Unity has published a gaming report in which it told how things were going with monetization in mobile games in 2020. We have chosen the main one from it.

Methodology

For its research, Unity attracted data from 300 thousand applications. All information was collected from January to December 2020. Only data related to rewarded video and static/fullscreen advertising (static display/interstitial) were taken into account.

1.Last year, mobile gamers spent more in games than ever before

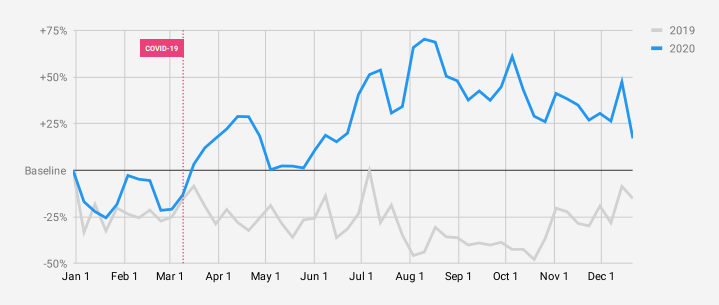

Mobile set new records in 2020 largely due to the COVID-19 pandemic. In-game purchases of the first day (D1 IAP) began to grow sharply in the spring with the arrival of the global lockdown. Over the year, this indicator has grown by more than 50% compared to 2019.

Dynamics of D1 IAP changes in 2019 and 20202. Advertising revenue has increased in almost all mobile genres

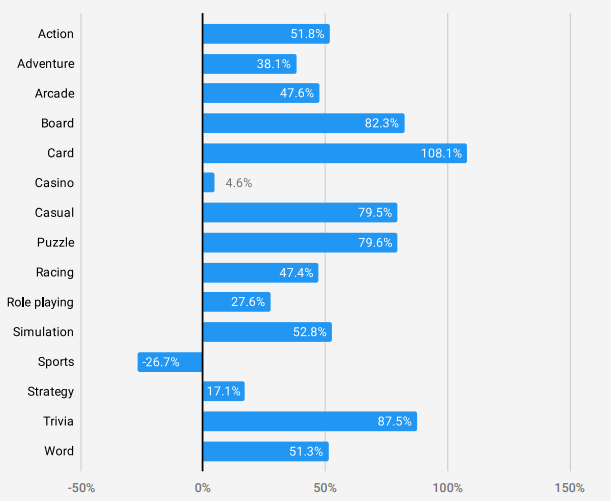

Total revenue from mobile advertising in games increased by 8% year-on-year. The greatest growth was shown by advertising in card projects (108.1%). Quizzes (87.5%), board games (82.3%) and puzzles (79.6%) also managed to achieve impressive results.

At the same time, advertising revenue in sports games fell by 26.7%. This is primarily due to the fact that in 2020, almost no large-scale sports events were held in real life due to covid restrictions.

Dynamics of revenue growth from advertising by genre compared to 2019The main source of earnings for most applications were in-game purchases

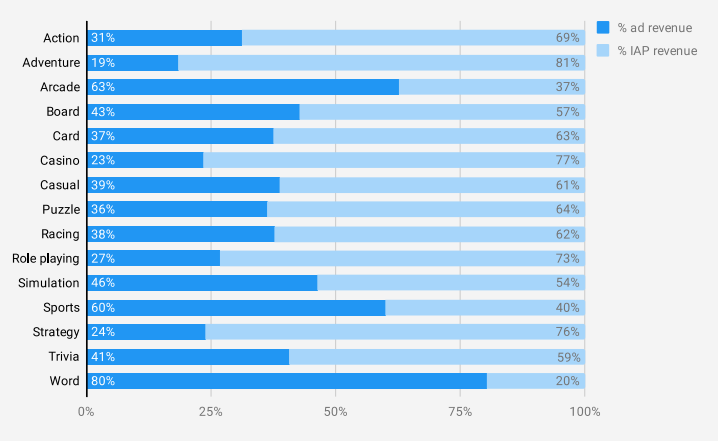

Only in three genres of mobile games, the share of advertising revenue exceeded the IAP: word projects (80%), arcade games (63%) and sports games (60%). Despite the fact that in 2019 there were twice as many genres earning mainly from advertising.

But for the Asian market, advertising has remained the most monetization channel. In China, it accounted for 60% of income, and in Japan — 57%.

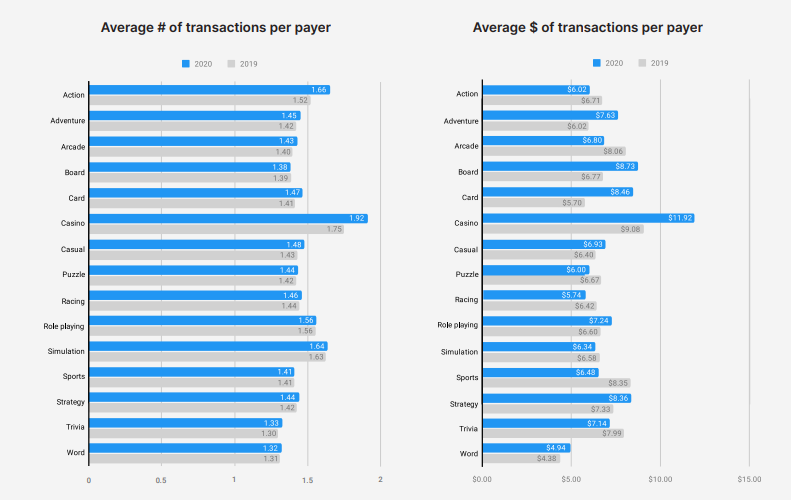

The ratio of revenue from advertising and from IAP by genreIn 2020, the number of payments per player increased, but their amount decreased

In seven of the fifteen analyzed genres, the amount of payments per user decreased slightly compared to 2019. Sports games suffered the most again. On average, the player spent $6.48 in them, which is $1.87 less than a year earlier.

The casino turned out to be the leader in terms of purchases per user — $11.92. In the same games, payments were made more often than in others — there were an average of 1.92 transactions per gamer.

Average number and amount of payments per playerForecast for 2021:

Changes in Apple’s policy towards IDFA will affect the advertising market and the mobile ecosystem itself.

- Developers of hyper-casual games, for example, will face considerable difficulties. The fact is that they will lose access to user data and will no longer be able to quickly increase the audience with targeting;

- the cross-platform trend will continue. According to Unity, in the past there was a clear boundary between smartphone games and PC/console games. However, in 2020, projects like Among Us and Genshin Impact proved that this boundary has become conditional. Modern mobile titles are now also able to support mid- and hardcore mechanics typical of console and PC games;

- even after the pandemic, the number of gamers will remain large. This is due to the fact that some of the users who started playing in 2020 have already managed to get used to doing it.

You can read the full report here. In it, Unity also told how 2020 went for mobile freeplay and for multiplayer console and PC projects.