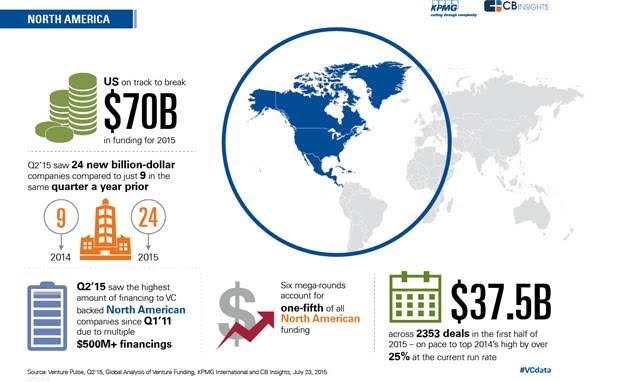

The amount of funds that US venture funds spend on investments will reach $70 billion by the end of 2015. This was reported in a joint study by the analytical firms KPMG and CB Insights.

The forecasts are based on the results of the second quarter of 2015. During this period, 2,353 transactions worth $37.5 billion took place in the United States. If analysts’ assumptions are justified, the level of venture capital investments in the country will reach the highest value in the last five years.

The activity of 45% of the companies that received investments is connected with the Internet.

Established companies remain the most attractive: investors prefer to invest in late rounds of financing. As a rule, this is the stage when the profitability of the business is clear.

In addition, investors are interested in investing in so-called “unicorns”. These are companies whose annual revenue exceeds a billion dollars. In the second quarter of 2014, there were 9 unicorns in North America. By the end of the same period in 2015, their number reached 24.

Recall that the Russian venture capital investment market demonstrates the opposite dynamics. Its volume in the first three months of 2015 fell by half.

A source: http://thenextweb.com

Other materials on the topic:

- The Russian venture capital market has fallen by 2 timesInvestment Guide: six main ways to finance a startup