The analytical company InvestGame has published a report on gaming transactions based on the results of the first quarter of 2024: we are talking about private investments, M&A and public offerings. According to the report, investors remain cautious, but there are signs of improvement in the market situation.

According to InvestGame estimates, in January-March 2024, gaming-related companies concluded deals totaling $4.9 billion. This is twice as much as in the first quarter of 2023. At the same time, the number of transactions decreased by a third to 132.

Let's briefly go through the types of transactions.

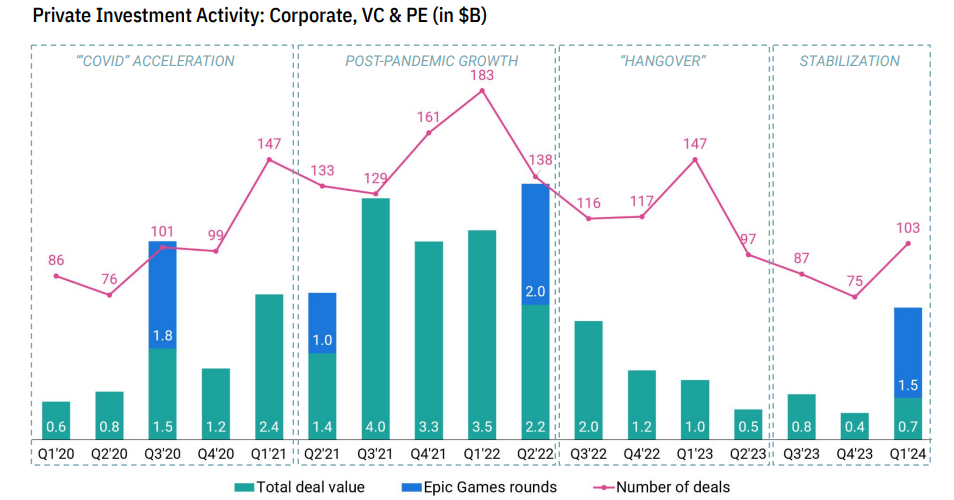

Private investments

- In the first quarter of 2024, the number of private investments amounted to 103. A year ago there were 147 of them.

- The total amount of investments has more than doubled — from $ 1 billion to $2.2 billion. However, the lion's share of the amount came from Disney's $1.5 billion investment in Epic Games. Without this deal, private investment would have fallen by 30% year-on-year.

- Investors were less likely to invest money at late stages, preferring seed and pre-seed investments. They also invested less often alone, switching to co-financing.

- Since 2019, at least 45 game-oriented funds have been opened — twice as many as in the previous decade. Of these, 12 appeared in 2024.

- In the first quarter, the most active funds in the seed stages were 1Up Ventures, BITKRAFT Ventures, Transcend Fund, The Games Fund and Ludus Ventures. The most active funds in the Series A rounds are a16z, Lightspeed Venture, 1UP Ventures, Hiro Capital and Sisu Game Ventures.

Investments in gaming companies in 2020-2024

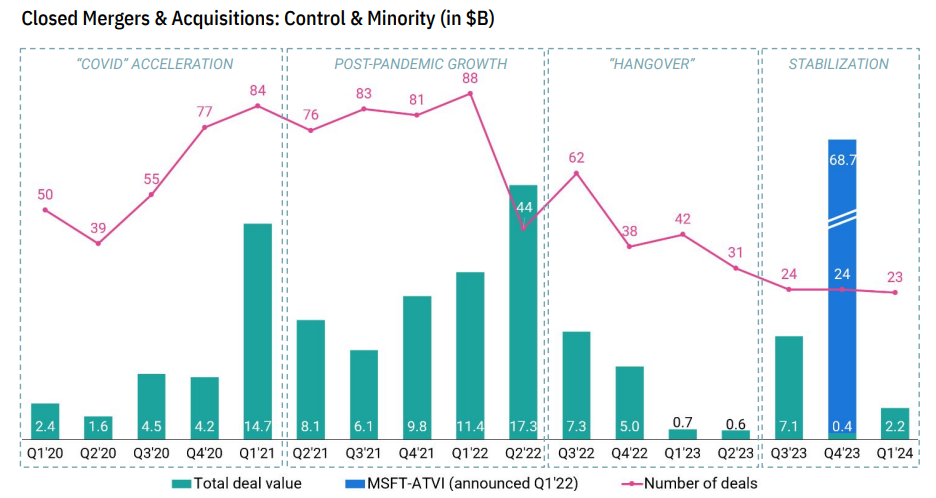

Mergers and acquisitions (M&A)

- Compared to last year, the number of closed M&A fell from 42 to 23.

- The total amount of closed M&A amounted to $ 2.2 billion. In 2023, much less was spent on mergers and acquisitions — $ 0.7 billion.

- According to analysts, gaming companies are not in the mood for mergers right now. Many large companies are busy restructuring and downsizing, in addition, they are actively buying back their shares. But InvestGame predicts the growth of M&A among companies worth less than $1 billion in 2024.

- The largest deal of the quarter was the purchase of Jagex by CVC Capital Partners and Haveli Investments for $1.1 billion.

M&A of gaming companies in 2020-2024

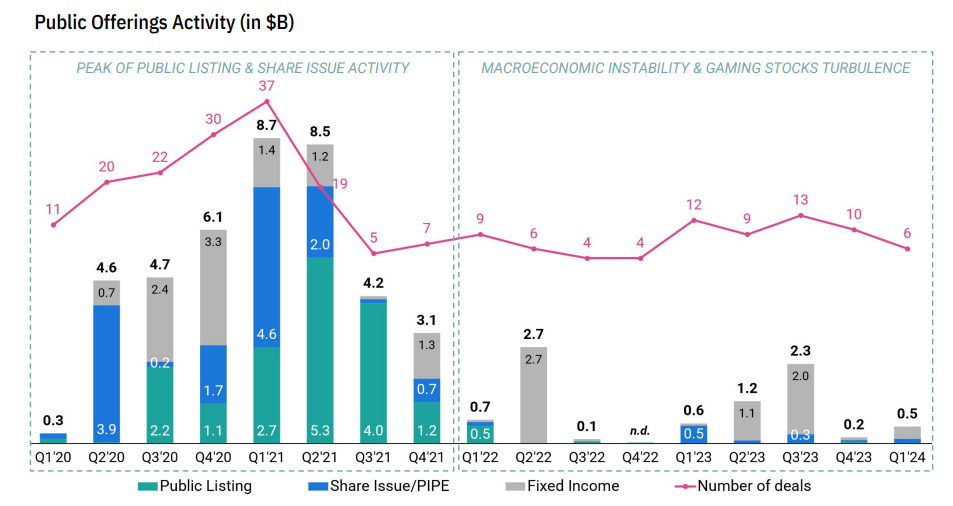

Public placements

- During the quarter, gaming companies placed their securities on the stock exchange six times. A year ago, there were twice as many placements — 12.

- The total valuation of public offerings of companies amounted to 0.5 billion. This is only 0.1 billion less than in the first quarter of 2023.

- The largest placements are the sale of Take—Two Interactive bonds for $350 million and the issue of new Stillfront Group shares in the amount of 1 billion Swedish kronor ($93 million).

Public offerings of securities of gaming companies in 2020-2024