Facebook has published the results of a large-scale study on the behavior of mobile gamers in 2020. The company told how the preferences of users and their purchasing power have changed, and compiled a portrait of new gamers — those who started playing only after the lockdown.Research methodology

The material is based on a survey of 13246 users from different countries, which the company conducted in July 2020.

In its research, Facebook divides gamers into two categories:

- new players — started playing only after the initial peak of the pandemic in March and continued to play at least one hour a week;existing players — played mobile games before the initial peak and continued to spend at least an hour a week in them.

- How has the audience of mobile games changed?

The largest quantitative growth after the start of the lockdown occurred in the USA — 28 million new gamers appeared in the country (an increase of 28%).

- Britain has the most new audience in percentage terms — 8.6 million new players (an increase of 50%).

- In South Korea, the audience of mobile games grew by 34% (9.4 million new gamers), and in Germany — by 25% (6.5 million new players).

- In most countries, new gamers are much younger than existing players.

- The only exception was South Korea, where there was a reverse trend.In the USA and Germany, there are more console owners among new mobile players than among existing gamers.

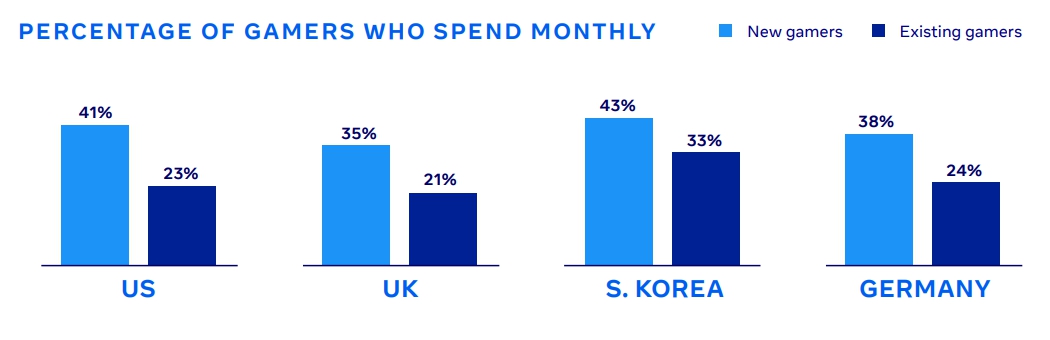

- The exception here is also South Korea, where everything is exactly the opposite.Percentage of users who spend money on games monthly, among new and existing players

Behavior and preferences of new gamers

With a generally equal number of sessions, new players spend more time in games.

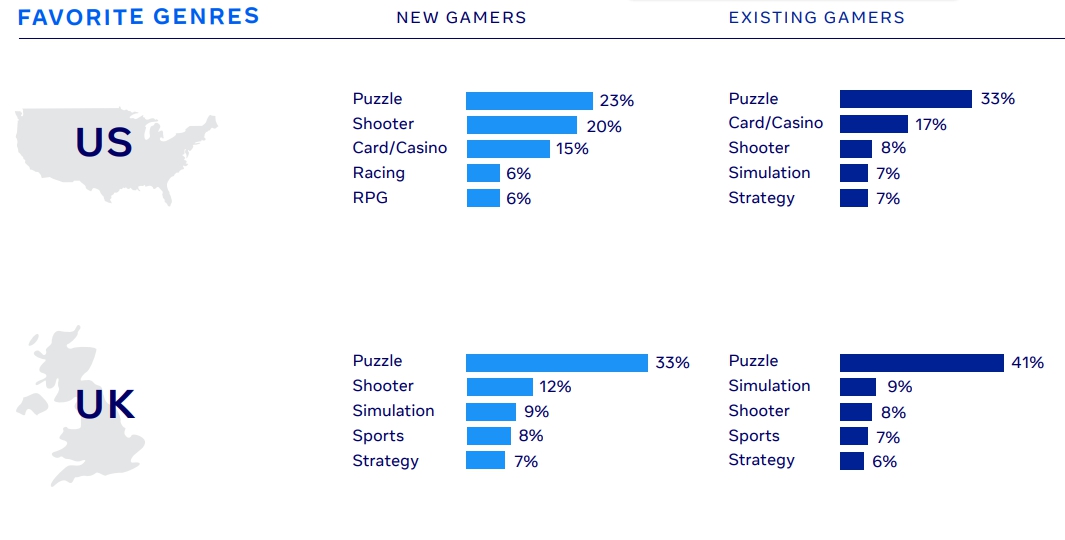

- In the USA, this figure is 13.1 hours per week, in Britain — 13.8 hours, in Germany — 11.8 hours, and in South Korea — 9.9 hours.In the USA and Britain, new gamers prefer more midcore and hardcore genres, while in South Korea and Germany, all users generally like the same categories of games.

- Puzzles occupy the first place in popularity among new gamers in all countries.

- In the USA and Britain, they also like to play shooters (20% and 12%, respectively), in South Korea — in RPG (13%), and in Germany — in simulators (12%).All the surveyed users stated that they like single-player mobile games the most.

- Despite this, new gamers turned out to be much more open to multiplayer and co-op, as well as communication in in-game chats.New gamers spend more money on games monthly than existing players.

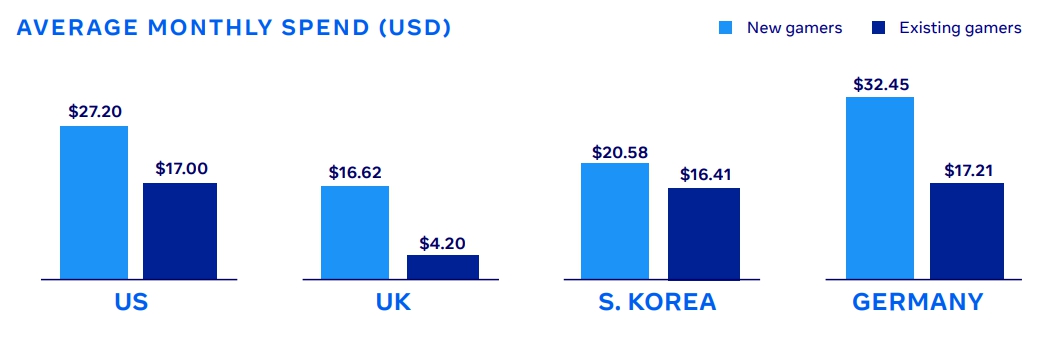

- Most purchases are made in Germany — for $32.45 per month. In the USA, players spend an average of $27.2, in South Korea — $20.58, and in Britain — $16.62.The average amount that new and existing gamers spend per month

What do new and existing players have in common?

Both groups of players give the same reasons why they play mobile games.

- Among the most popular answers are stress relief, just a pastime and a sense of satisfaction with progress.Despite the difference in spending on games, both categories of gamers give the same reasons for purchases.

- They differ only by country. In the USA and Britain, people spend money to remove ads, and in South Korea and Germany — to skip difficult levels.All the surveyed players prefer free-play games with advertising.

- At the same time, new gamers in the USA, Britain and Germany are more open to alternative ways of monetization like in-game purchases.All players want to see real gameplay in advertising.

- Other preferences depend on the market and the genres popular on it. For example, in South Korea, users also want to see the progression of characters and their getting levels in advertising, and in Germany — the basic principles of management.Genre preferences of new (left) and existing (right) gamers in the USA and the UK

Conclusions from the study

The pandemic and lockdowns made players more involved and developed new habits in them — for example, people began to buy more often in numbers, and 49% of consumers expressed a desire to continue buying online even after the end of the pandemic.

On the other hand, since March, the purchasing power of existing players on mobile devices has decreased. Facebook advises developers to reconsider the monetization of their projects and consider the possibility of introducing mixed models (taking into account changes in user behavior in different countries).

The company also recommends paying special attention to new players who are currently the most active. This involves both reviewing existing marketing strategies, as well as interacting with users and creating special activities outside of games — for example, in social networks and other sites.