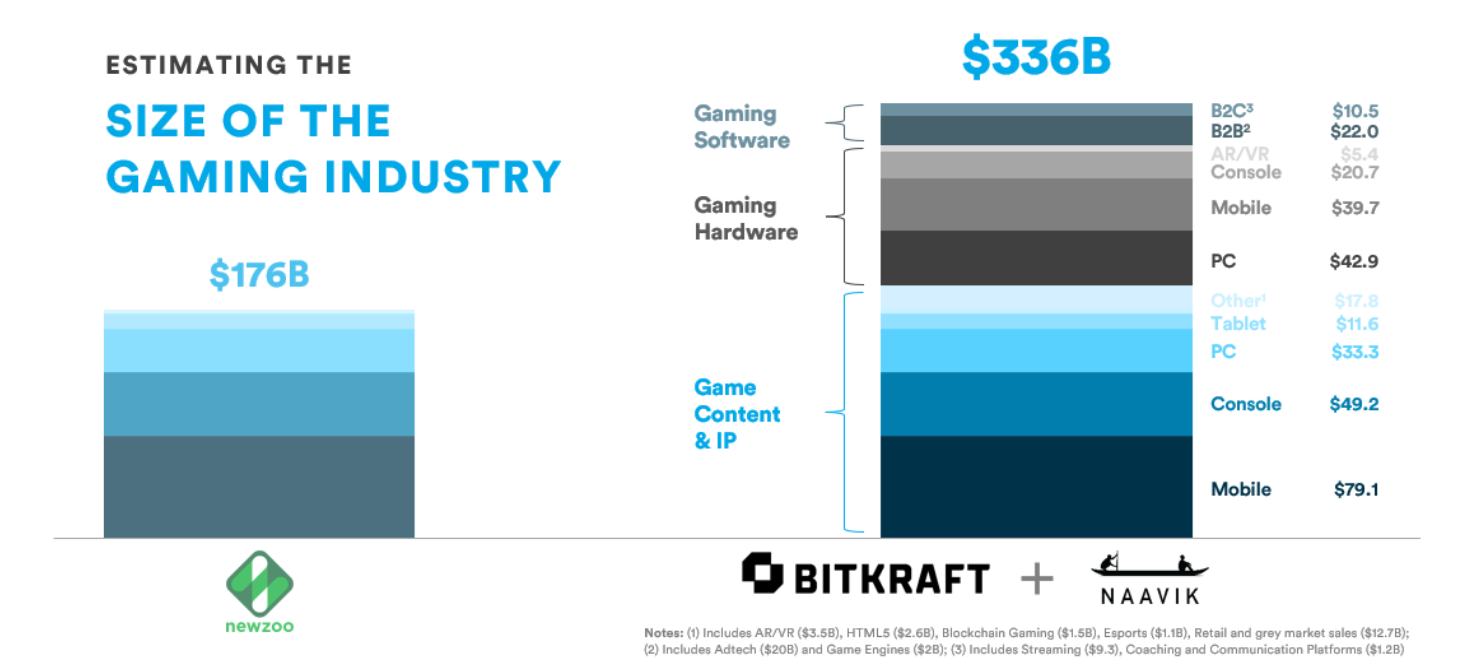

The consulting firm Naavik and the investment fund BITKRAFT Ventures have estimated that this year the revenue of the video game industry will be $336 billion — twice as much as previously forecast*. They received such a figure after they took into account the income of the gray market, blockchain, advertising, iron sales and many other things that analysts had previously ignored.

According to the companies, after the term “gamer” has evolved, it’s time to reconsider the definition of the “gaming industry”. We need to look at it more broadly, since many segments have changed significantly and have begun to earn more. For example, previously, analysts did not track the revenues of VR and blockchain games, but in recent years they have grown well. Also, hardware was no longer limited to consoles, but began to include esports accessories and peripherals for streamers.

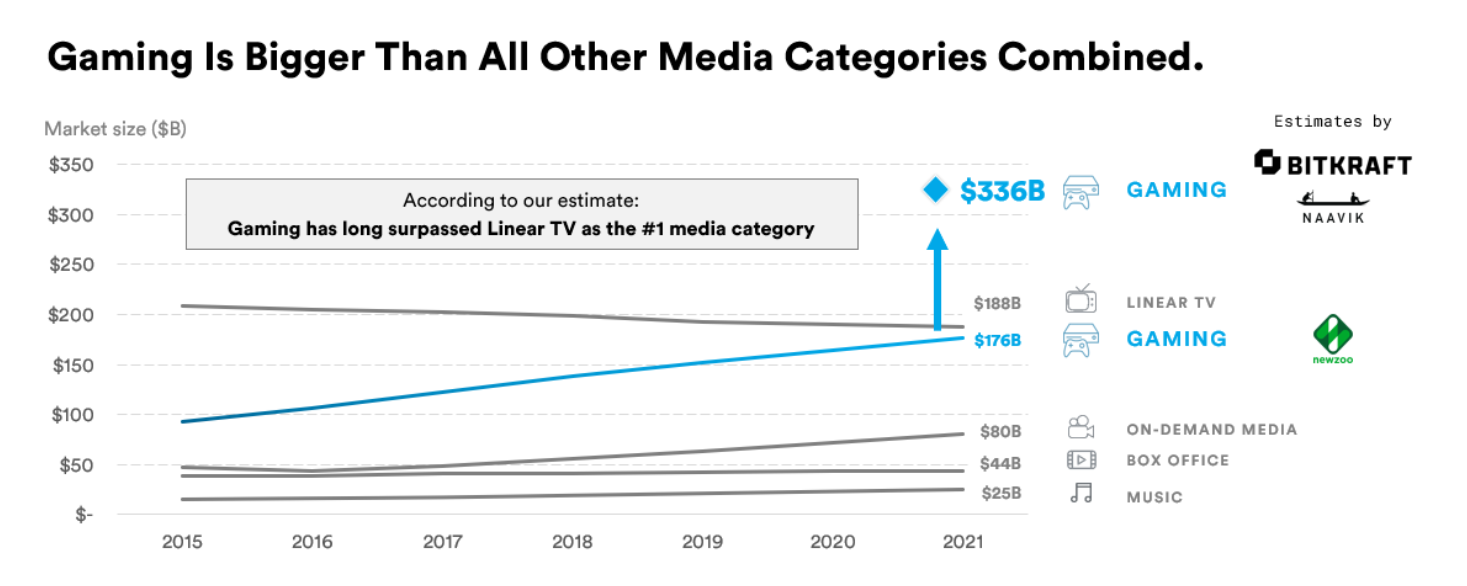

If we take into account everything that was previously omitted, then at the end of 2021 the gaming industry will be more profitable than television, cinema and music combined.

*Naavik and BITKRAFT Ventures compare their data with the Newzoo report. In May, Newzoo indicated that the gaming industry will earn “only” $175.8 billion by the end of 2021. The latter took into account exclusively the sales of video games.

Video games

Revenue directly from video games is what analysts usually pay attention to when they study the revenue of the gaming industry. Most often we are talking only about sales on so-called traditional platforms: PC, mobile and consoles. But Naavik and BITKRAFT Ventures decided that this was not enough for the full picture and added a few more categories.

- In 2021, video games will be responsible for more than half of the industry’s revenue. They will bring in $194.5 billion or 58% of the total revenue.

- The lion’s share of video game earnings (89% or $173 billion) will come from traditional platforms: mobile ($90.7 billion), consoles ($49.2 billion) and PC ($33.3 billion).

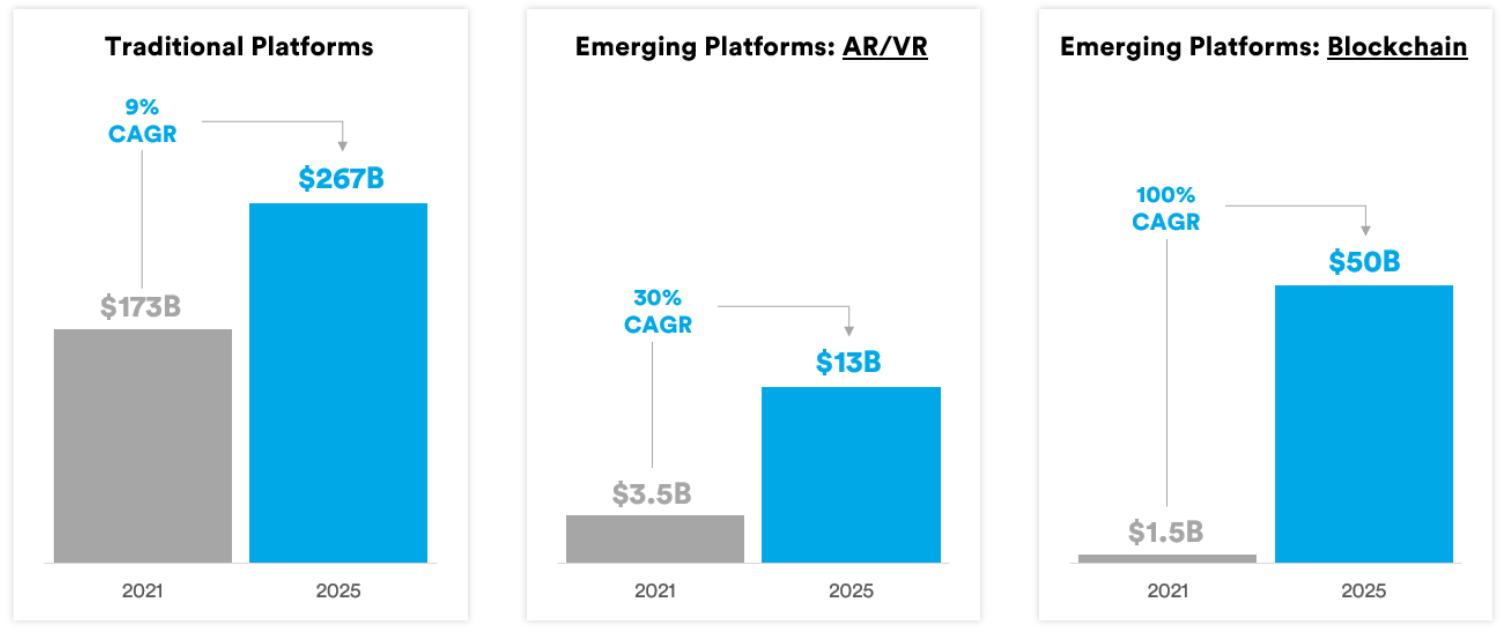

- Another 4% or $7.7 billion will be provided by developing platforms: AR/VR* ($3.5 billion), browser ($2.6 billion), blockchain ($1.5 billion). Moreover, despite the fact that blockchain games will earn the least in 2021, in the future they will show rapid growth. According to the forecast, in 2025 their revenue will be $ 50 billion, while AR/VR titles will collect only $ 13 billion.

- Sales on the gray market will bring $11.5 billion — 6% of all video game earnings.

- Also, about $ 0.3 billion segment will earn through the sale of cheats.

- Esports revenue will be $1.1 billion.

According to Naavik and BITKRAFT Ventures, the interests of gamers may change a lot in the near future. For example, it is possible that users will play much more blockchain games (including those with NFT). At the moment, there are relatively few such games — about a thousand. The same number of titles were in the first time of the App Store. But the companies do not deny that there is a possibility that blockchain projects will find themselves in a “depression of disappointment” when gamers stop being interested in them.

Naavik and BITKRAFT Ventures also note the potential of esports. When the pandemic is over, tournaments will begin to take place more often, and there will be more spectators at them. Because of this, revenue will grow. In addition, new games may appear in the future that will attract the attention of esports players.

*Companies did not take into account mobile AR/VR games, but looked at projects for headsets. Like Tilt Five.

Iron and peripherals

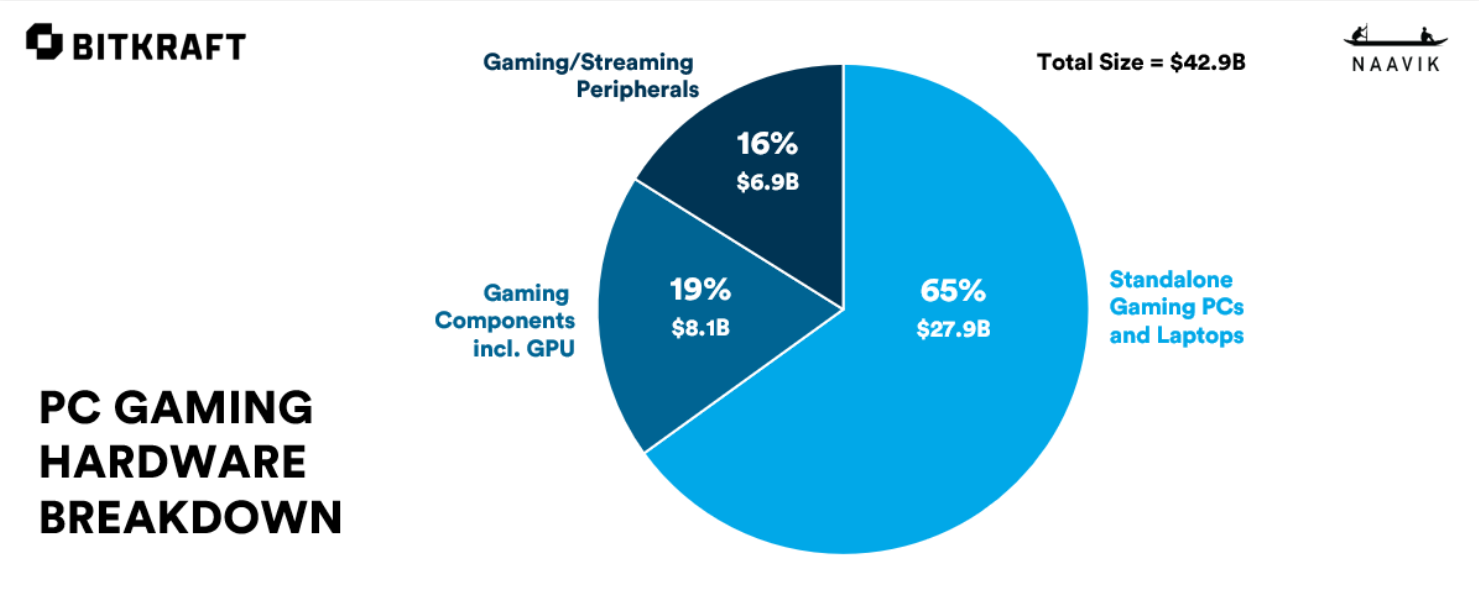

As in the case of video games, analysts used to approach the hardware segment too narrowly, Naavik and BITKRAFT Ventures are sure. The companies stressed that cloud and PC games have become so popular that it is worth considering the sales of related devices. Both gaming computers themselves and accessories with peripherals.

The same applies to the VR/AR category. According to the companies, headset sales may even surpass console sales in the coming years. Largely thanks to investments from IT giants such as Facebook, Apple and Sony. However, first this category needs to cope with technical barriers.

Gaming smartphones are another important category. According to Naavik and BITKRAFT Ventures, mobile games will continue to gain popularity around the world, and smartphone manufacturers will increasingly release devices for gamers.

- Iron sales are the second most profitable segment in the gaming industry. This year, it will earn $108.6 billion (32% of the total industry revenue).

- Of this amount, $42.9 billion will be on the PC. Sales of gaming desktop computers and laptops alone will provide $27.9 billion. Another $8.1 billion will bring sales of components, and $6.9 billion — sales of peripherals.

- Gaming smartphone sales will be responsible for $39.7 billion.

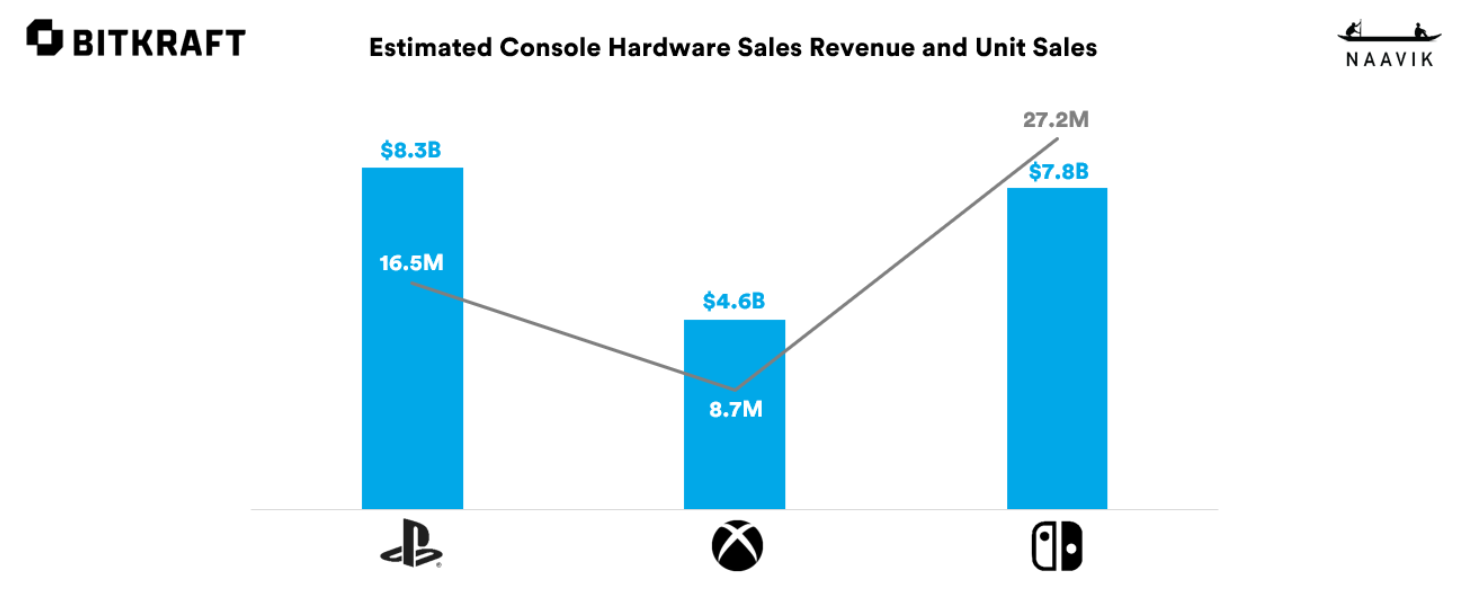

- As for console sales, they will generate $20.7 billion. The most profitable console will be the PlayStation — $ 8.3 billion. In second place will be the Nintendo Switch — $ 7.8 billion, and in third place the Xbox — $ 4.6 billion.

- Sales of VR/AR headsets will provide the segment with another $5.4 billion.

Gaming-related services and content

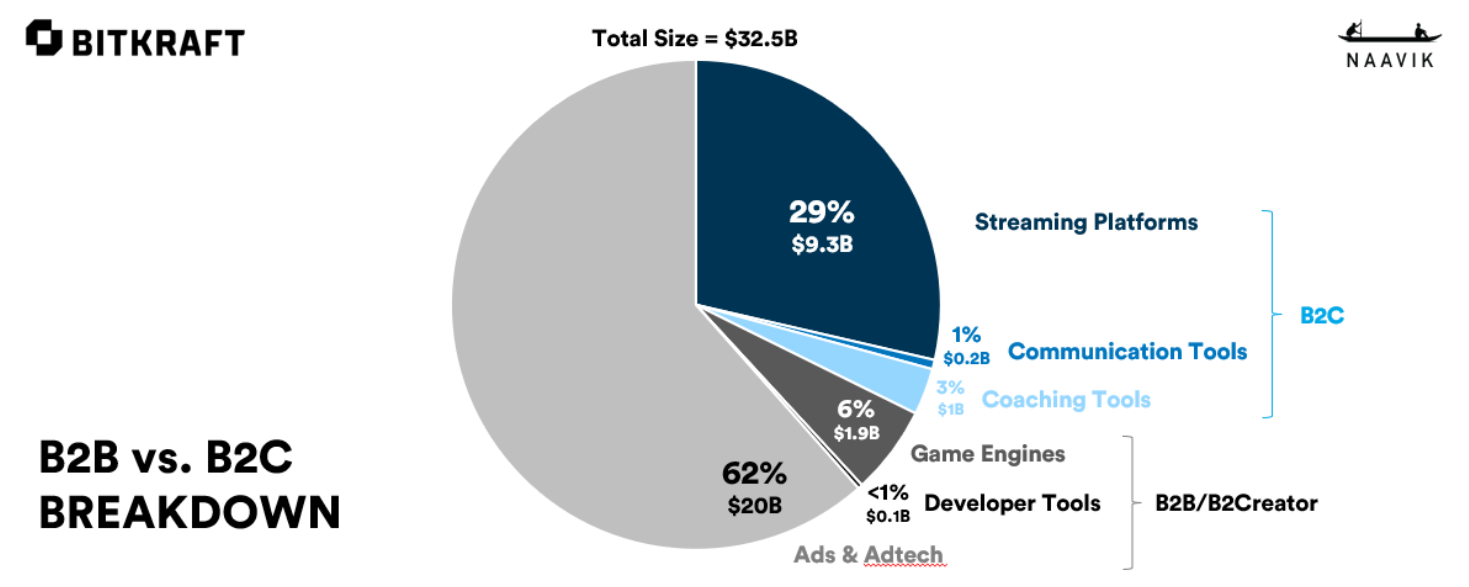

Naavik and BITKRAFT Ventures decided to divide the segment into two categories: B2B (business focused on another business) and B2C (consumer-oriented business). For example, B2B includes advertising, engines and tools for developers, and B2C includes streaming platforms like Twitch, platforms for gamers to communicate such as Discord and Teamspeak, and training courses for gamers.

- In total, the segment will earn $32.4 billion for the year.

- Of these, two—thirds will come from B2B – $22 billion. Moreover, $20 billion is revenue from advertising alone. The remaining $2 billion B2B will bring game engines ($1.9 billion) and developer tools ($0.1 billion).

- The revenue of the B2C category in 2021 will be $10.5 billion. Most of this money ($9.3 billion) will be generated by streaming platforms. Communication platforms will be responsible for another $0.2 billion. The training courses will bring in the remaining $1 billion.

Separately, Naavik and BITKRAFT Ventures pointed out the potential of game engines. According to the companies, now engines like Unity and Unreal Engine focus on attracting users, not on monetization. But that may change over time. In this case, their share in the total revenue of the gaming industry will grow. However, it is worth considering the behavior of more democratic platforms like Manticore Games, which can dump the market in an attempt to lure more developers.