Yesterday’s ban on Free Fire in India seriously affected the creators of the Battle royale. During the day, the cost of Sea — the parent company of Garena — decreased by $ 16 billion. Investors fear that the ban of the game may be just the beginning of the company’s problems.

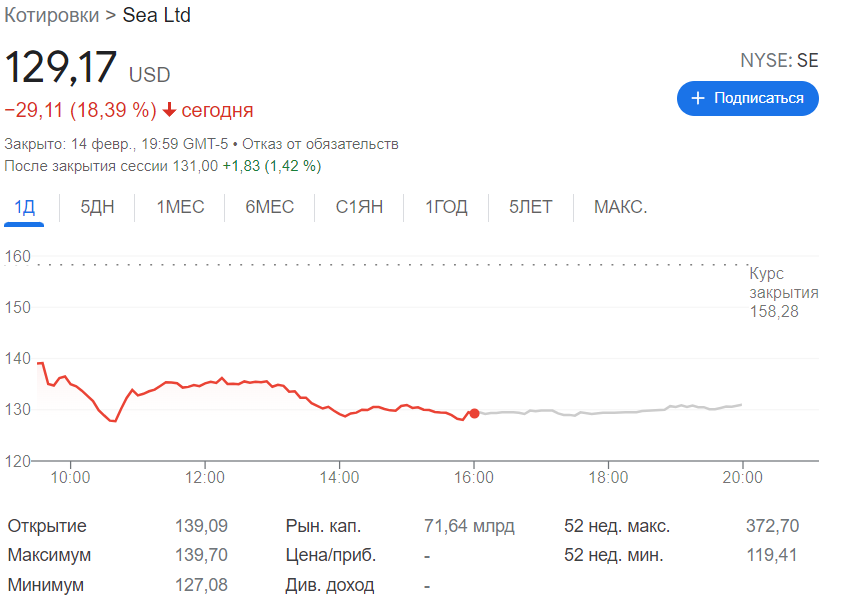

In total, Sea shares fell by 18.39% and began trading at a price of $129.17 apiece. This is the largest daily drop for Sea.

According to Bloomberg, some investors believe that the ban on Free Fire may be followed by the blocking of the Shopee trading platform — the second most important Sea project. Yesterday, during the annual shareholders’ meeting, the head of the company, Forrest Li, tried to convince them that this would not happen, but to no avail. He did not comment on the Free Fire ban at all.

Later, in a statement to Bloomberg, Sea representatives indicated that the company’s projects do not violate Indian law.

“Sea is a Singapore company, and we intend to support India’s mission in developing the country’s digital economy. We protect the privacy and security of our users both in India and around the world. We comply with the laws and regulations of India, and we do not transfer or store any data of Indian users to China,” Sea said.

Investors have grounds for alarm.

According to Bloomberg, although Sea is indeed registered in Singapore, it has close ties with China — developers from this country are not satisfied with Indian officials. For example, Li and most of the other top managers come from China. Also, the largest stake in Sea belongs to the Chinese giant Tencent, whose applications have already been blocked in India. Lee previously stated that he relied on Tencent’s experience in the early days of Sea, and the giant’s support helped the company with the promotion of Free Fire.

However, at the beginning of the year, Tencent announced plans to sell part of Sea shares. It decided to reduce its share from 21.3% to 18.7% in order to avoid further conflicts due to possible competition of companies in some markets.

It is also worth noting that Sea shares have been falling rapidly since last October. During this time, the price of them has decreased by 40%. According to analyst Ranjan Sharma from JPMorgan, banning Free Fire will only worsen the situation.

Recall that Free Fire was banned in India along with 53 other applications associated with companies from China. Officially, the reason for the blocking was the threat to the national security of the country, since, according to the Indian authorities, these projects can transfer user data to foreign servers. Mass banning of such applications in India began a year and a half ago amid clashes in the Galvan Valley — the border territory between India and China. In total, about 300 applications have been banned to date.