At the end of February, the AppMagic analytical service prepared a study of the casual games market for mobile devices. We tell you about the most important of them.

One of the goals of the work, as formulated by the researchers, was to help developers answer the question: which genre should they choose to launch a mobile casual game in 2024?

To do this, the authors:

- we studied the indicators of 300 casual game genres;

- We chose only those genres whose games earned more than $ 10 million in total in 2023 (in the USA, Great Britain, Australia, Canada, France and Germany).

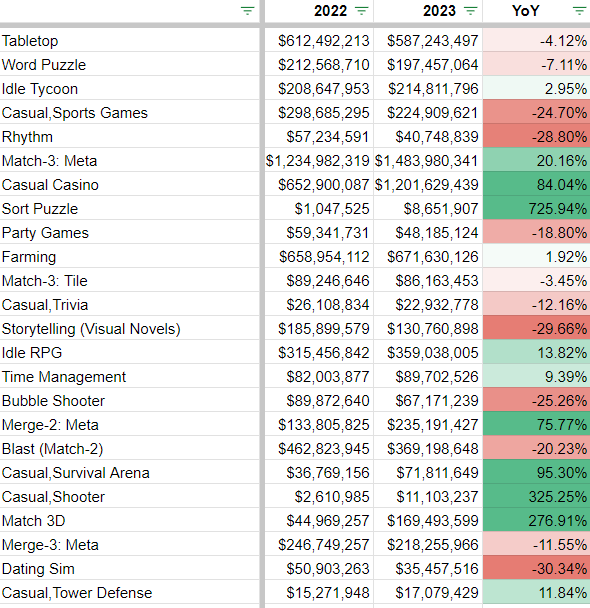

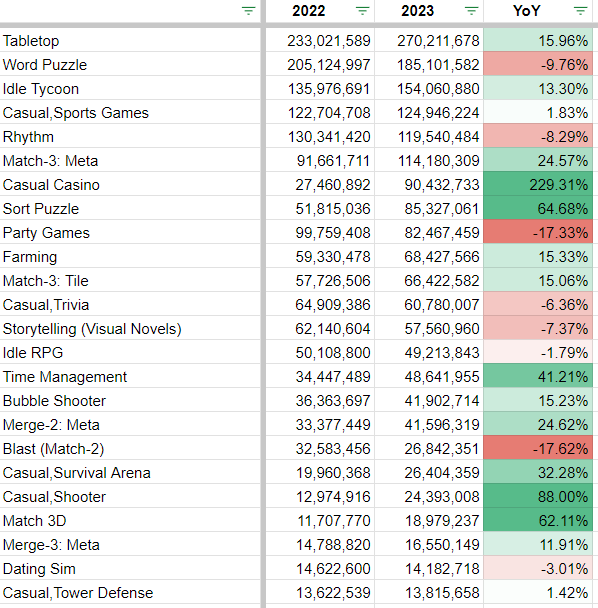

AppMagic has a table covering 24 genres. It shows which casual genres (of those that are generally worth attention) showed the greatest growth in box office and downloads, and which, on the contrary, lost the most.

Comparison of the box office of the top casual genres in 2022 and 2023 (AppMagic)

Comparison of downloads of top casual genres in 2022 and 2023 (AppMagic)

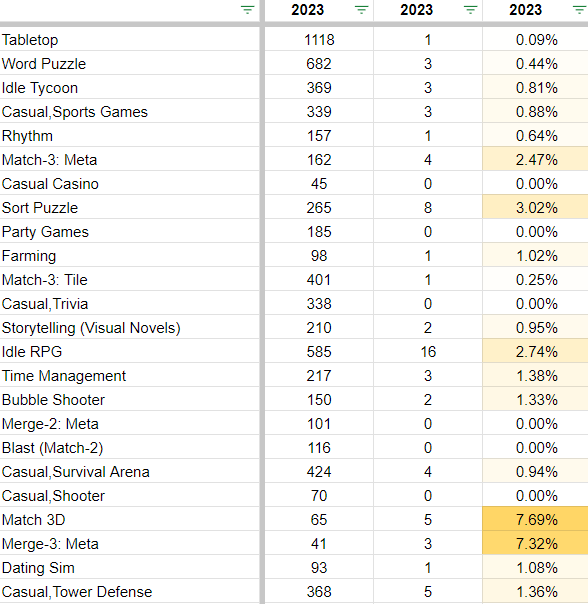

Analysts have also compiled a so-called success rate (SR) for each genre. This is the ratio of all games in a particular genre released during the year to the number of new successful games in the same genre.

Simply put, SR shows what proportion of novelties in a particular genre were successful in 2023. A successful game is considered to be the one that started earning more than 50 thousand dollars a month.

LIST of top casual genres in 2023 (AppMagic)

However, the main part of the study is devoted not to the table, but to five genres that AppMagic decided to consider separately. The principle underlying the selection of a particular five is not completely clear. For example, the Idle RPG genre was ignored, which demonstrated both good SR and a large number of launches. They took Idle Tycoon instead. Also, analysts did not stop at the Casual Shooter genre, which showed an annual revenue growth of 325%, but at the same time did not receive a single release for the entire last year.

Anyway, let's focus on the information about those genres that are mentioned in the work.

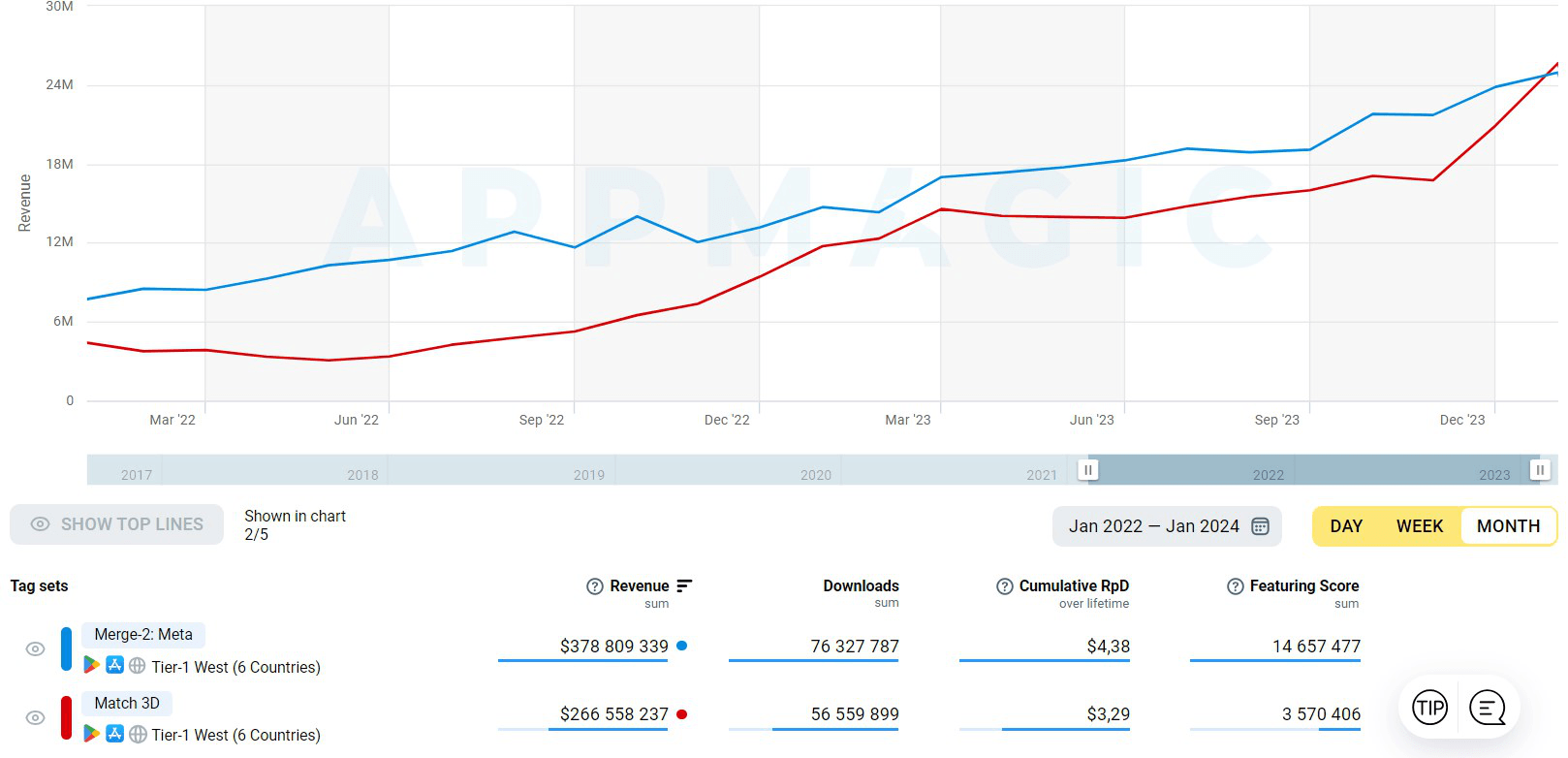

Merge-2: Meta

- The genre showed good growth in terms of total revenue from IAP — by 75.7% to $ 235 million.

- In 2023, 101 new titles were released in this genre, but none of them broke the $50,000 per month mark.

- Of these 101 games, only two games use quests in the spirit of Merge Mansion. All the others use an order system, like in Love & Pies.

Merge Mansion Love & Pies has completely different task systems

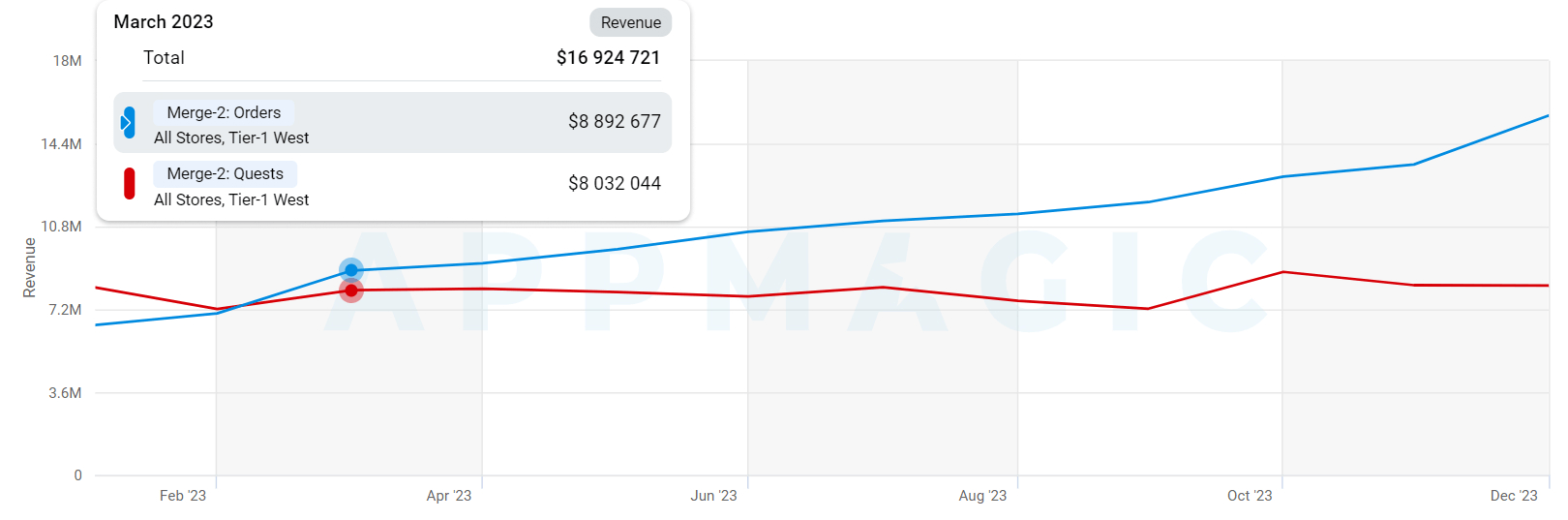

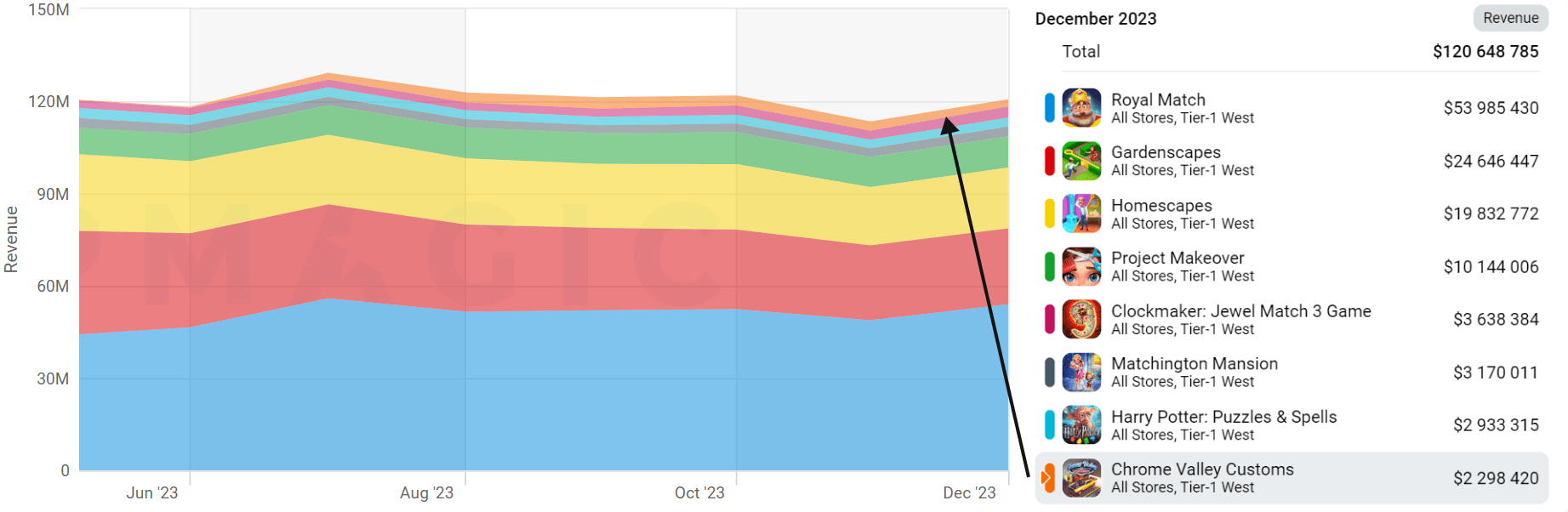

- By December 2023, the total revenue of the subgenre with orders had almost doubled that of Merge-2: Meta with quests.

The dynamics of sales of the Merge-2 subgenres: Meta

- Competition within Merge-2: Meta with orders is fierce. As a result, in 2023, the leader of the top 10 highest-grossing games of the subgenre changed (Love & Pies fell to fourth place) and three games released in 2022 appeared, previously absent from the top.

- Analysts believe that a game in the Merge-2 genre takes an average of a year from the moment of release to realize its potential. Most successful niche games have grown slowly.

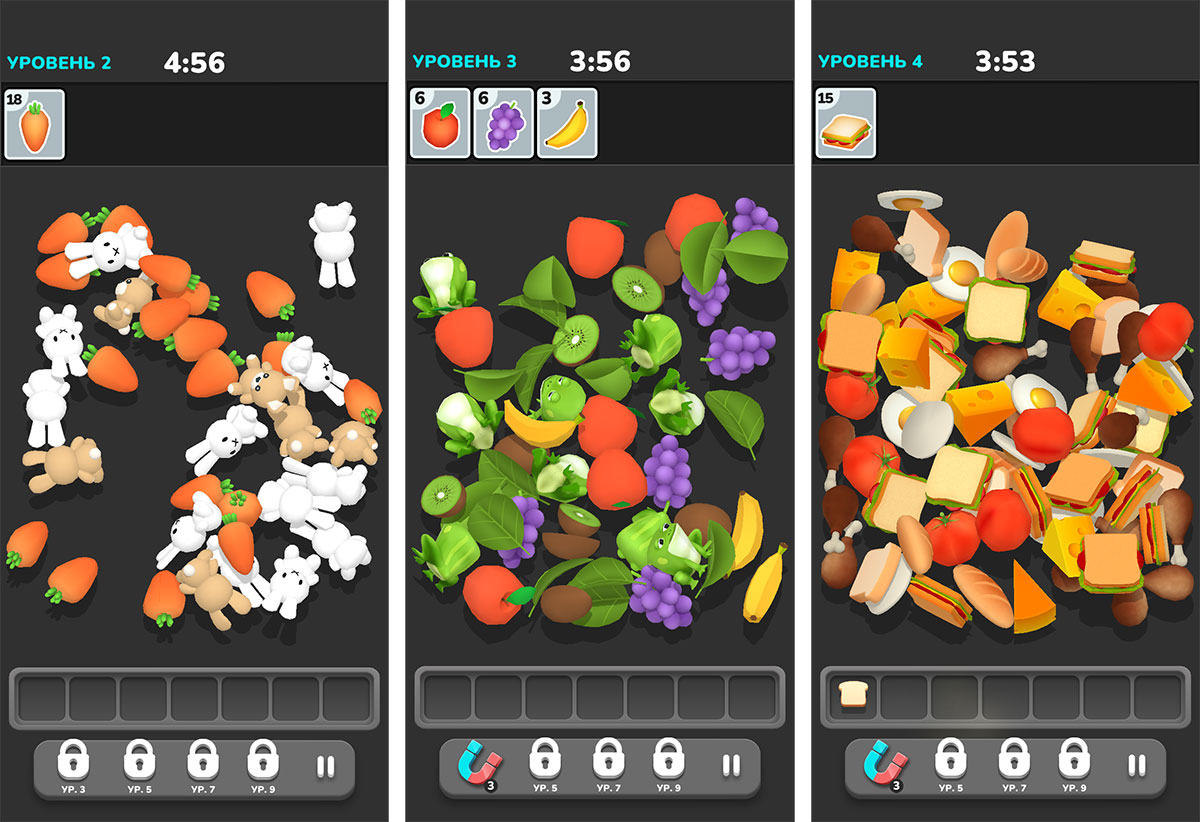

Match 3D

- This genre showed the highest SR — almost 8%: of the 65 games released in 2023, five were successful.

Triple Match 3D is the highest—grossing IAP game in the genre

- The genre also showed high dynamics at the box office. The annual total revenue of all games in the genre increased last year by 276.91% to $ 169.4 million.

- By the end of 2023, the Match 3D genre was already earning more per month than the Merge-2: Meta genre (more than $24 million).

Dynamics of genre sales of Match 3D and Merge-2: Meta

- AppMagic believes that the niche, which has been actively growing over the past two years, may soon be closed to newcomers. The point of growth for those who still want to try themselves in the genre may be the introduction of a more complex meta into the genre.

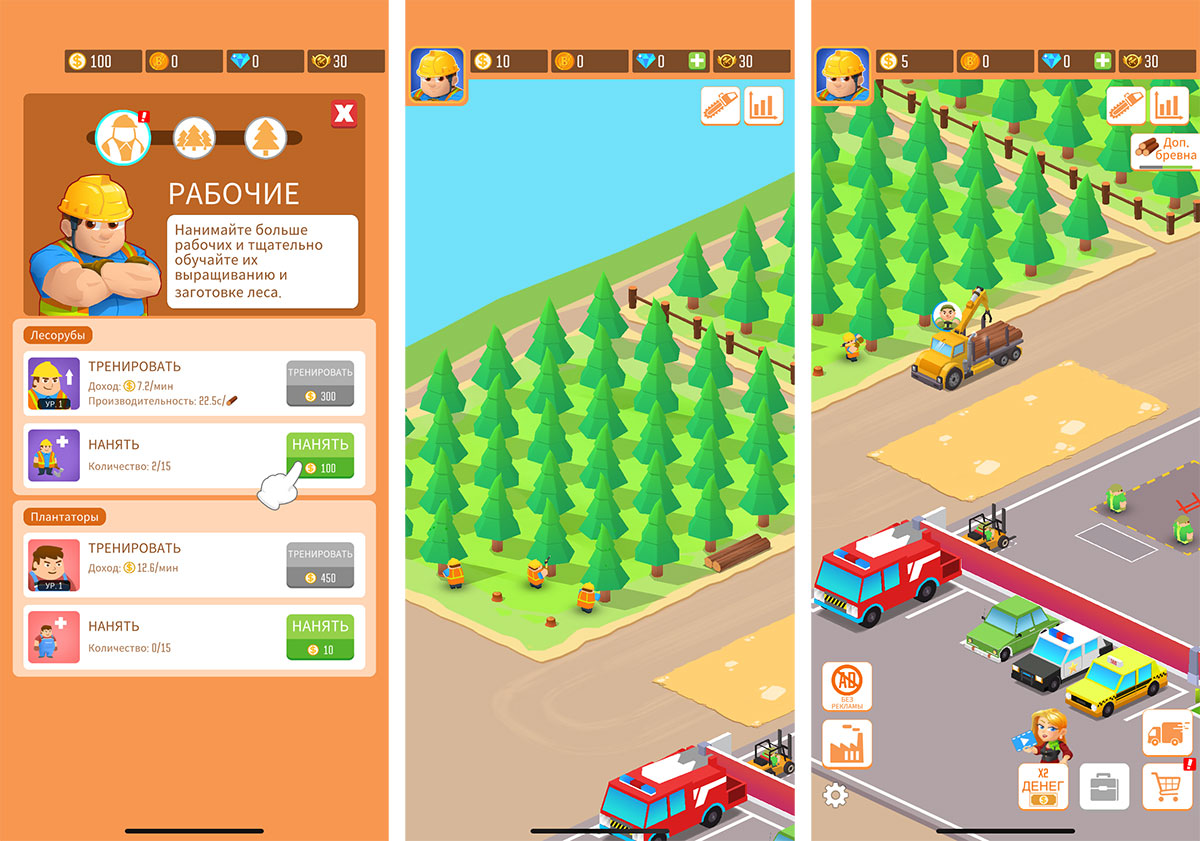

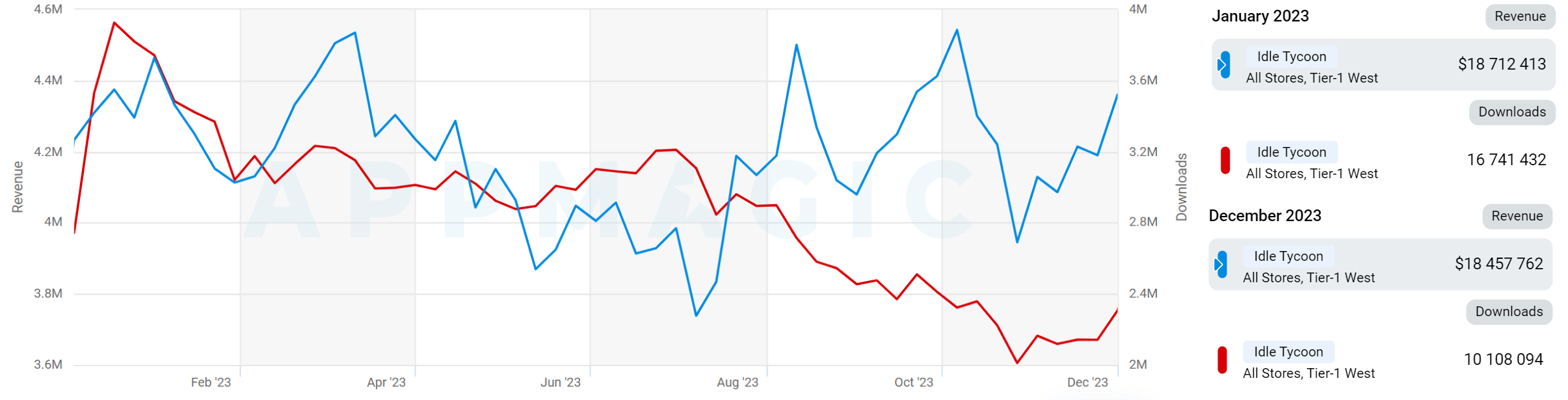

Idle Tycoon

- Last year, 369 games were released in this genre. Of these, only three titles became successful. That is, the SR is 0.81%.

Idle Lumber Empire is one of the highest—grossing games in the Idle Tycoon niche

- The total number of downloads in the genre was 154 million. This is 13% more than a year earlier.

- Of the genre box office of $ 214 million collected from IAP, about a quarter of the total amount was for one game — the latest release of Isekai: Slow Life.

Dynamics of sales and downloads of the Idle Tycoon genre

- Analysts consider the genre to be very highly competitive. To succeed in it, it is necessary to constantly improve the game, work closely on its LiveOps and monetization systems.

Match-3: Meta

- During the year, 162 games were released in the genre. Four of them are successful.

- This is the highest-grossing genre. During the year, he earned $1.4 billion in top Western markets. This is 20% more than a year earlier.

- The main project in the niche is Royal Match, which earns $ 50 million a month from the Turkish studio Dream Games.

- One of the central trends in the niche is three—in-a-row about car tuning. Analysts of the service believe that by doing so, their developers are betting on a male audience, which is usually less interested in the genre.

Chrome Valley Customs — the highest-grossing match-3 about tuning

Chrome Valley Customs earned more than $2 million per month at the end of the year

Merge-3: Meta

- In 2023, 41 niche games were released. Three of them achieved revenue above the monthly level of 50 thousand dollars.

- As before, this is a niche with high costs and complex production. However, new items in this genre are flying into the top. However, not without the help of hypercausal mislides.

Merge Topia and Alice's Dream are promoted by mislids

- As a rule, novelties in the genre do not try to clone the main games in the niche — EverMerge and Merge Dragons. Instead, they experiment.

The full version of the study is available at the link.