Tax incentives remain a key tool for governments worldwide to attract digital and R&D companies. This is particularly true for the corporate income tax (CIT), which is considered one of the most burdensome. Experts from Futura Digital, in a column for App2Top, discussed the most relevant types of CIT incentives for IT and GameDev companies that are in demand among their clients.

Alexandra Kurdumova, co-founder of Futura Digital, and Roman Motorin, lawyer at Futura Digital

1. R&D and Software Development Deductions

What is the incentive? The ability to deduct software development expenses at a rate exceeding 100% instead of capitalizing them.

Where applied (examples) — Czech Republic, Denmark.

Relevant for companies with high development expenses, startups with high levels of cash burn.

Details

Typically, a company incurring such expenses can proceed in one of the following ways:

- deduct these expenses immediately (if allowed by the country's tax legislation);

- capitalize them as the cost of intangible assets.

Some jurisdictions allow these expenses to be immediately deducted, and at a rate higher than 100%. This means the company can report increased development expenses, thereby reducing the corporate income tax payable.

Example

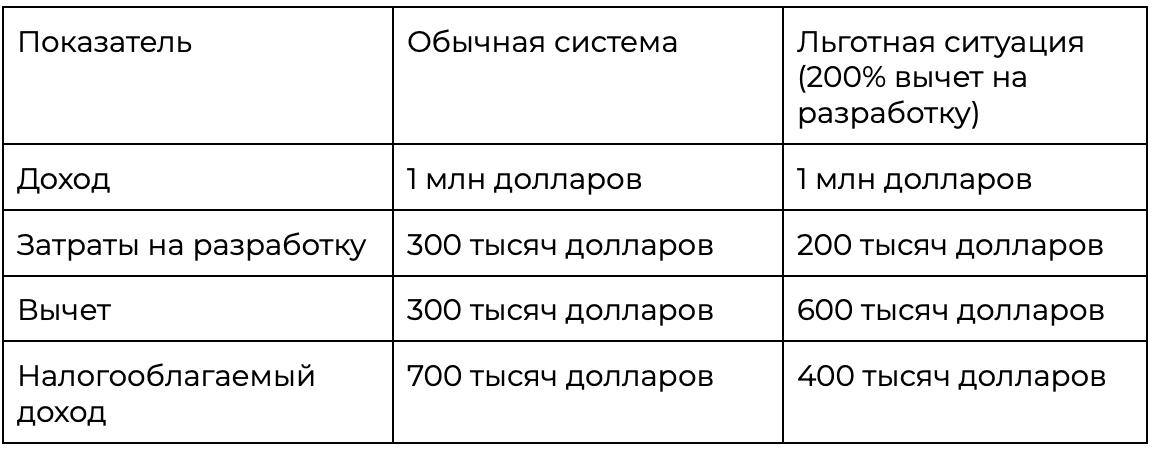

Consider a company that earns revenue of $1 million in 2024 (income excluding expenses) and spends $300,000 on development during 2024. For simplicity, assume the company has no other expenses.

Due to the 200% deduction incentive for actual expenses, the company reduces its taxable income from $700,000 to $400,000, leading to reduced tax liability.

Effect of the incentive

The more a company spends on development, the less it pays in corporate income tax, with a larger share of its profit not being taxed.

Important! If your company is not yet profitable but incurs substantial development costs, pay attention to the carryforward rules for these deductions. In the Czech Republic, taxpayers can carry forward development deductions for up to three years, so plan your product release date to maximize accumulated deductions.

2. Tax Payment Deferral

What is the incentive? You don’t pay corporate income tax until you decide to distribute dividends.

Where applied (examples) — Estonia, Georgia.

Relevant for holding companies, venture capital funds investing in IT and GameDev, cost accumulation centers, especially those not related to software development (e.g., marketing and traffic procurement costs).

Details

Typically, corporate income tax is paid annually. For example, a company pays tax on profit earned in 2024 within several months after the year's end. Similarly, for profit earned in 2025, taxes are due after 2025 ends, and so on.

Example

If a company earns a profit of $500,000 for 2024, in Estonia or Georgia, it is not required to pay corporate income tax until it distributes dividends.

The effect of this tax incentive is temporary. A company is not taxed on profits until dividends are distributed. This means the company can reinvest profit into the business and assets without paying corporate income tax. Companies are thus encouraged to acquire new assets.

This allows, for example, the creation of a holding company in Estonia or Georgia to purchase new assets: shares of other companies, stock options, other financial instruments, new intellectual property (IP), and other assets that can help scale your business.

3. Tax Reduction under the IP-Box Regime

What is the incentive? Corporate income tax is reduced by applying a lowered rate or reducing the tax base.

Where applied (examples) — Cyprus, UAE, Kazakhstan.

Relevant for companies engaged in both development and publishing/licensing of games/software.

Details

This mechanism allows reducing corporate income tax for companies developing software in the jurisdiction. Each jurisdiction provides specific ways to reduce tax:

- in Kazakhstan, the tax base is reduced by 100%;

- in the Republic of Cyprus, the tax base is reduced by 80%;

- in the UAE, a 0% corporate income tax rate is applied.

These tax incentives apply only to the portion of profit derived from IP utilization. This portion is determined based on the nexus ratio — the proportion of qualifying development expenses to total development expenses.

Nexus Ratio Formula

NR = (CQ * 130%) / CT, where

- NR – nexus ratio;

- CQ – qualifying development expenses (e.g., developer salaries, outsourcing development to independent contractors, etc.);

- CT – total development expenses incurred by the company (qualified development expenses + all other development expenses).

In other words, developing software using employees or independent contractors increases the nexus ratio. Purchasing rights to ready-made software or outsourcing development to affiliates decreases the ratio. In any case, it cannot exceed one.

After calculating this ratio, the profit from IP is multiplied by the nexus ratio. The result is the share of profit that qualifies for the tax incentive.

Example

If the nexus ratio for a company in the UAE is 80%, and the company earns a profit of $1 million (considering expenses), a 0% tax rate applies to 80% of this amount, or $800,000. The remaining $200,000 will be taxed at 9%.

To simplify the tax calculation process, we've developed an easy-to-use tool in spreadsheet form to understand the IP-box regime principle, which can be found here.

The effect of this tax incentive is to reduce the actual corporate income tax paid. However, it has its downsides:

- requires more complex and bureaucratic accounting;

- available only to companies incurring development expenses (employee salaries, independent developers);

- the company must generate income solely from IP (e.g., royalties).

***

We've covered three of the most popular types of tax incentives for IT and GameDev companies, but there are significantly more overall.

We must note: every jurisdiction has its peculiarities, and the choice of optimal strategy depends on your business specifics. Consulting with experts will help you develop a personalized plan to maximize the benefits of tax incentives for your company.