Analytical service data.ai I have published a report on the state of the mobile application market for the past year. Here are the main facts from his chapter on mobile gaming.

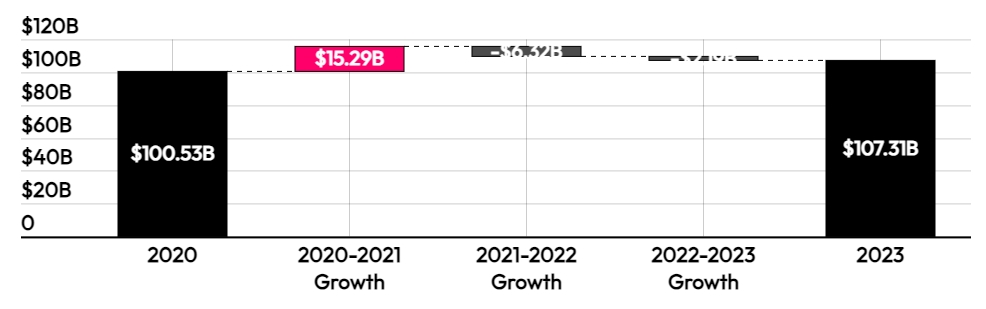

User spending on mobile games in 2023 decreased by 2% compared to the same indicator in 2022. In total, users spent $107.3 billion on mobile games last year.

Player spending on mobile games has been falling for the second year in a row. This could well be called a post-pandemic market correction. For context: in 2021 alone, spending jumped by $15.3 billion relative to 2020.

Annual dynamics of user spending on mobile games

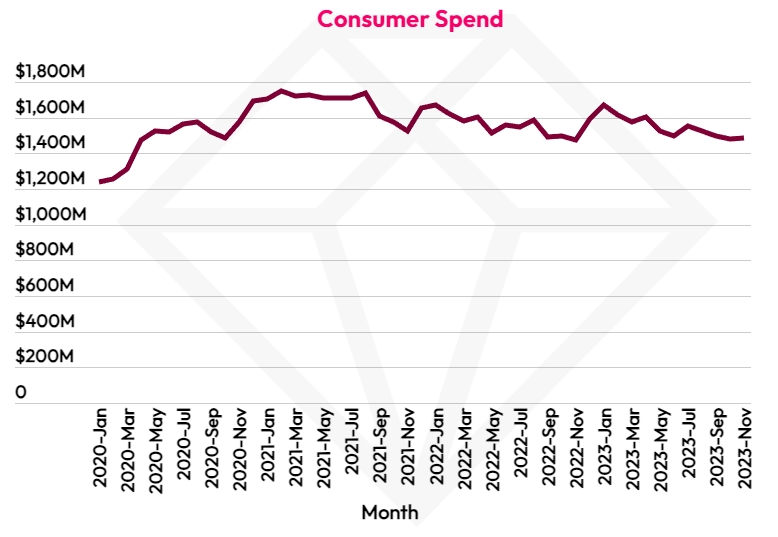

Over the past two years, weekly global spending on mobile games has ranged from $1.4 billion to $1.6 billion. Moreover, their annual dynamics have received a seasonal pattern: spending falls in September-December and reaches peak values in January-February. Also, a separate surge in sales is now regularly observed in July and August.

Annual dynamics of weekly user spending on mobile games by month

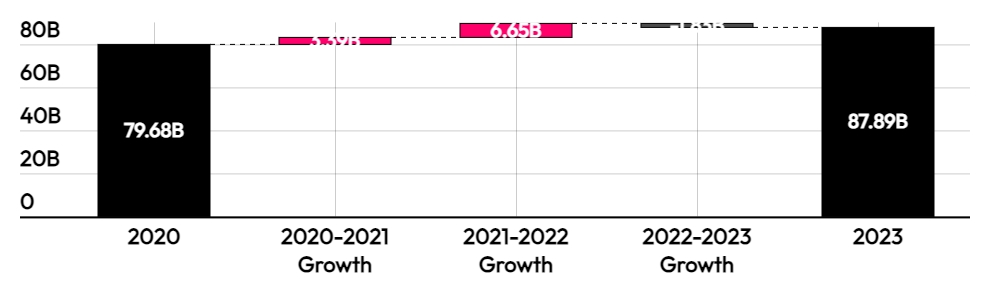

As for downloads, there is also a slight correction (up to 88 billion).

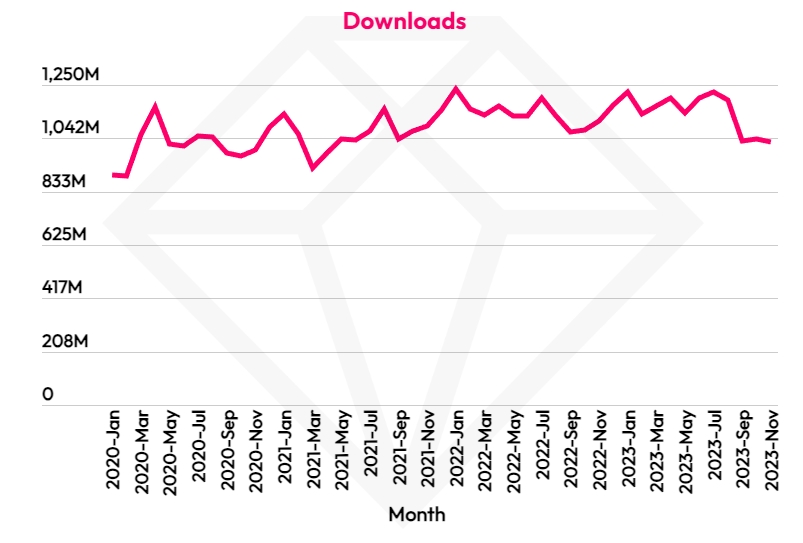

Annual dynamics of gaming installations

But it's difficult to identify any pattern in terms of downloads. It is only clear that since September 2023, the level of weekly installations has fallen to the level of May 2021

Annual dynamics of weekly downloads of mobile games by month

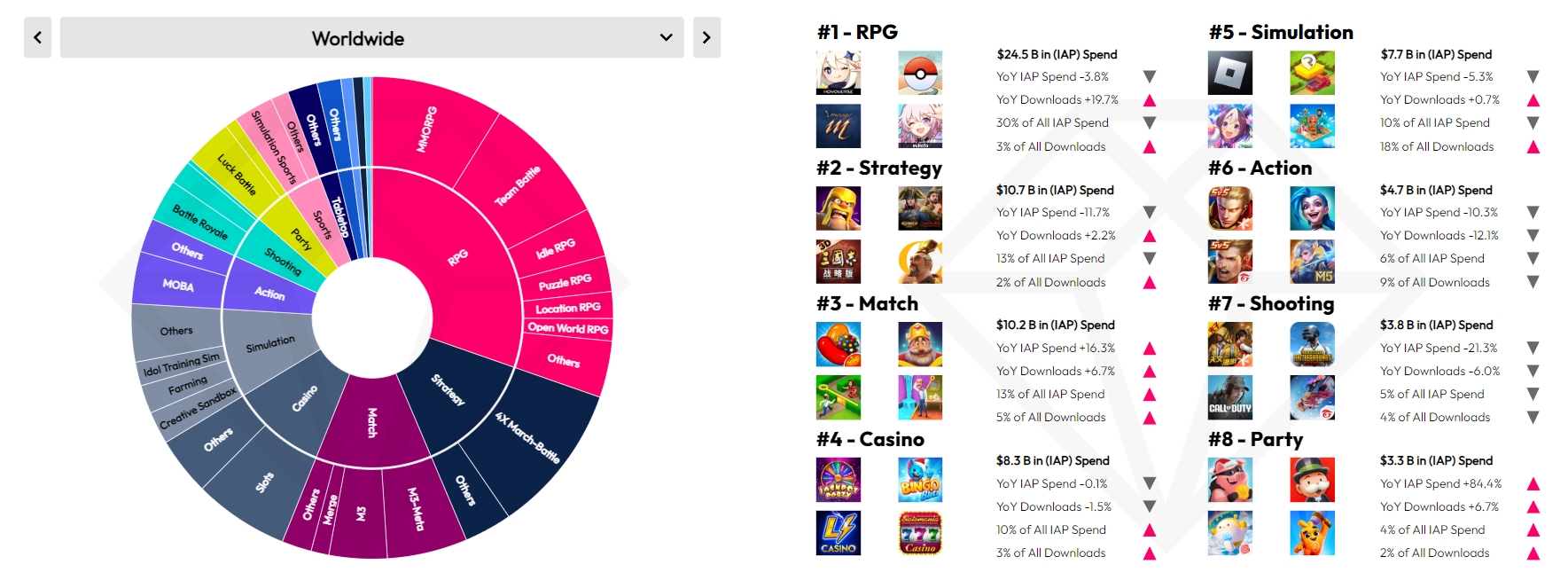

The highest—grossing genre of mobile games is RPG. About 30% of all gaming spending — $24.5 billion — is on role-playing games. The second place in the cash register is for strategies. The puzzle genre is lagging behind it with minimal lag. Both generate slightly more than $10 billion and occupy 13% of the market each.

Distribution of user gaming expenses by genre

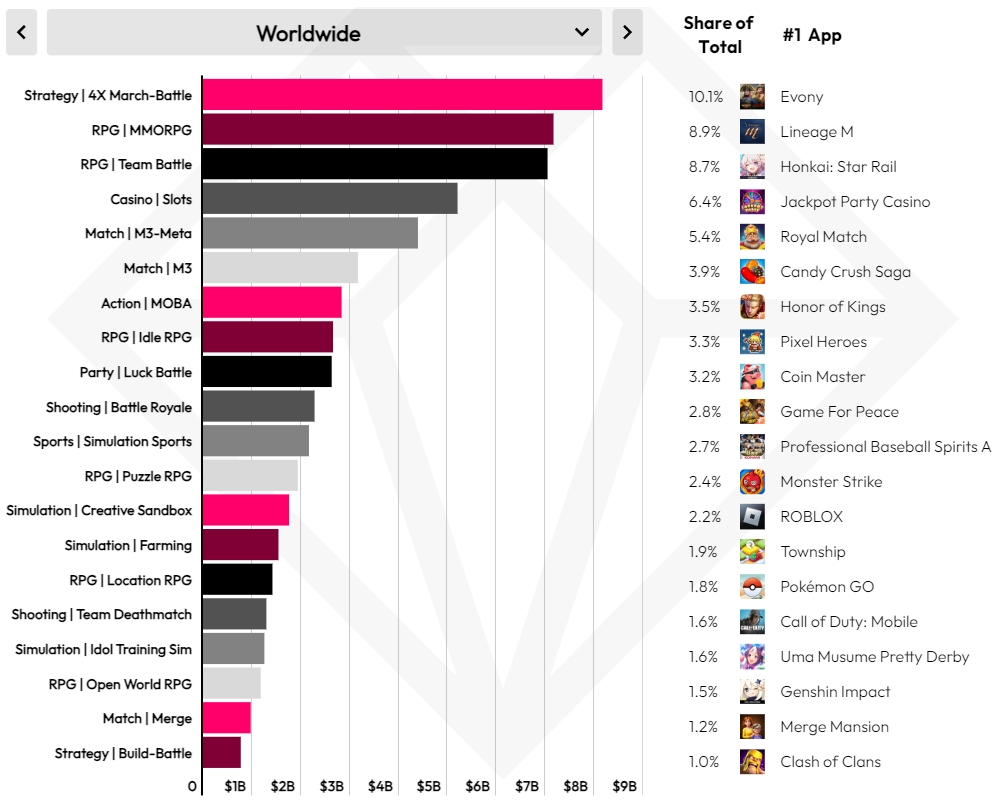

However, the highest-grossing subgenre of mobile games does not relate to role-playing titles at all, but to strategies. 4X games, the most successful representative of which is the Hong Kong Evony project: The King's Return generates more than $8 billion a year. In second place in terms of spending are mobile MMORPGs in the spirit of Lineage.

Distribution of user gaming expenses by subgenres

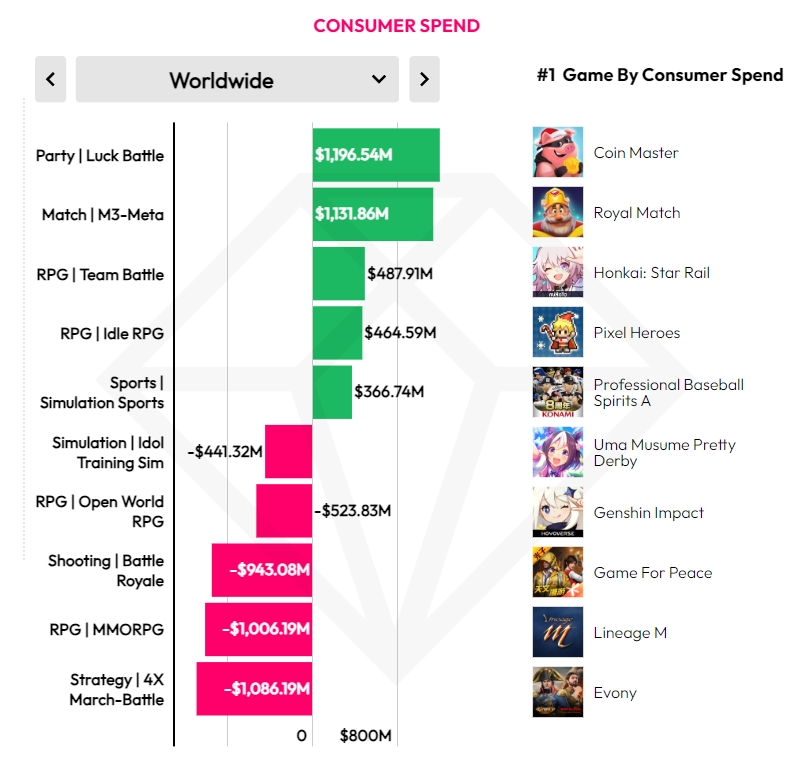

At the same time, the subgenres that showed the greatest box office growth were: Luck Battle (this subgenre was invented in data.ai We are talking about projects in which the main mechanics are based on generating numbers, but which cannot be attributed to social casinos), match3 with meta, team battle (another invented subgenre that we usually call a battler), role-playing idle projects and sports simulators.

The subgenres with the largest increase in spending, as well as the subgenres that showed the largest drop in cash

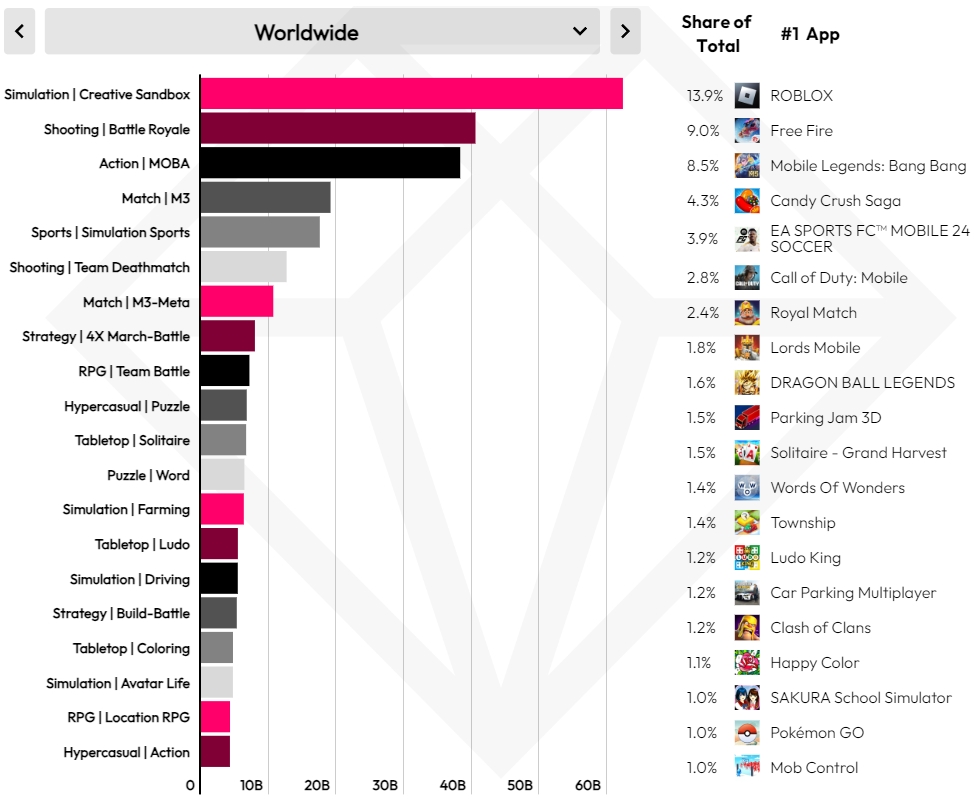

It's funny that the top highest-grossing subgenres and the top subgenres whose games had the most time spent over the past year are not "fighting". In 2023, players spent most of their time in "creative sandboxes" (that is, in Roblox), royal battles and MOBA titles, rather than in 4X strategies and MMORPGs.