The volume of transactions in the video game industry continues to grow. Investment banking firm Drake Star Partners estimated that in 2021, gaming companies conducted public offerings, investments and M&A transactions worth $85.4 billion. This is 154%* more than in the previous year.

* According to InvestGame, in 2020, the volume of transactions in the gaming industry amounted to $33.6 billion.

The main thing from the report

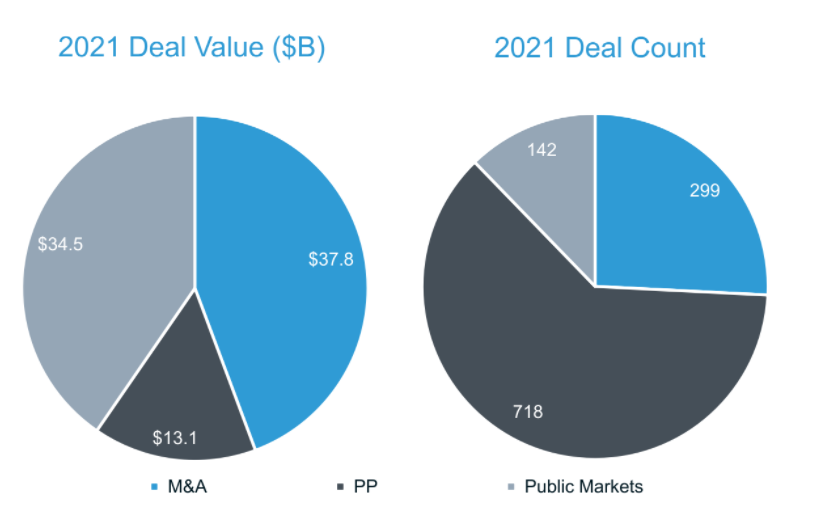

- In total, 1,159 transactions related to video games were carried out in 2021. For comparison, only 664 transactions were conducted in 2020.

- Three quarters of all transactions (718 transactions) are investments. In total, investors have invested $13.1 billion in gaming companies.

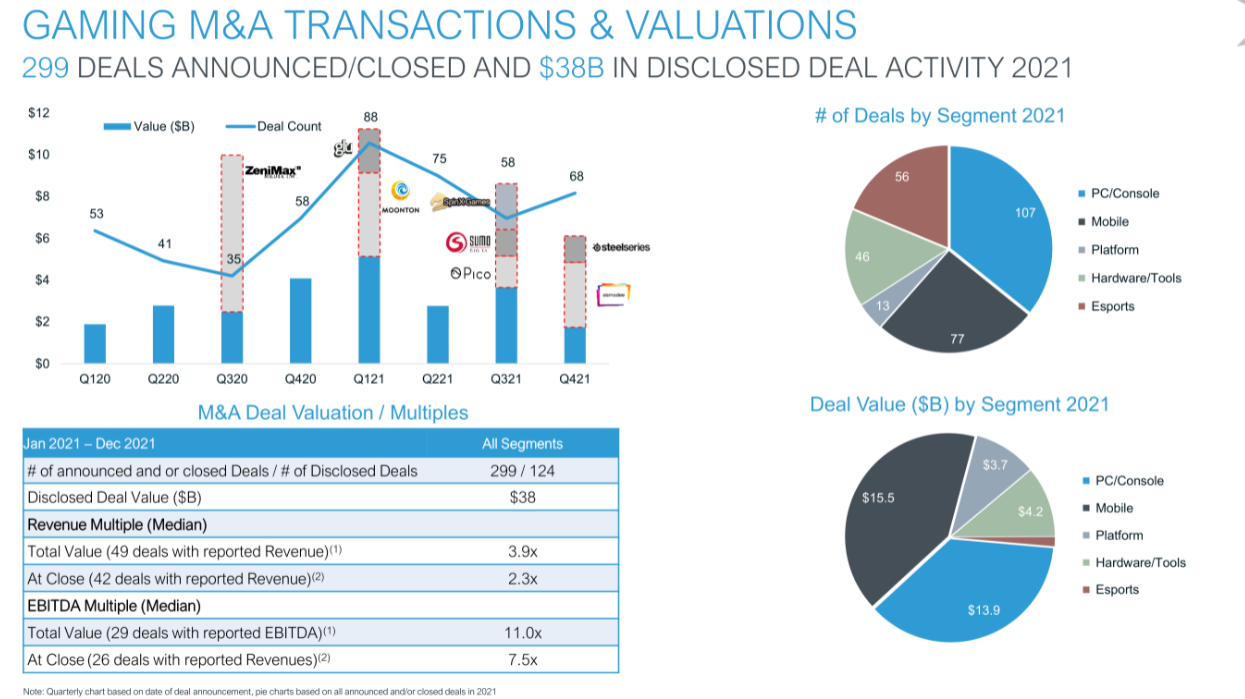

- In second place in terms of the frequency of transactions were M & A agreements – 299 transactions worth $ 37.8 billion. Market exits close the top three — 142 operations worth $ 34.5 billion.As for platforms, in 2021, the majority of mergers and acquisitions were in the PC and console segment — 107 transactions ($13.9 billion).

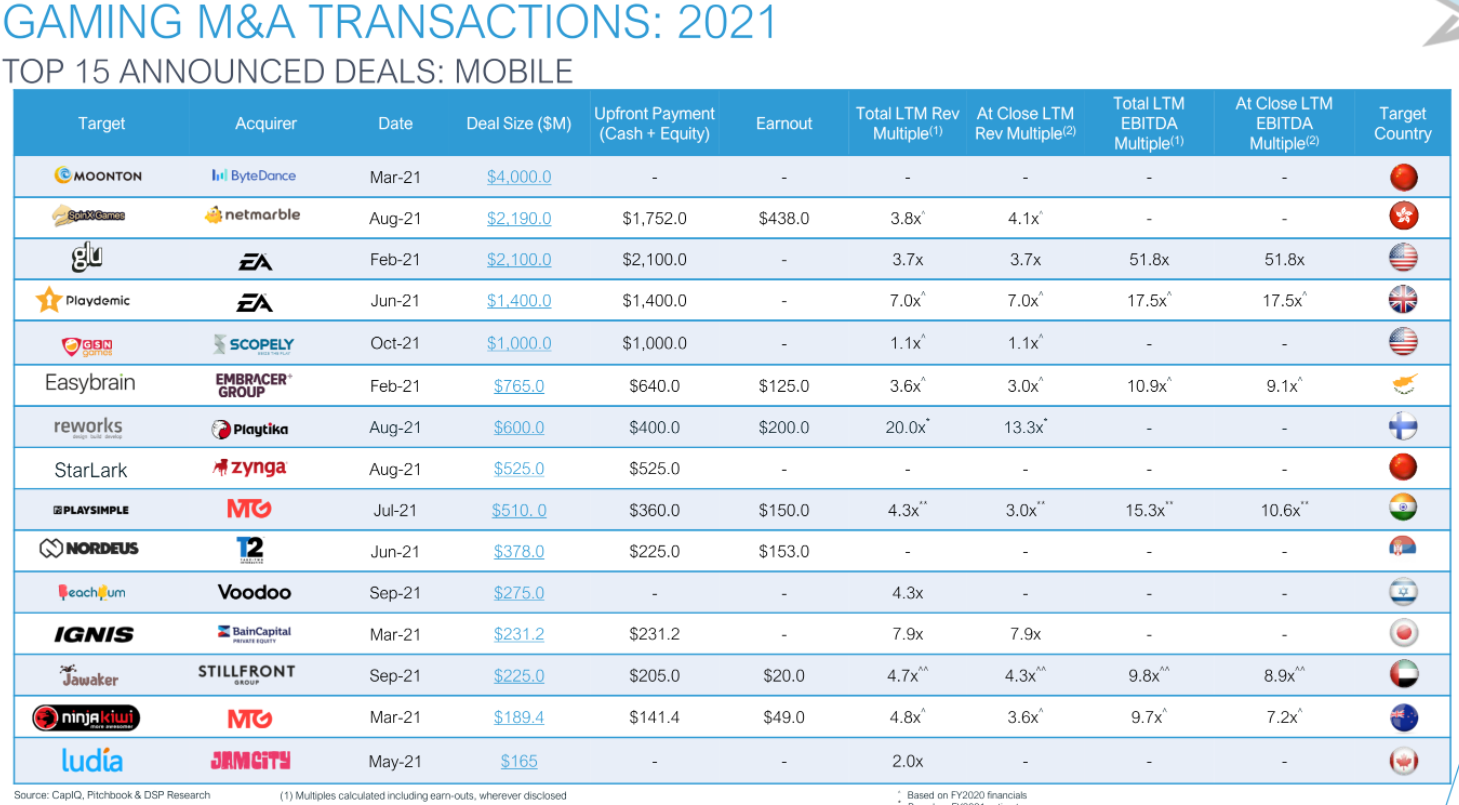

- About a quarter of all M&A agreements related to mobile – 77 transactions ($15.5 billion). Also, 56 transactions worth $ 0.5 billion were related to esports.

- The largest M&A deal announced in 2021 was the purchase of the Chinese mobile studio Moonton by ByteDance ($4 billion). Also in the top 5 mergers and acquisitions included deals between Embracer Group and Asmodee ($3.1 billion), Netmarble and SpinX Games ($2.19 billion), Electronic Arts and Glu Mobile ($2.1 billion), ByteDance and Pico ($1.5 billion).

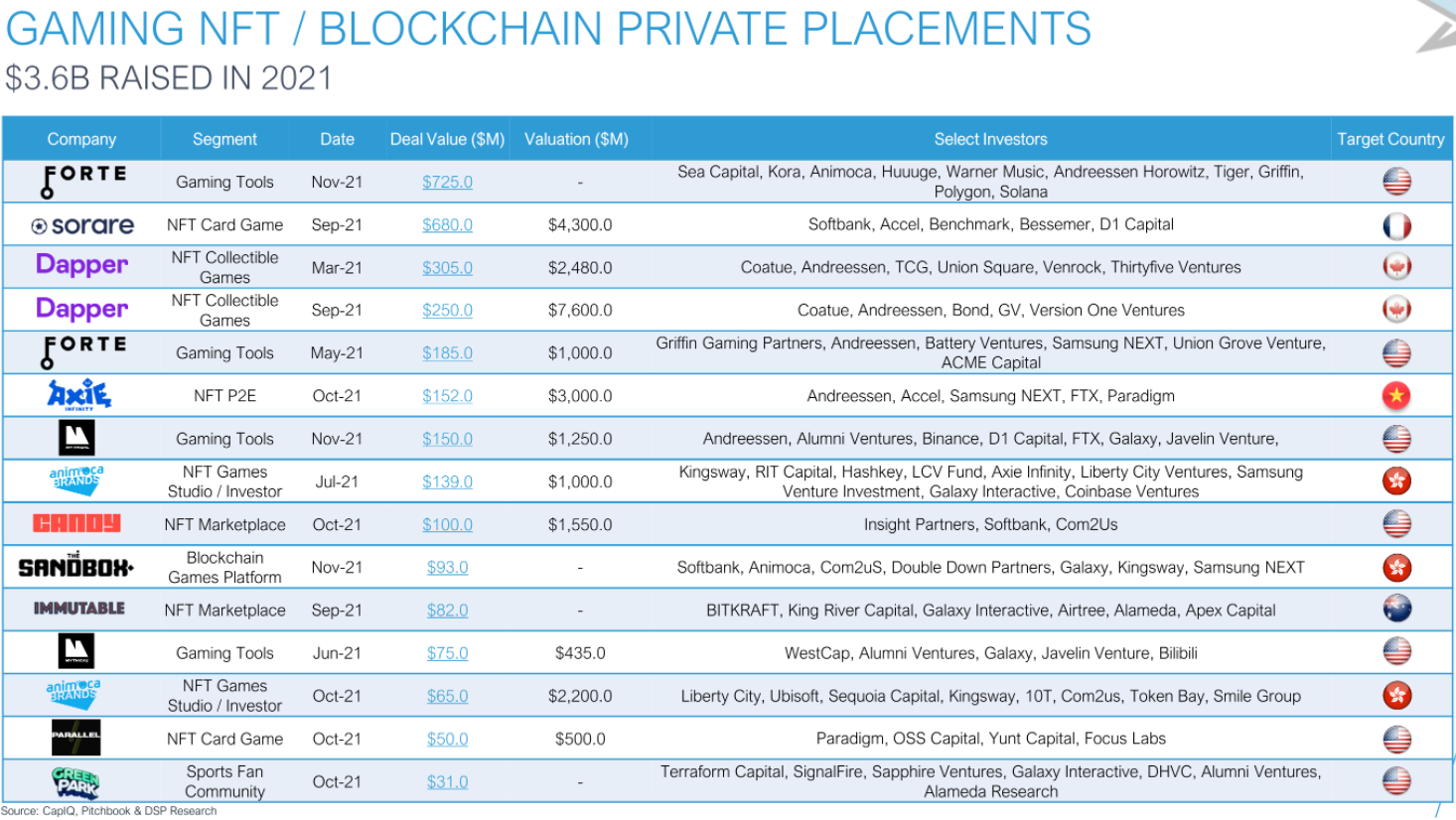

- In 2021, blockchain and NFT gaming companies raised $3.6 billion from investors. The largest deals in this segment are Forte ($725 million), Sorare ($680 million) and Dapper Labs Series ($305 million).

- The most active investors in the gaming industry included Bitkraft, Galaxy Interactive, Makers Fund, Play Ventures and a16z.