InvestGame analysts have prepared a study on transactions in the gaming industry over the past year. It turned out to be fruitful. The volume of investments, public offerings and M&A agreements reached $33.6 billion.

Important: the company does not have an array of comparative data for previous years, since it began analyzing transactions only in 2020. Also, the collected statistics do not take into account transactions related to gambling entertainment (casinos, etc.).

In total, InvestGame examined in detail three key sectors: gaming, gaming platforms and technologies, as well as esports. We chose the main thing about the games — you can read about the rest in the report itself.

But first the big picture

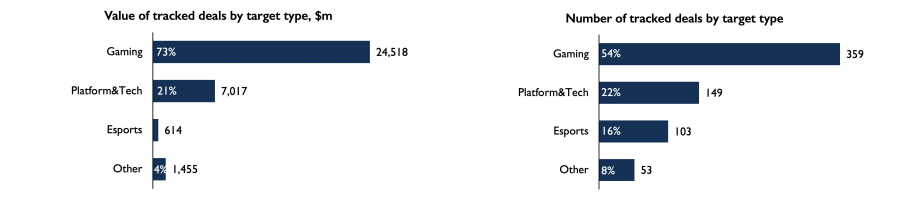

- In 2020, 664 transactions related to the gaming industry were conducted in the world. Of these, 359 were directly related to games, 149 — to platforms and technologies, 103 — to esports, 53 — to other segments.

- The total volume of transactions amounted to $33.6 billion. $24.5 billion was spent on gaming companies, $7 billion on platforms and technologies, $614 million on esports companies, and $1.4 billion on the rest.

Volume and revenue of transactions in the gaming industry for 2020

- Most of the deals were concluded in the USA. The States account for 36% of all transactions and four transactions that are in the top 10 largest.

- A little less often transactions were carried out in China. The Celestial Empire was responsible for 27% of agreements and four out of ten top deals.

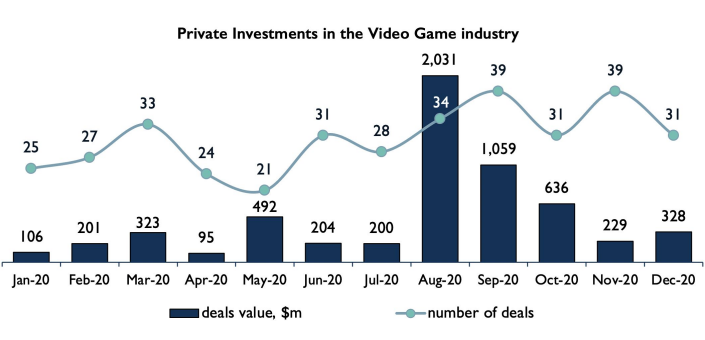

- Private investments turned out to be the most common type of transactions in the industry, although not the most monetary — 363 investments accounted for “only” $5.9 billion.

- The most actively invested in the second half of 2020. It was then that 55% of transactions were carried out, the cost of which amounted to approximately $ 4.4 billion (75% of the total amount of all private investments).

Dynamics of private investment in the gaming industry in 2020

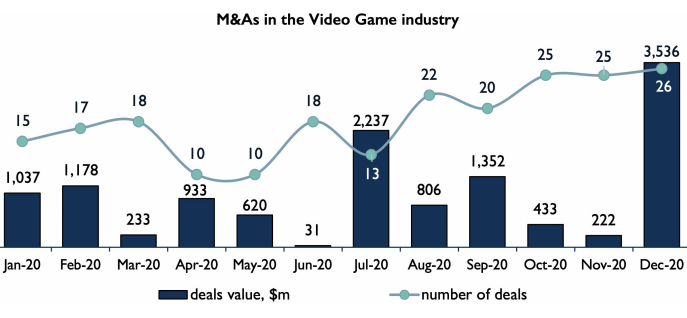

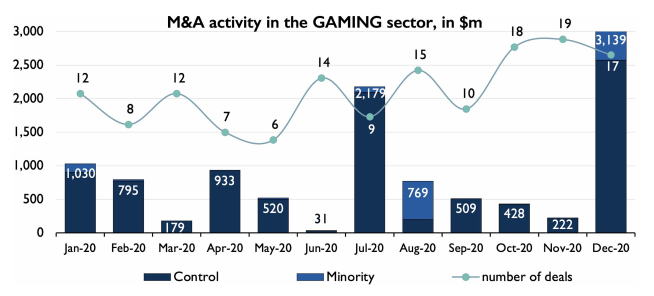

- 2020 was the largest year for M&A agreements in the gaming industry (before that, 2016 was considered a record). In total, 219 transactions with a total size of $12.6 billion were closed on the market in 2020. And if we take into account the announced, but not yet completed deals like the takeover of ZeniMax Media by Microsoft, then this amount will jump to $ 22.2 billion.

- The key buyers of 2020 are Tencent, Embracer, Stillfront and Zynga. In total, they concluded 60% of all transactions.

- The two most expensive acquisitions in the past year were the purchase of Peak Games by Zynga (about $2 billion) and the sale of Leyou Technologies to the Chinese giant Tencent (about $1.4 billion).

Dynamics of mergers and acquisitions in the gaming industry in 2020

- 2020 could be a bad year for public offerings related to the gaming industry. In the first quarter, the market activity almost completely froze, but it managed to catch up later due to a surge of interest in the entertainment sector. The volume of PO (Public Offering activity) for the year exceeded $ 15 billion.

- Despite the market instability, 18 companies decided to go public at once last year. The most “cash” IPOs were organized by Unity Software, Skillz and Kakao Games — together they raised $2.8 billion.

Dynamics of public offerings in the gaming industry in 2020

Transactions in the gaming segment

Investments:

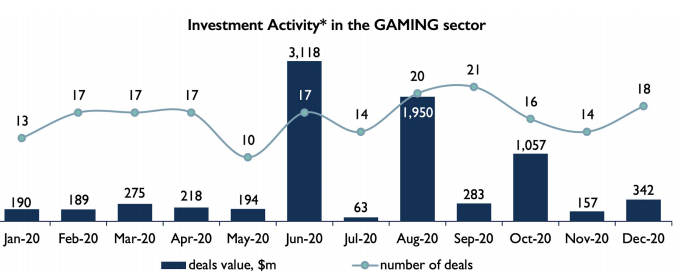

- the gaming sector set a new record for the number of investments in 2020. If you add up all the venture, corporate and private investments in companies directly related to games, the total amount for 194 transactions will be an impressive $ 8 billion;

Dynamics of investments related to games in 2020

- $4.8 billion (61%) came from investments in just three companies: NetEase, Epic Games and Embracer Group;

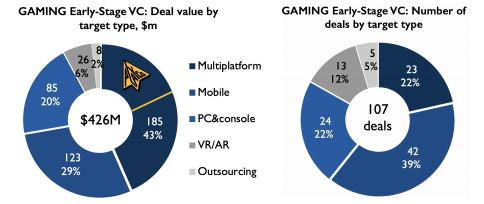

- pre-sowing and seed investments in publishers and developers amounted to about $426 million out of all $8 billion. Moreover, investors most often invested in mobile at the early stages — 39% of transactions (42 out of 107) with a total value of $185 million related to this segment;

- although mobile took the leading position in early investments, the largest transaction was in the multiplatform segment. In September, the startup for instant games Playco raised $100 million at a valuation of $1 billion;

Distribution of early investments in gaming-related companies by segment

- transactions of later stages of financing accounted for $2.9 billion through 48 transactions. Most of the money (70%) went to developers and publishers of multiplatform games (mainly for PC and smartphones);

- Epic Games ($1.78 billion) and Roblox ($670 million) received the largest investments in the late stages;

- also in 2020, investors invested a lot of money not only in gaming companies themselves, but also in venture funds focused on games. For example, Griffin Gaming Partners ($235 million), Bitkraft ($165 million), Grishin Robotics ($100 million), March Gaming ($60 million), Ne3twork ($50 million), Transcend Fund ($50 million) and VGames ($30 million);

- The most active funds of the past year are Bitkraft, Galaxy Interactive and Andreessen Horowitz.

Mergers and acquisitions:

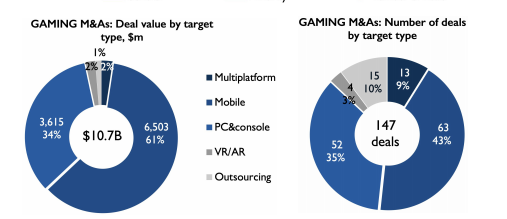

- It took $10.7 billion to acquire gaming companies.

Dynamics of M&A activity related to games in 2020

- moreover, those who specialize in a particular platform were most often bought — these 115 transactions cost $ 10.1 billion. For comparison, the multiplatform segment could boast of only 13 purchases totaling $250 million;

Distribution of purchases and mergers of gaming companies by segments

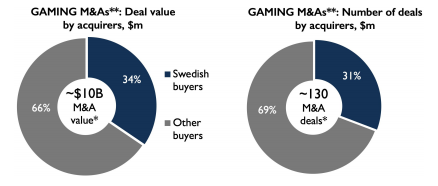

- In 2020, companies from Sweden performed well in the M&A market. They accounted for 31% of all purchases in the gaming segment. The leading Swedish strategic investor was Embracer, which spent $1.4 billion in 25 deals. Among other Swedish firms, Stillfront, Enad Global, MTG and Thunderful Group were also active;

The ratio of Swedish companies to the rest

- but among the global strategic investors, Tencent, Zynga and Microsoft were especially noted.

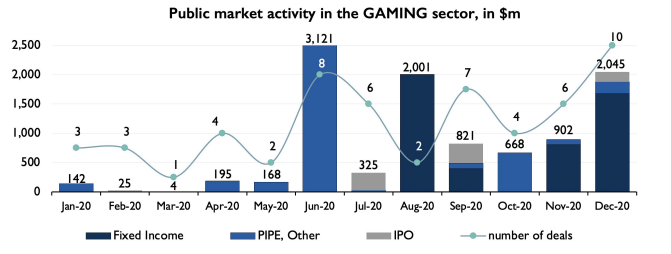

Public offering of shares:

- Due to the COVID-19 pandemic, there was a lull in the stock market until the end of spring. Later, the situation improved. For example, in July and August, repeated placements were carried out by NetEase ($2.7 billion) and Activision Blizzard ($2 billion), respectively. It should be noted that these were the largest placements on the stock exchange last year;

Dynamics of public offerings related to games in 2020

- in general, 11 gaming companies entered the stock exchange for the first time during the year, where they collected a total of $0.9 billion (Unity‘s IPO is not taken into account here, since InvestGame refers the developer to the segment of technology platforms, not games);

- In total, gaming-related companies raised $4.7 billion on the stock market last year, making 39 transactions.

Forecast for 2021

- Market consolidation will continue this year, InvestGame believes. The place of the most active buyers is likely to go to Tencent and Scandinavian corporations (for example, Embracer). Many American companies can also join them.

- InvestGame assumes that in 2021, large gaming companies will compete with venture funds in terms of investments.

- Analysts also predict that there will be a lot of IPOs in 2021. The main candidates for successful initial placements, according to InvestGame, are Scopely, AppLovin and Epic Games.