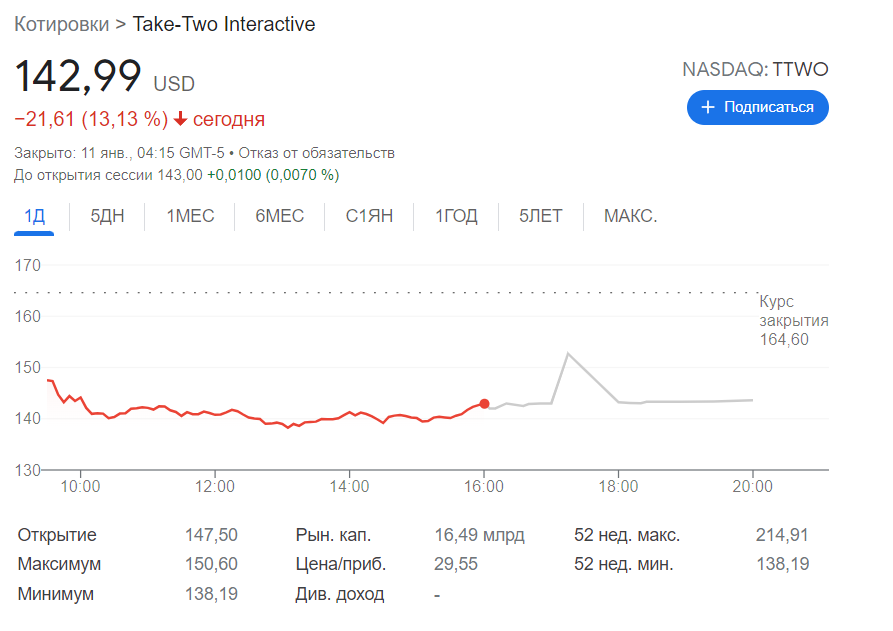

Yesterday, Take-Two announced the purchase of Zynga for $12.7 billion and announced plans to move its main franchises to mobile. Soon after, the shares of the GTA publisher went down.

By the time the exchange closed on Monday, the value of Take-Two shares had fallen by 13.13% to $142.99 apiece. According to the Market Watch portal, this is the biggest drop for the company since December 4, 2009. Then the shares of Take-Two immediately collapsed by 29.12%.

Probably, such a drop occurred due to the too large size of the transaction. Some investors believe that Take-Two is overpaying for the purchase of Zynga. The company is ready to give $9.86 for each Zynga share — 68% more than they were worth at the close of the exchange on January 7. As a result, this deal may become the most expensive in the history of the gaming industry.

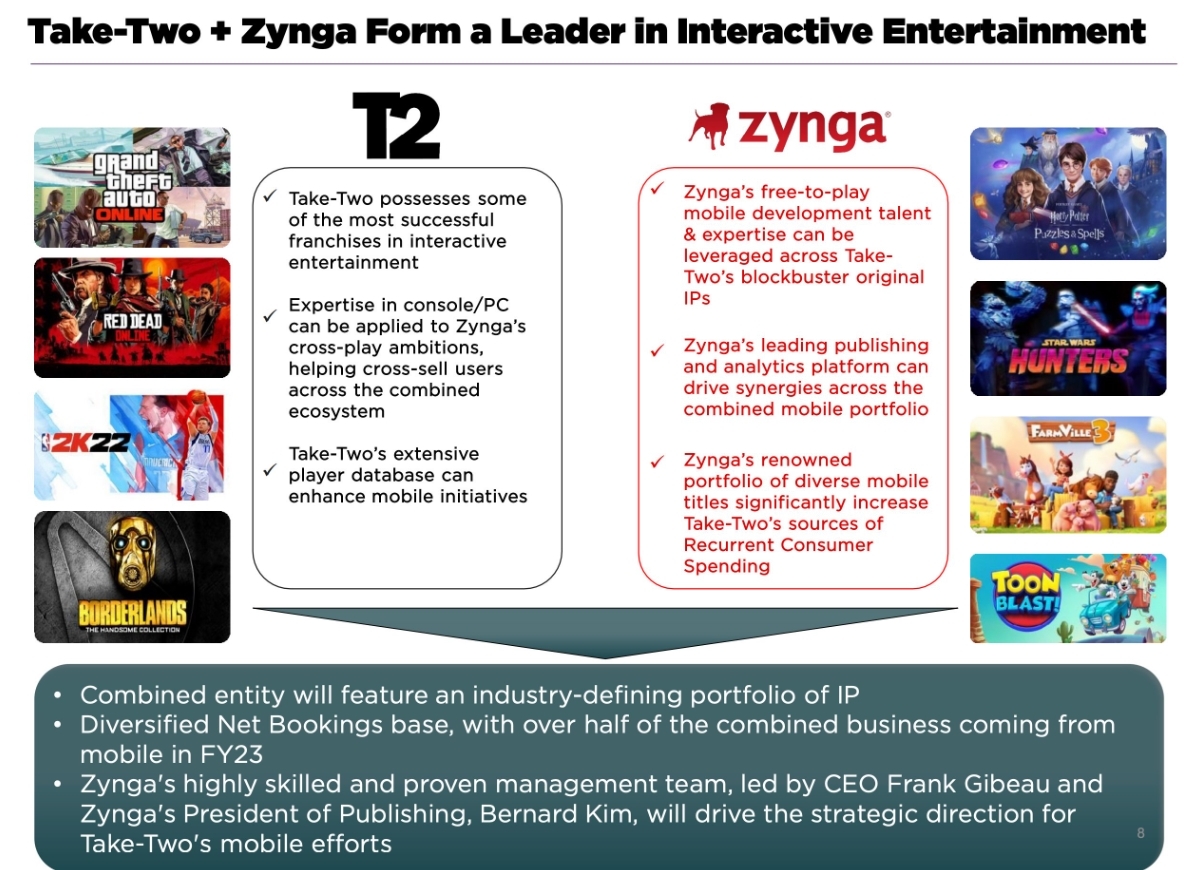

It is also possible that investors do not fully understand the benefits of buying a mobile company. As Mike Futter, the founder of F-Squared, stated, if Take-Two had simply informed investors that it wanted to make a mobile GTA Online, they would have reacted better.

By the way, according to Futter, Take-Two shares fell by 14.5%.

Take-Two stock down 14.5%, Zynga stock up 45%.

This says to me that T2 investors haven't put the pieces together re how T2 IP can benefit from Zynga expertise. I know T2 wouldn't commit to this right now, but if it said "GTA Online… for mobile users?" Investors would get it.

— Mike Futter (@Futterish) January 10, 2022

However, the deal has not yet been completed (it is assumed that it will be closed by the end of June 2022). Formally, other buyers can apply for Zynga. This happened, for example, with Codemasters. Despite the agreement with Take-Two, the British studio moved to Electronic Arts, which offered a larger sum.

But, according to Piers Harding-Rolls from Ampere Analysis, this time Take-Two hedged in advance and “did everything possible to bring the deal to an end.” Such a high price for buying Zynga should scare off competitors.

Zynga itself is doing well. Against the background of the announcement of the deal, its shares rose by 40.67% to $8.44 apiece.

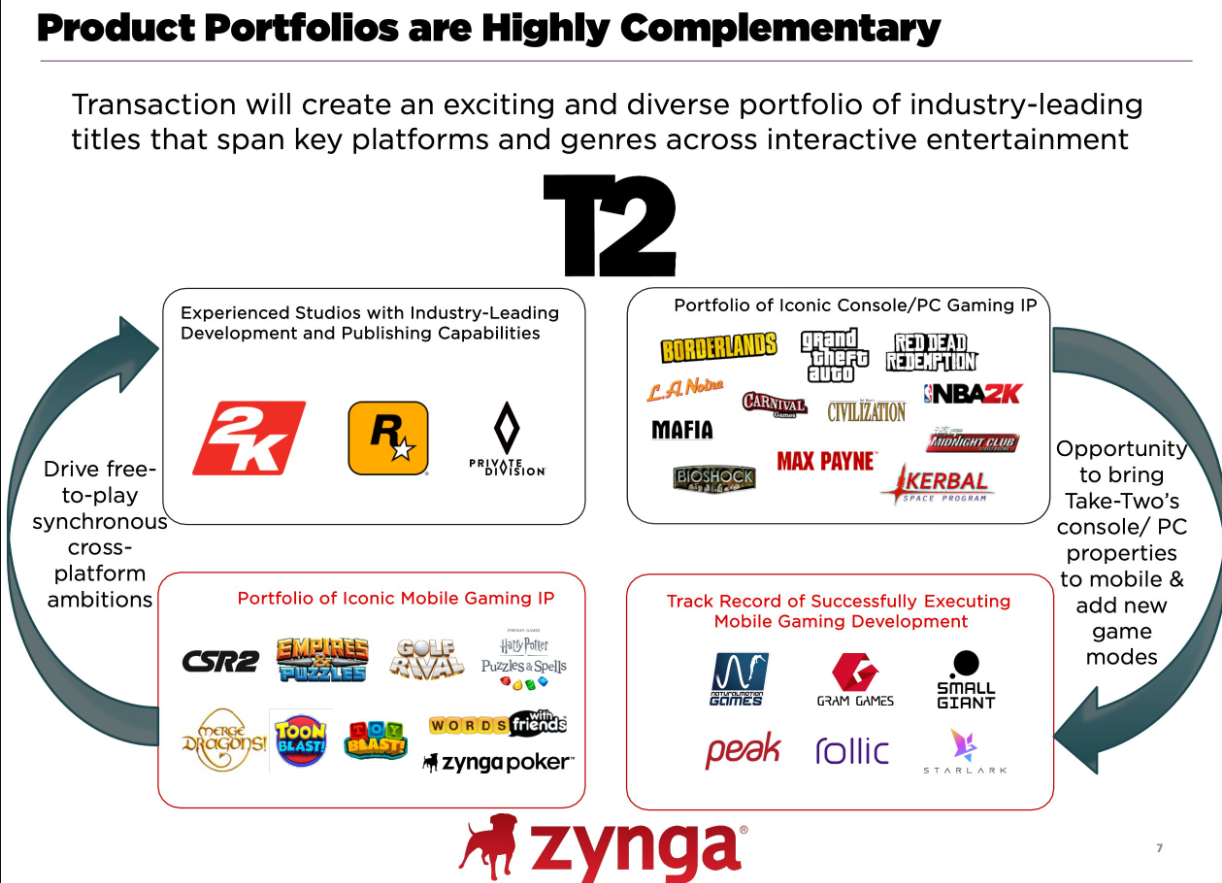

Recall that if the acquisition is completed, then Take-Two will become the owner of one of the largest companies specializing in mobile games. Take-Two plans to release games such as GTA, Red Dead Redemption, Borderlands, NBA 2K and BioShock on smartphones, as well as to enter new regions. It is assumed that after some time, the combined company will be able to count on $500 million in net receipts annually (net bookings).