Continuing with the review of 2025 with gaming (or gaming sector-related) teams and experts. In our fourth annual interview, we spoke with Andrey Postnikov, Senior Business Developer at Nutaku.

How was the year 2025 for your business? What achievements would you highlight?

Andrey Postnikov, Nutaku: 2025 was a year of significant expansion and strengthening of the Nutaku ecosystem. We observed notable growth in the number of studios coming to us with various projects—both adaptations of their games for the "adult" audience and completely new ones created specifically for us.

One of the fastest-growing segments has been the Russian-speaking development sector: the number of such studios among our partners has increased several times. These include both small indie teams and major international companies.

To illustrate, here is the top 30 highest-grossing games on the platform for November.

- Lust Goddess

- Project QT

- Aeons Echo

- Everlusting Life

- Amazons vs Zombies

- Megaha:Re

- Ero Dorado

- Horny Legends: Harem of Goddesses

- Cherry Tale

- King of Kinks

- Harem Heroes

- Horny Villa

- Zone Nova

- Kamihime PROJECT R

- Waifu Shop

- Sluts Inc

- Booty Calls

- Sail Girl

- King of Wasteland

- Fap CEO

- President’s Ambition-Project Beauty-R

- Slut Squad

- Ark Re:Code

- Rise of Eros

- Passion Rif

- Chick Wars

- Legeclo: Legend Clover X Rated

- Kink Inc.

- Soul Descent

- Sexy Airlines EVO

Seven of these were created by Russian-speaking teams.

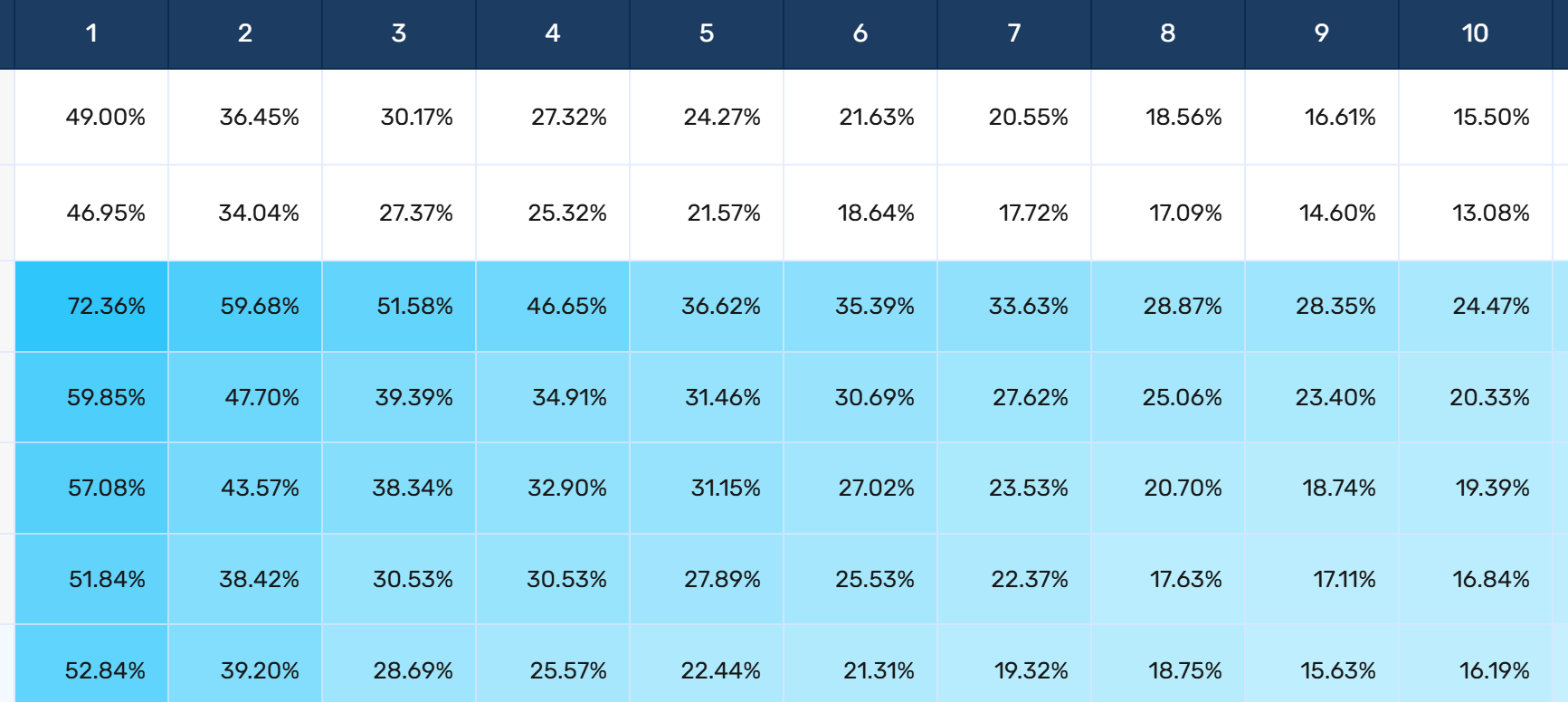

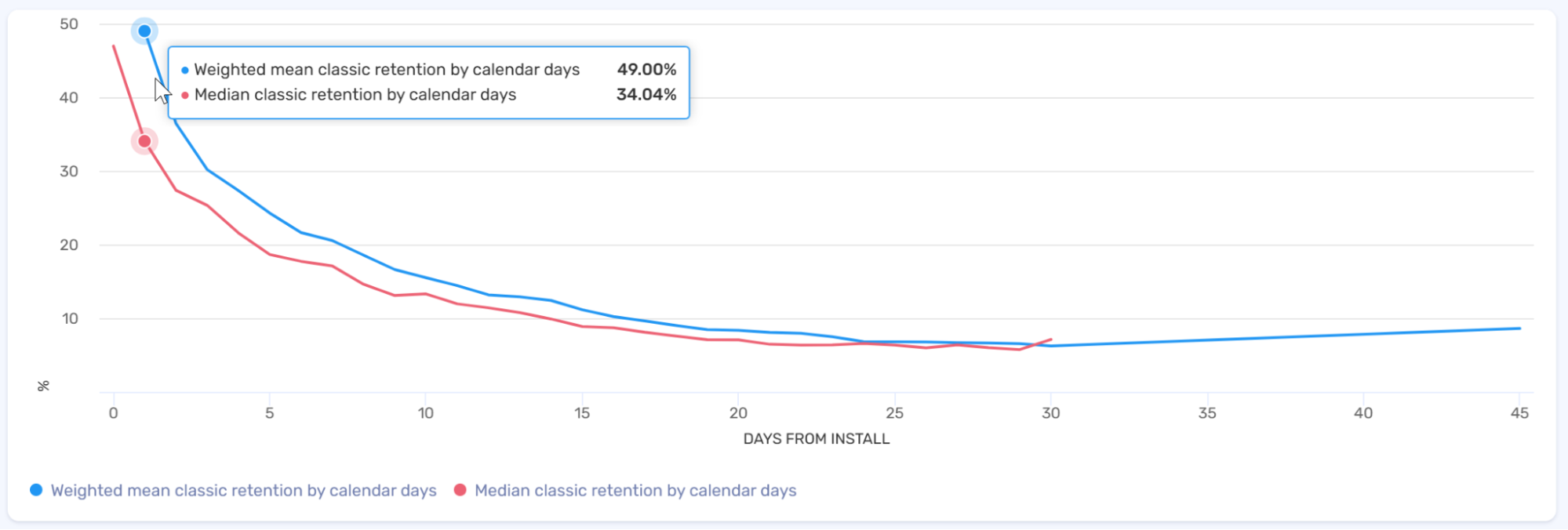

We also want to highlight the consistently high day-one retention rates on our platform.

As an illustration, here’s a real retention graph of a typical average project in soft launch. These figures are representative of most well-assembled projects.

Typically, our day-one retention is close to levels rarely seen in the mainstream environment.

How has the gaming market situation for publishing changed from your perspective?

Andrey: Publishing has become more complex and tech-driven.

First. Today, developers expect the publisher not only to release the game but also to provide analytics, attribution, omni-channel marketing campaigns, as well as handle creative production and LiveOps. Plus, to launch the game not in one store but several.

Second. The perception of the "adult" segment within the industry is changing. Today, it's seen by many studios as a growth channel. This directly impacts development and operational strategies overall.

Third. The niche is maturing but remains far from saturated. Entire genres well established in the mainstream are still predominantly unrepresented here, leaving significant room for further growth.

Have interaction practices with developers changed?

Andrey: Yes, practices have noticeably changed. The volume of incoming projects has significantly increased. This has led to the analytical approach to decision-making becoming more important than ever. Plus, of course, there's been a rise in the importance of quality LiveOps planning and content adaptation to our audience’s specifics.

How was the year for the niche in which you primarily release games?

Andrey: The niche matured. Along with it, the demands for visuals, gameplay depth, and meta-design significantly increased.

Despite increased competition among "adult" games, the size of the market still lags behind the mainstream games market. I am confident this provides ample opportunities for the emergence of new genres and formats.

The dominant player group—men aged 18–27—creates demand for dynamic gameplay, regular content updates, and wide genre diversity. Projects with well-executed LiveOps show particularly high performance.

Overall, the niche still represents an environment with high potential, where genres that have already proven successful in the broader free-to-play market can achieve success.

What conclusions and lessons from 2025 would you highlight for developers who are just preparing to release?

Andrey:I would highlight three points.

LiveOps is the key retention driver

The "adult" game audience consumes content faster than "regular" game players. Therefore, regular major updates—new characters, modes, and events—are necessary for success.

Production quality directly impacts project potential

Games with strong art direction, developed UX, quality animations, and a cohesive narrative consistently deliver better results. Simple or superficial products have significantly lower long-term potential.

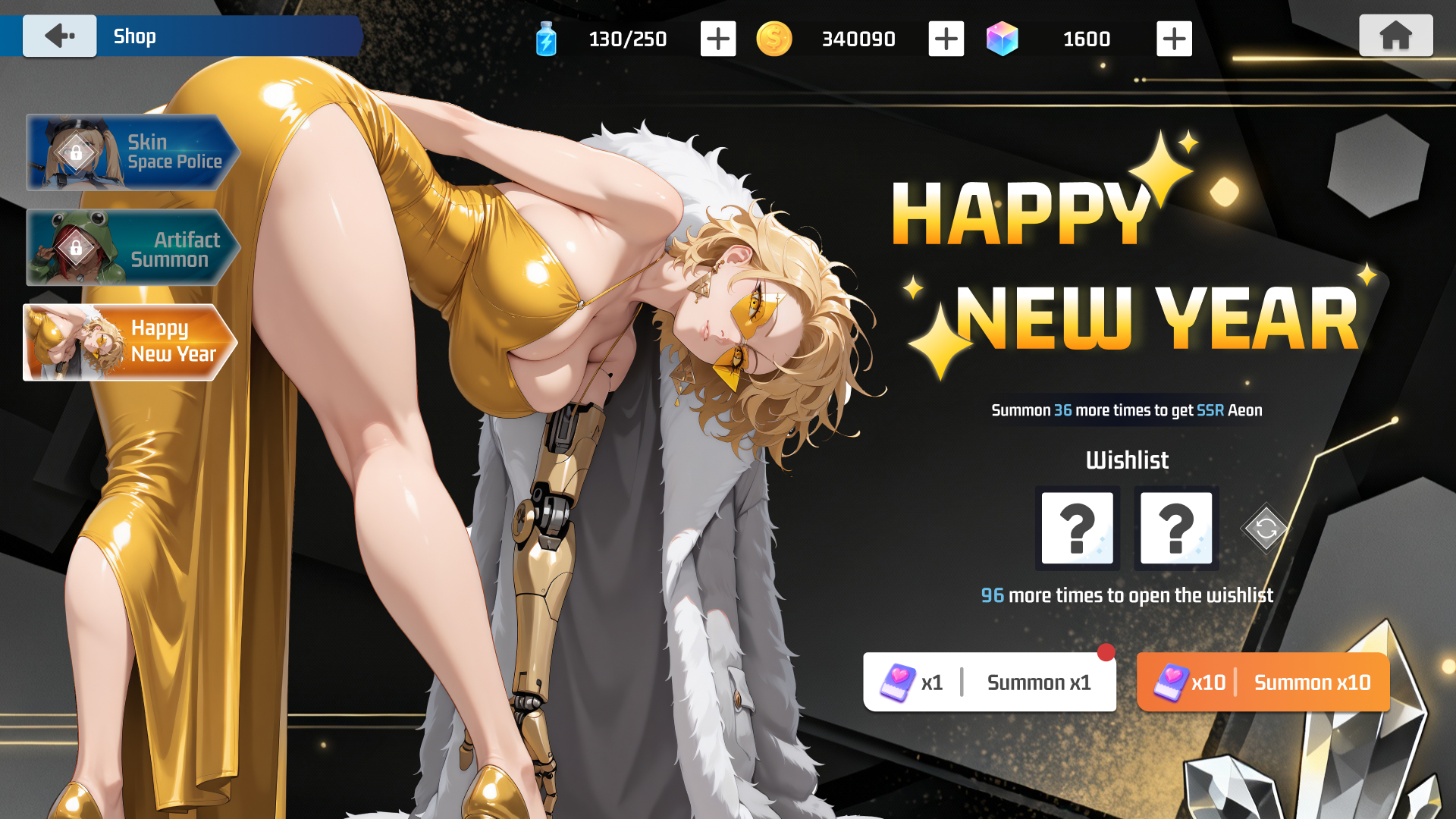

Teams can quickly adapt to "adult" themes

To illustrate how new teams can enter the niche, here’s an example of early rough character concepts from a game currently in development.

All these are screenshots from a project by an experienced mainstream studio from Europe, which had not previously worked with the 18+ segment. Despite this, the team quickly adapted to audience expectations and established a strong visual style early in production.

What trends in your niche do you expect to strengthen or emerge in 2026?

Andrey: First, an increase in cross-platform releases and expansion into new platforms.

Next, the emergence of genres that are currently underrepresented in the "adult" segment.

Third, a rise in LiveOps planning requirements and an acceleration of content production cycles.

Fourth, a stronger focus on narrative and game world, including franchise development.

Then, stricter compliance standards, including requirements related to AI usage.

The ongoing shift towards adult projects becoming a primary strategic direction for studios rather than a secondary focus.

What are the company's plans for next year?

Andrey: Nutaku will continue to develop the Platform + Publishing model, providing studios with a transparent, flexible, and scalable infrastructure.

Our key priorities:

- expanding the Nutaku Publishing portfolio;

- developing UA technologies, deep linking, and MarTech tools;

- enhancing analytics and improving KPI validation frameworks;

- expanding international partnerships in Europe, the CIS countries, and Asia;

- developing support for LiveOps, localization, storefront optimization, and community management.

Our goal is to provide developers with full-cycle support: from concept/soft launch to global release and long-term cross-platform growth.