The analytical company InvestGame has published a report on the situation in the gaming investment market for 2023. Thanks to the merger of Microsoft and Activision Blizzard, the total amount of transactions increased, but overall the investment climate was turbulent.

According to the report, video game-related companies entered into deals totaling $85.1 billion last year. This is 54.5% more than in 2022. However, if we remove from the list the deal between Microsoft and Activision Blizzard for $ 68.7 billion, then the volume of transactions will be much more modest — $ 16.7 billion, which is 70% less in annual terms.

The number of transactions has dropped. There were 567 in 2023 and 805 in 2022.

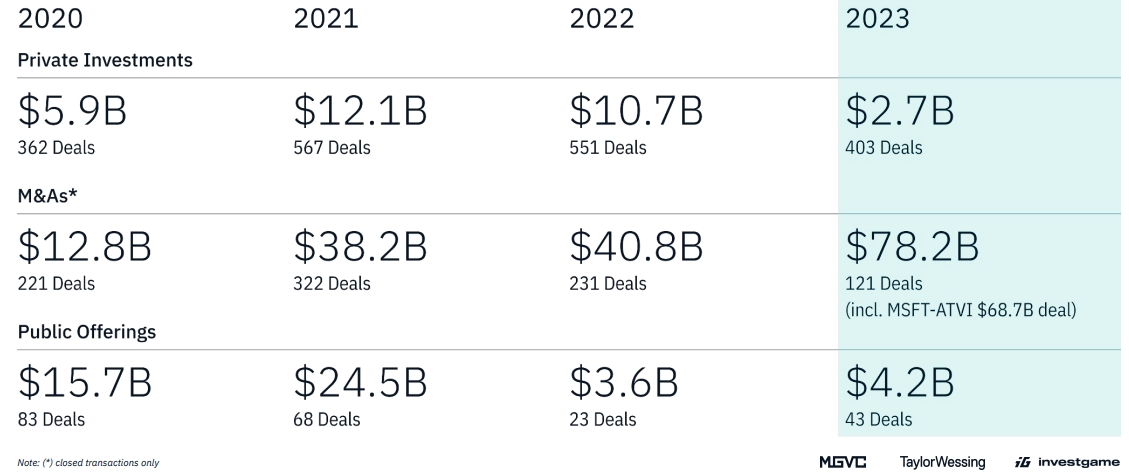

The number and volume of transactions with gaming companies in 2020-2023, broken down by private investments, M&A and public offerings

Let's briefly go through the types of transactions.

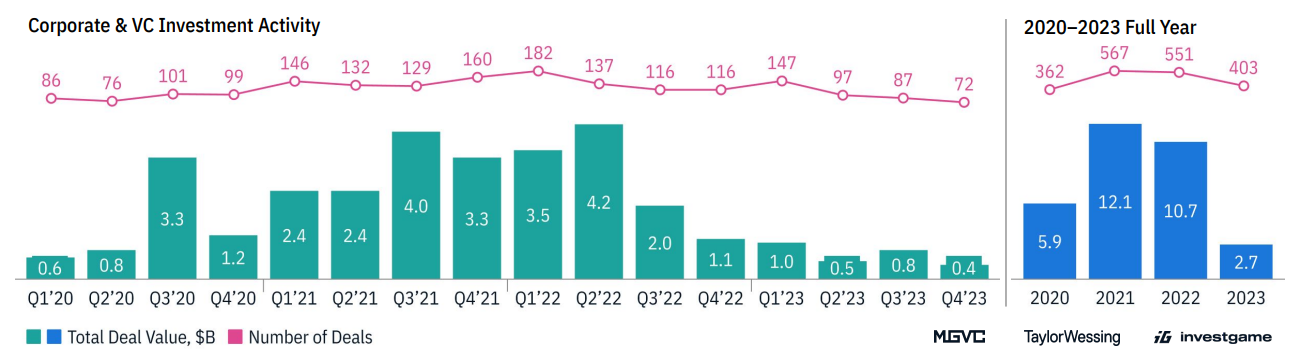

Private investments

- In 2023, the number of investment deals with video game-related companies was 403, compared to 551 in 2022.

- The total amount of investments fell almost four times compared to the previous year to $2.7 billion. Although this is a strong drop, analysts note that the volume of investments is still higher than before the COVID-19 pandemic.

- InvestGame expects investor activity to grow in 2024, as gaming companies raised a total of $1.7 billion in January alone (this is taking into account the deal between Disney and Epic Games).

- The number of investments in companies directly involved in the development or publication of games amounted to 169. Their volume is $900 million.

- The most active venture fund is BITKRAFT Ventures. He closed 18 deals totaling $290.7 million. Next are Sisu Game Ventures (16 and $42 million), Andreessen Horowitz (12 and $164.5 million).

Investments in gaming companies in 2020-2023

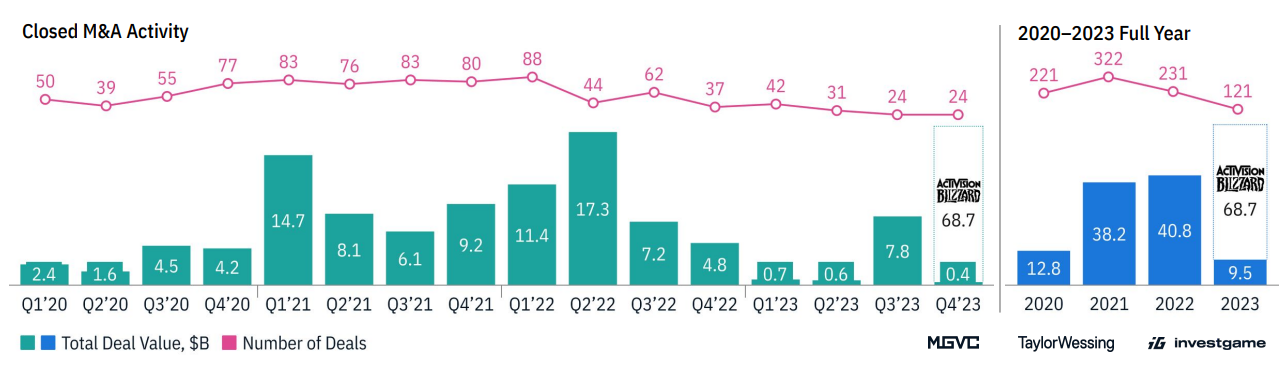

Mergers and acquisitions (M&A)

- The number of closed M&A fell from 231 to 121.

- Excluding the deal between Microsoft and Activision Blizzard, the volume of M&A amounted to $9.5 billion. In 2022, it was equal to $40.8 billion.

- InvestGame believes that in 2024 the number of M&A may grow if macroeconomic conditions stabilize. As a positive sign, they referred to the recently announced purchase of Jagex Studio by CVC Capital Partners.

M&A of gaming companies in 2020-2023

Public placements

- Activity in the public offerings segment remains low for the second year in a row.

- In 2023, gaming companies placed shares on the stock exchange 43 times. For comparison, they did it 23 times in 2022, 68 times in 2021, and 83 times in 2020.

- The total valuation of the company's share placements amounted to $4.2 billion. $600 million more than in 2022, but $20.3 billion less than in 2021.

Public offerings of shares of gaming companies in 2020-2023

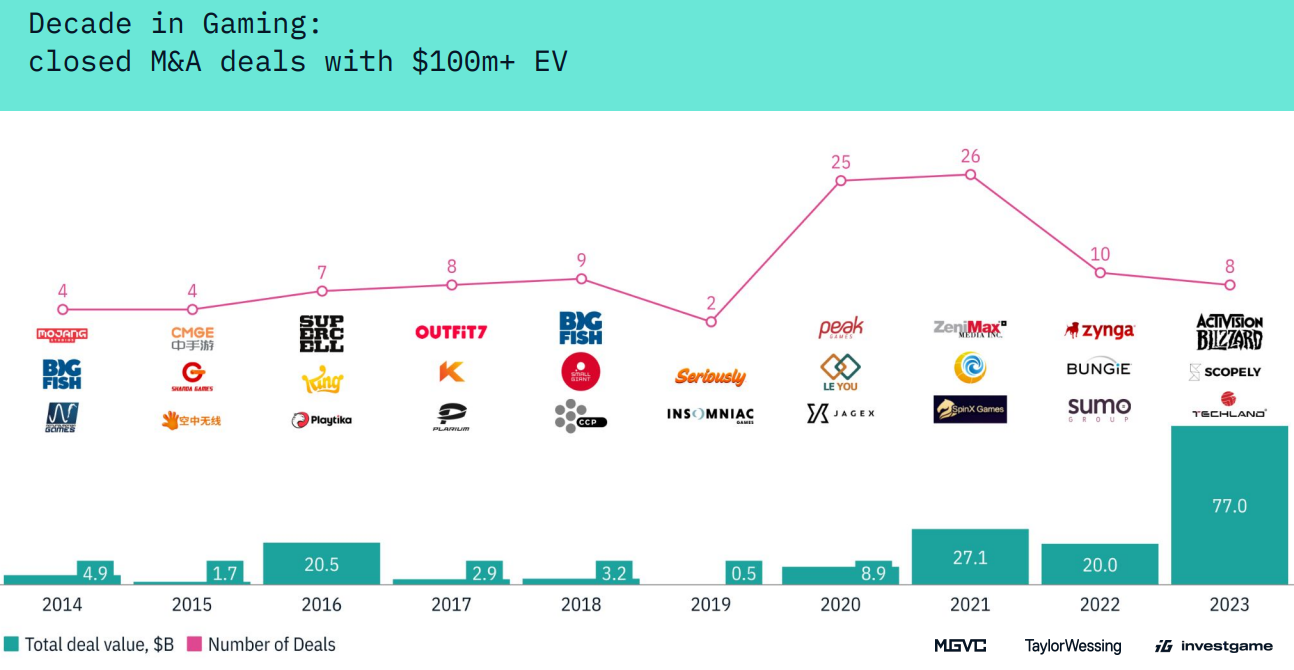

InvestGame also recalled all mergers and acquisitions of companies whose market value exceeds $100 million that have been closed over the past ten years.

The most notable years:

- 2016: the total volume of transactions is $20.5 billion. The largest deals were between Tencent and Supercell ($8.6 billion), Activision and King ($5.9 billion), the Chinese consortium (which included Giant, Yungfeng Capital and other companies) and Playtika ($4.4 billion);

- 2021: the total volume of transactions is $27.1 billion. The largest deals were between Microsoft and ZeniMax ($7.5 billion), ByteDance and Moonton ($4 billion), Netmarble and SpinX Games ($2.19 billion);

- 2022: the total volume of transactions is $20 billion. The largest deals were between Take-Two and Zynga ($12.7 billion), Sony and Bungie ($3.6 billion), Tencent and Sumo Group ($1.27 billion);

- 2023: the total volume of transactions is $77 billion. The largest deals were between Microsoft and Activision ($68.7 billion), Savvy Games Group and Scopely ($4.9 billion), Tencent and Techland ($1.5 billion).