Swedish publisher with Russian roots G5 Entertainment shared a financial report for 2021. The company managed to earn over $140 million. At the same time, most of the revenue is provided by G5’s own games.Jewels of Rome

Results for the whole year

G5’s annual revenue was 1.315 billion Swedish kronor ($143.7 million).

- In annual terms, this is a drop of 3% in crowns, but an increase of 4% in dollars.Gross profit reached 810.4 million Swedish kronor ($88.5 million), which is 3% more than the result for 2020.

- EBIT amounted to 216.1 million Swedish kronor ($23.6 million) — an increase of 14% year-on-year.

- Revenue and EBIT from 2009 to 2021 (in crowns)

Fourth quarter results

Revenue for the fourth quarter alone (ended December 31) amounted to 324.6 million Swedish kronor ($35.4 million).

- Compared to the same period in 2020, this is 3% less in crowns and 6% less in dollars.EBIT for the last quarter amounted to 56.6 million Swedish kronor ($6.1 million) — an increase of 8% year-on-year.

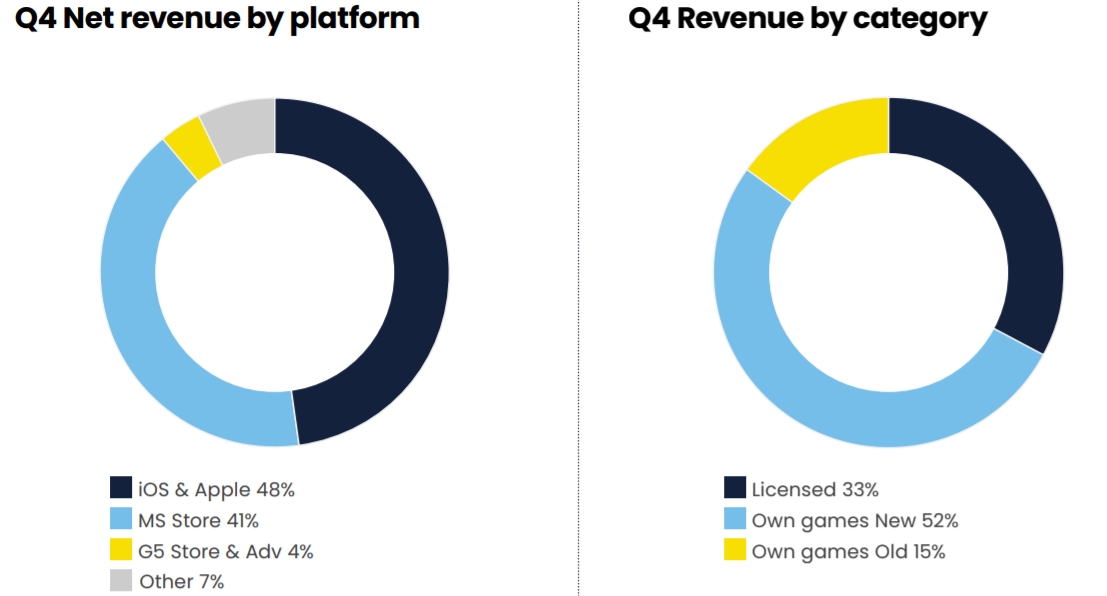

- Most of G5 Entertainment’s revenue came from its own games: 52% brought new titles (released after 2019), and another 15% — old projects.

- The App Store accounted for 48% of the company’s revenue.

- Another 41% was provided by the Microsoft Store. But the own store, together with advertising revenue, brought only 4%.Distribution of revenue for the fourth quarter by platforms and categories

Jewels of Rome remains the most successful game — it provided 30% of all G5 revenue in the fourth quarter.

- Sherlock is next — it accounted for 13%.61% of the revenue came from North America.

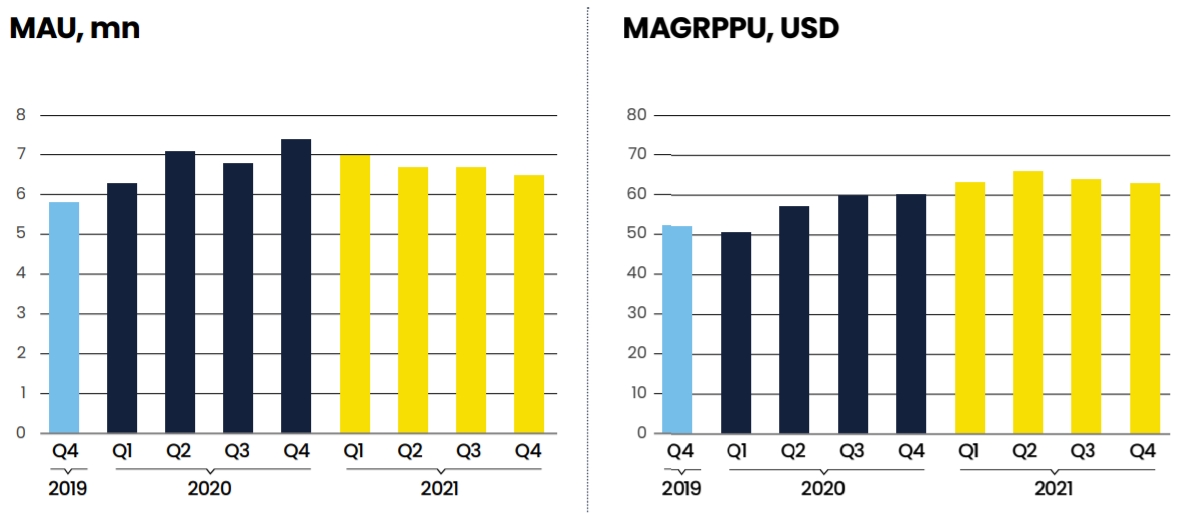

- Europe (22%), Asia (10%) and all other countries (6%) follow.The average MAU of the company’s games was 6.5 million people, which is 12% less compared to the fourth quarter of 2020.

- The DAU index grew by 1% in annual terms and amounted to 1.8 million people.

- The average number of unique paying users per month (MUP) remained at around 189.7 thousand (a drop of 13%).

- The average gross monthly income per paying user (MAGRPPU) reached $63.3 — an increase of 5% year-on-year.

- MAU and MAGRPPU indicators from 2019 to 2021