A new day, a new report. This time from App Annie, which has prepared a giant document about the mobile games market. It covers the first half of 2021. We have prepared a squeeze in Russian.

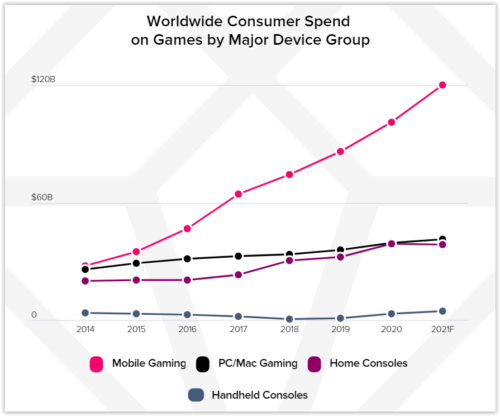

1. The report starts with a forecast. Spending by mobile gamers by the end of 2021 may reach $120 billion. This is 3.1 times more than the users’ spending on console games.

Dynamics of gaming spending in the world

2. Now to the current situation.

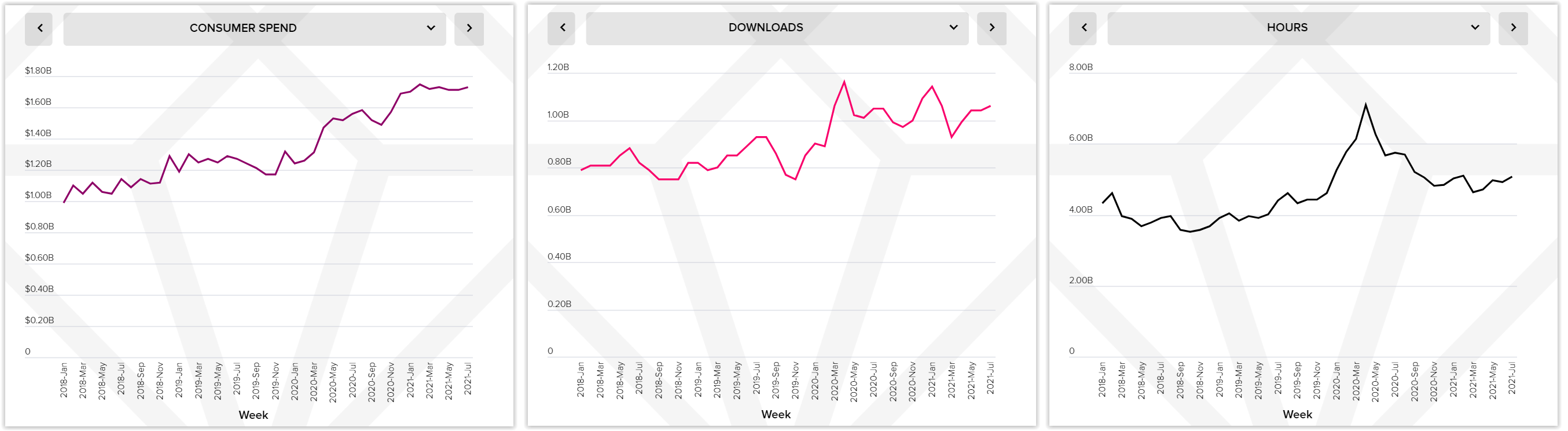

The level of game consumption has changed a lot over the past year. Today, 5 billion hours are played every week in mobile games around the world, $1.7 billion is spent in them and more than 1 billion downloads are made. To understand the situation: such a level of consumption was first achieved during the world lockdown, but since then it has not thought to decrease (the exception is the hours spent in games, but it also remains higher than in the pre-crisis times).

Dynamics of spending, downloads and hours spent in mobile games

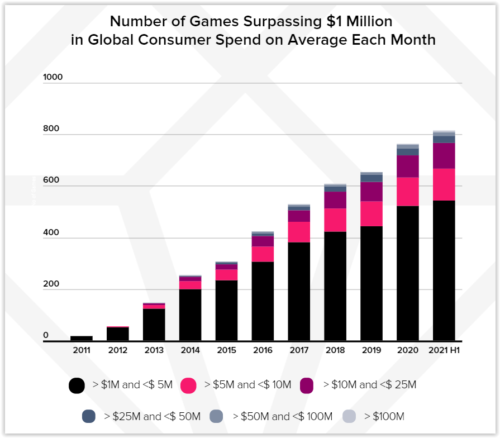

3. There are more games-dollar millionaires now than ever in the entire history of the mobile industry.

In the first half of this year, 810 game titles overcame the threshold of one million dollars every month, 7 of them reached the $100 million mark. In 2019, there were 650 monthly millionaire games, and only two games capable of earning $100 million per month.

Dynamics of the number of games earning more than a million dollars a month in stores

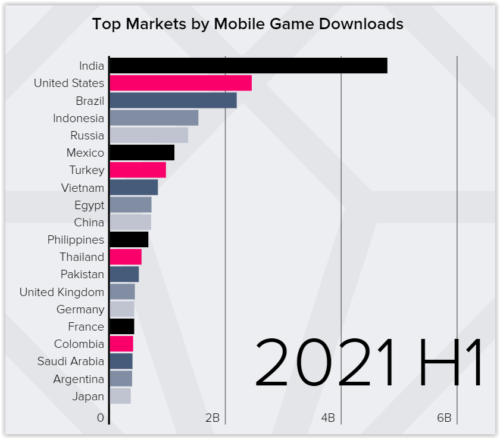

4. India is the world leader in game downloads.

This is the only region in which game downloads in the first half of the year approached the value of 5 billion. App Annie also highlights countries such as Indonesia, Brazil and Russia in terms of downloads.

Top markets by number of game downloads

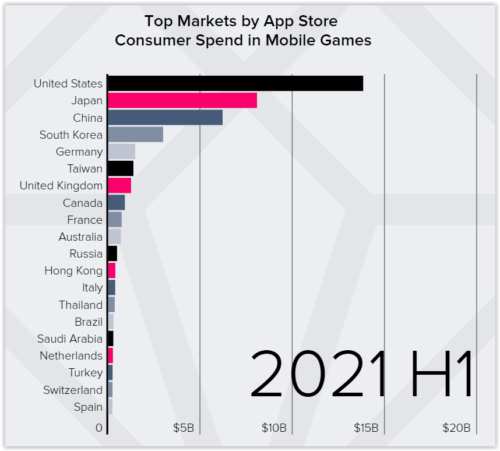

5. In terms of gaming spending, the USA remains the leader in the mobile market.

But in terms of revenue growth, Saudi Arabia and Turkey show phenomenal figures. The growth of their gaming revenue over the past year alone amounted to 60% and 35%, respectively.

Top Markets for user Spending in games

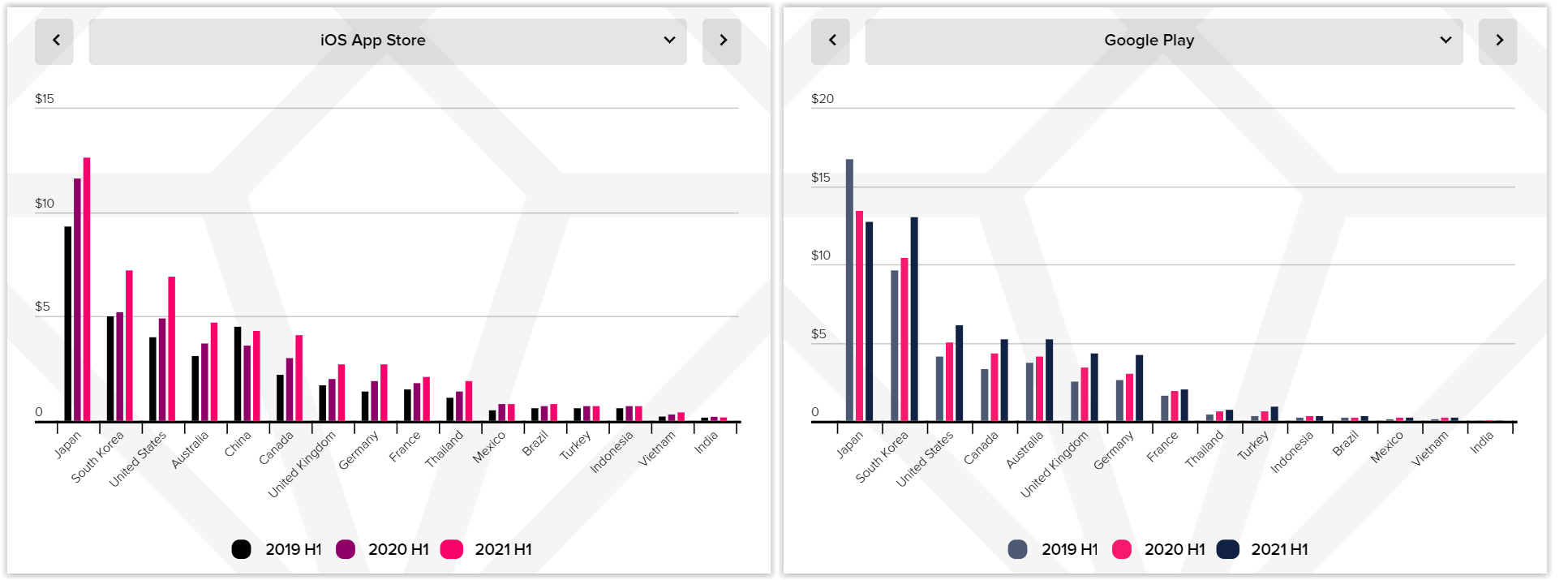

6. Average gaming spending on the device is also steadily growing.

The most noticeable growth is shown here in Japan, where the history of the pandemic is superimposed on the refusal of users to pay for games through mobile operators in favor of working with bank cards.

The level and dynamics of average gaming expenses per device by region

7. China’s presence is increasing in the mobile games market.

Games created in the Middle Kingdom account for an average of 20% (depending on the region) of all global revenue (for understanding: Russian games are only around 4-5%). At the same time, Chinese games account for barely more than 11% of downloads (about 9% for games published by French companies).

8. The main gaming age group in mobile is generation Z (“zoomers” born between 1997 and 2012). If you take the top 1000 games by MAU and look at their audience, then the “zoomers” will have more than 60%, depending on the region.

9. In Western countries, the main audience of mobile games is now women. For example, in the USA 64% of mobile players are women. By the way, one of the most popular games among them is Among Us.

10. It will not be a secret to anyone that hyper-casual games generate the largest number of downloads. In the first half of 2021, they accounted for one third of all game downloads in mobile – 6.8 billion. This is 2 times more than two years ago and about 5 times more than three years ago.

Distribution of downloads by genre and subgenre

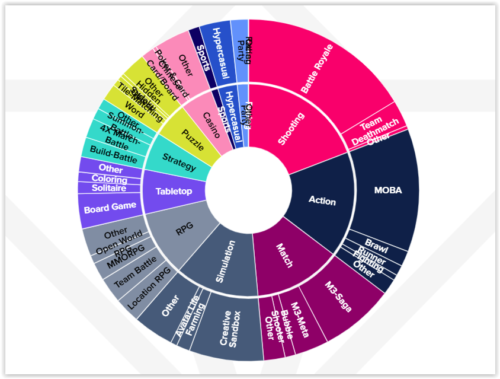

11. Royal bits, shooters and MOBA account for most of the time spent in games.

In third place here are match games.

Distribution of time spent in games by genre and subgenre

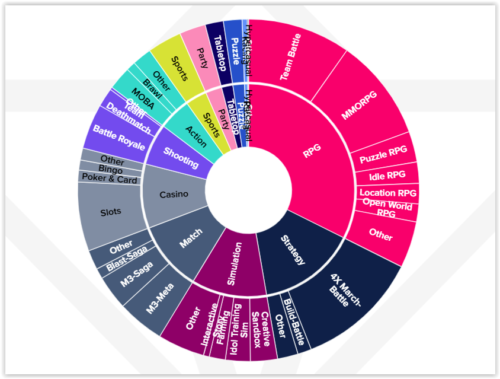

12. As for spending, role—playing games and strategies are in the lead here.

They account for 50% of all global gaming spending.

Distribution of user spending by genre and subgenre

13. More about downloads and hyper-casual games.

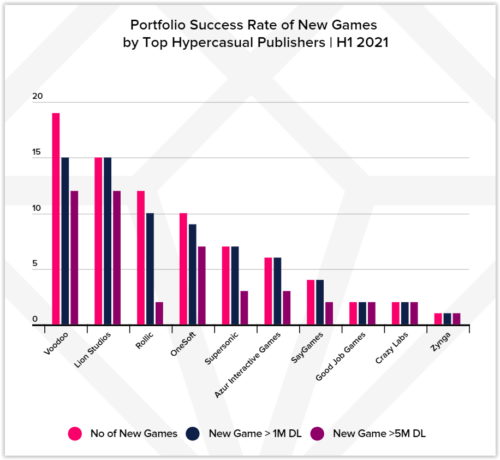

About half of all hypercausal projects released in the first half of 2021 generated at least 5 million installations. The market leaders, both in terms of the number of releases and the number of millionaire games, are Voodoo and Lion Studios.

Successes of leading hypercausal companies in the first half of 2021

The full version of the study is here.

It contains information about trends in marketing, a detailed analysis of the situation with genres and their features, as well as information about the highest-grossing games in the first half of the year, broken down by country. In general, there is something to read over a cup of coffee.