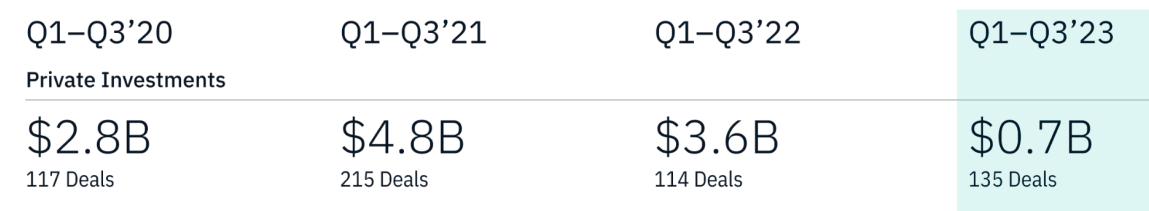

Separately, analysts have calculated investments in gaming companies directly involved in game development.

Eventstitions to gaming companies engaged in game development (1st quarter 2020 — 3rd quarter 2023)

For the three quarters of 2023, the total volume of transactions in the studio amounted to $0.7 billion. For comparison, a year earlier, $3.6 billion was invested in them over the same period. At the same time, the number of transactions themselves has grown — from 114 last year to 135 this year.

The driver of the growth in the number of transactions was pre-sowing and seed investments. Important: the number of deals in companies that create games for PC and consoles has increased, but the number of deals in mobile developers has decreased.

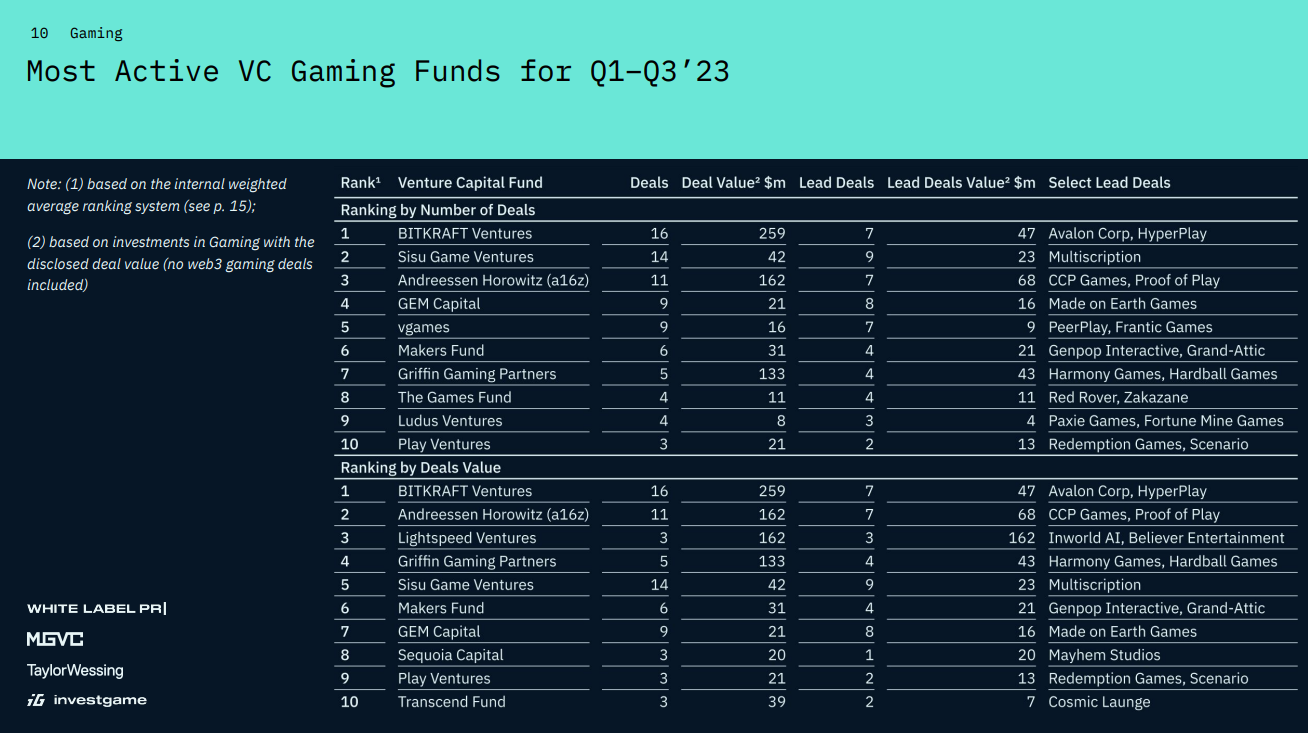

During the reporting period, the BITKRAFT Ventures fund invested the most in game developers — $259 million. He also made the largest number of transactions — 16. Sisu Game Ventures, Andreessen Horowitz and Lightspeed Ventures are also in the top three.

Charts (by volume of investments and by number of investments) of venture funds investing in gaming companies engaged in game development

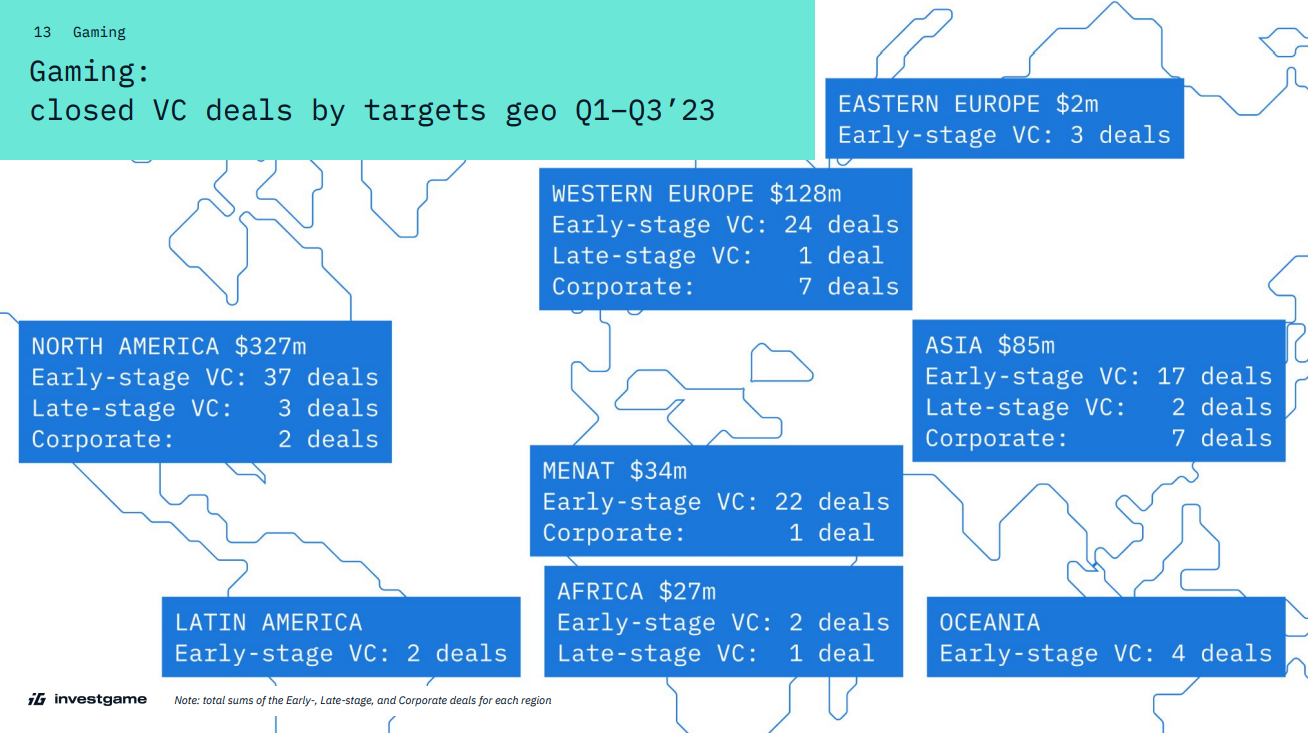

Most of the venture investments in game developers came from the United States. At the same time, it is worth noting the large number of early deals in the Maghreb and the Middle East (MENAT) and the growth of investments in African startups (suddenly a more promising region than Latin America).

Distribution of investments in gaming companies engaged in game development by region

Mergers and acquisitions

First, a small remark: the report takes into account only closed transactions. Therefore, the purchase of Activision Blizzard for $68.7 billion, which will officially end in the fourth quarter of 2023, is not taken into account here yet.

Now to the numbers.

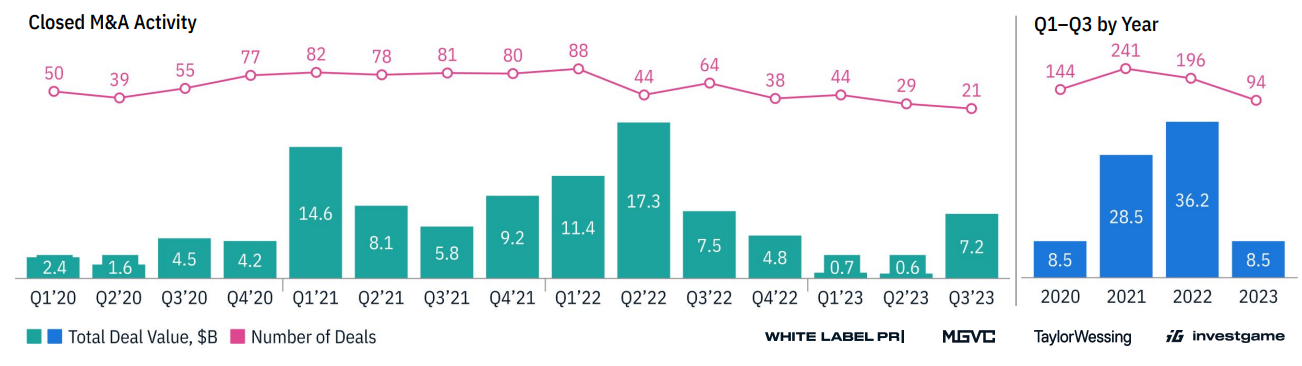

In January-September 2023, the volume of M&A amounted to $8.5 billion. This is the same amount as was spent on mergers in 2020, but 3.8 times less than in the same periods of 2021 and 2022.

M&A of gaming companies (January 2020 — September 2023)

Despite the observed decline in indicators, InvestGame analysts see a structural growth of the sector. In their opinion, three factors indicate this:

- there is a lot of unspent cash from private investors interested in investing in the entertainment market;

- significant financial resources in the accounts and, in general, the stabilization of the value of shares of strategic investors, who can still afford to grow without organic;

- the state of affairs in the early investment market cannot be compared with what it was five years ago. A lot of venture funds (including corporate ones) have appeared, actively investing in new studios in the hope of growing new "unicorns".

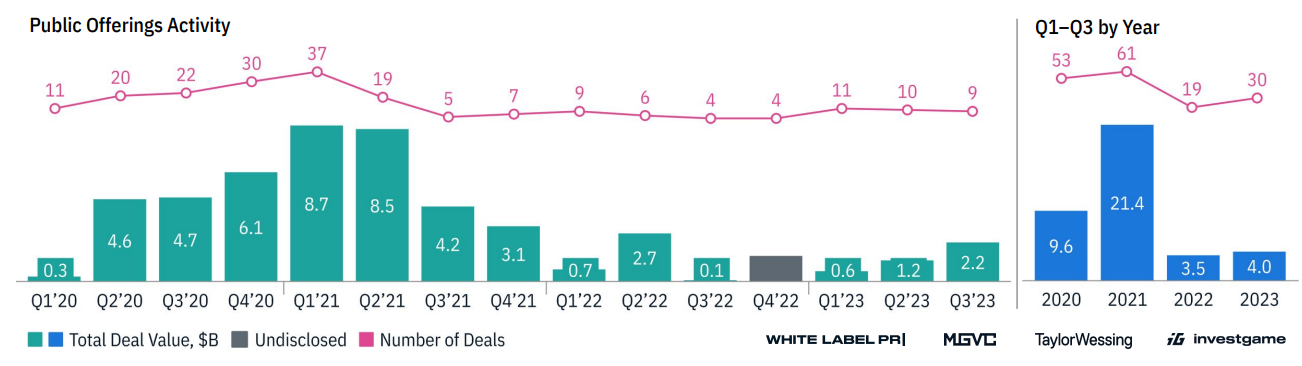

Public placements

For the first three quarters of 2023, the total valuation of the company's share placements engaged in the gaming sector amounted to $4 billion. This is half a billion dollars more than in the same period last year. The number of operations has also increased — from 19 last year to 30 this year.

Important: the placement of shares does not equal the initial public offerings. This year, the largest placements did not relate to IPOs at all. For example, Applovin brought $1.5 billion worth of shares to the market as a loan refinancing.

At the same time, there were no significant IPOs this year at all, apart from Azerion, whose market value fell from $ 1.2 billion to $0.1 billion, and e-sports FaZe, whose valuation fell from $0.7 billion to $18 million.

Analysts explain the difficult situation with IPOs (more precisely, with their absence):

- by raising interest rates in the United States;

- mixed results of recent large non-gaming initial placements in the United States;

- unstable market situation.

More interesting figures and conclusions can be found in the report (by reference to the source).