The authors of the Deconstructor of Fun blog summed up the results of 2021. They shared several charts, telling about the revenue of the mobile market, the number of new releases and the impact of IDFA-related changes on the industry.Note: The graphs are based on Sensor Tower data.

They do not take into account information from China, Japan and South Korea, because “these markets are relevant mainly for local developers.”

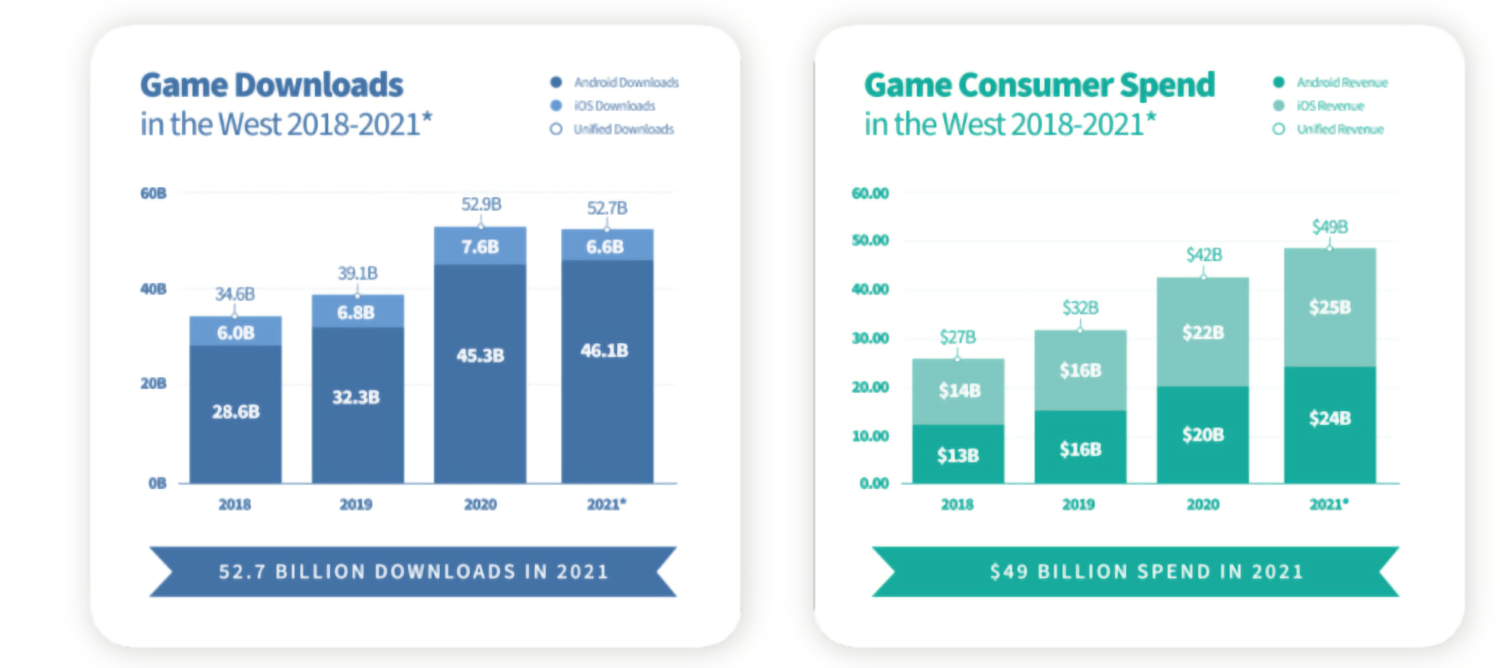

- Compared to 2020, the mobile industry slowed down its growth last year. Downloads remained approximately at the same level as a year earlier — 52.7 billion. Revenue also reached a record $49 billion — an increase of 17% year-on-year.Deconstructor of Fun attributes the decline in growth rates to changes in Apple’s IDFA policy.

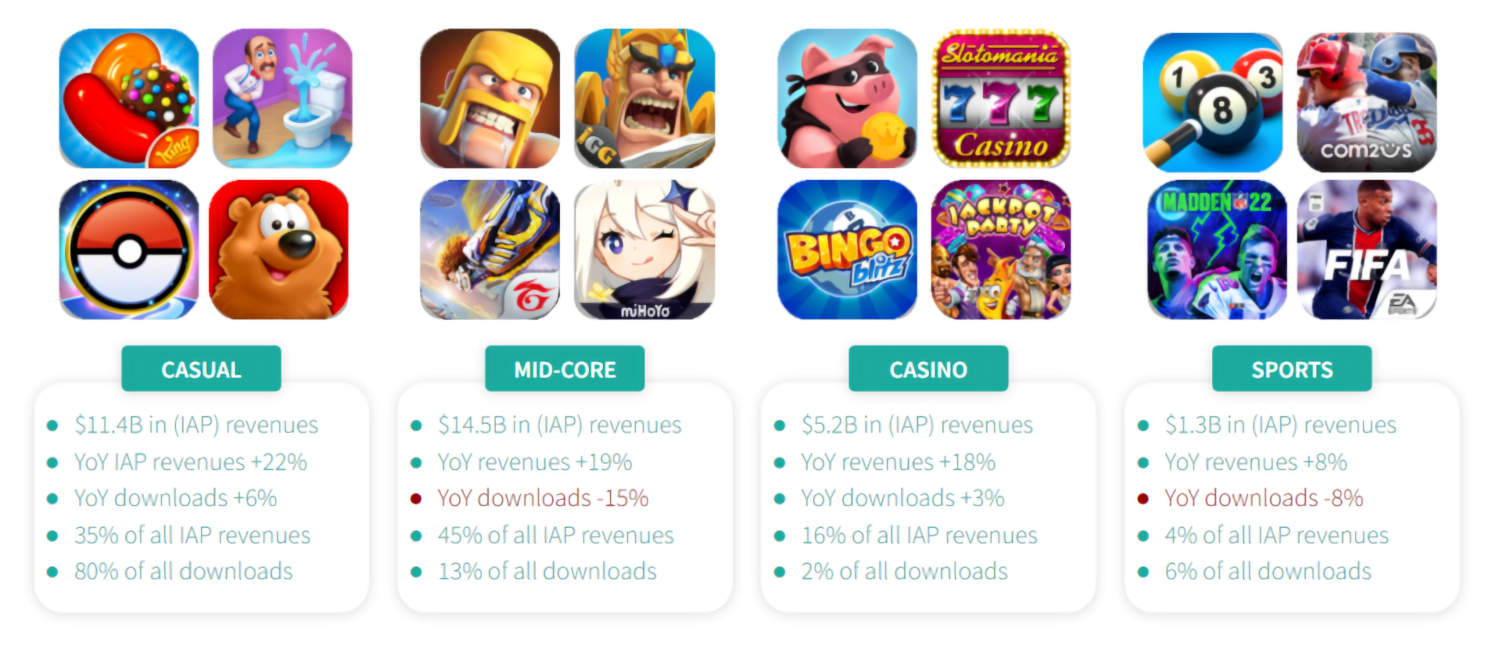

- Because of this, it became much more difficult to purchase users in the second half of last year.Genres whose monetization depends on “whales” suffered the most from the changes on iOS.

- As a result, downloads of midcore titles fell by 15% year-on-year. Sports games also had a negative effect on themselves — their downloads decreased by 8%.Despite this, revenue increased for all genres represented on the charts.

- The revenues of casual titles amounted to $11.4 billion (an increase of 22% year—on-year), midcore – $14.5 billion (+19%), social casinos — $5.2 billion (+18%), sports games — $1.3 billion (+8%).

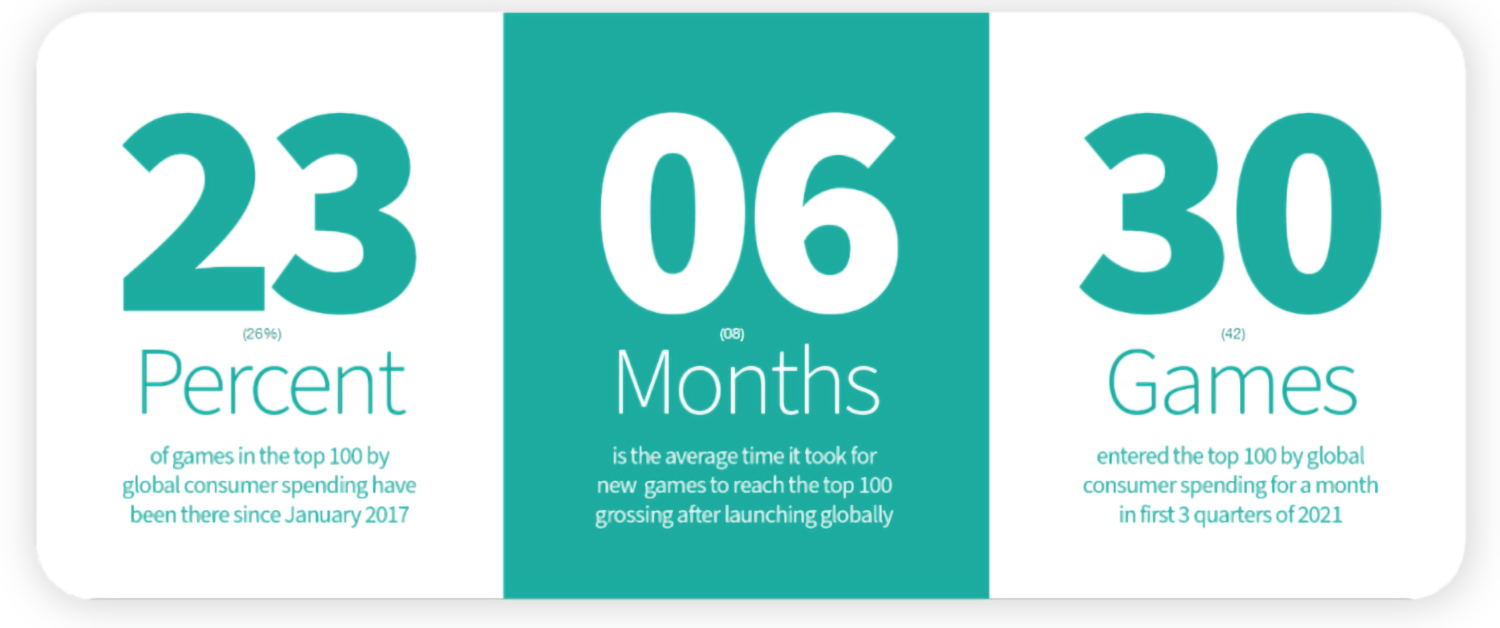

- In 2021, 46 thousand new games appeared on the mobile market — this is the worst result since 2011. Deconstructor of Fun notes that lockdowns and difficulties associated with the transition to remote work played a big role in this. Also, new restrictions on the market slowed down the speed of advertising campaigns, which affected the launch of games in the softlonch.On average, new games took six months after the global launch to enter the top 100 highest-grossing titles.

- In total, 30 new projects got into the top 100, which is 12 pieces less compared to 2020.At the same time, 23% of all games from the top 100 by global revenue have been held there since January 2017.

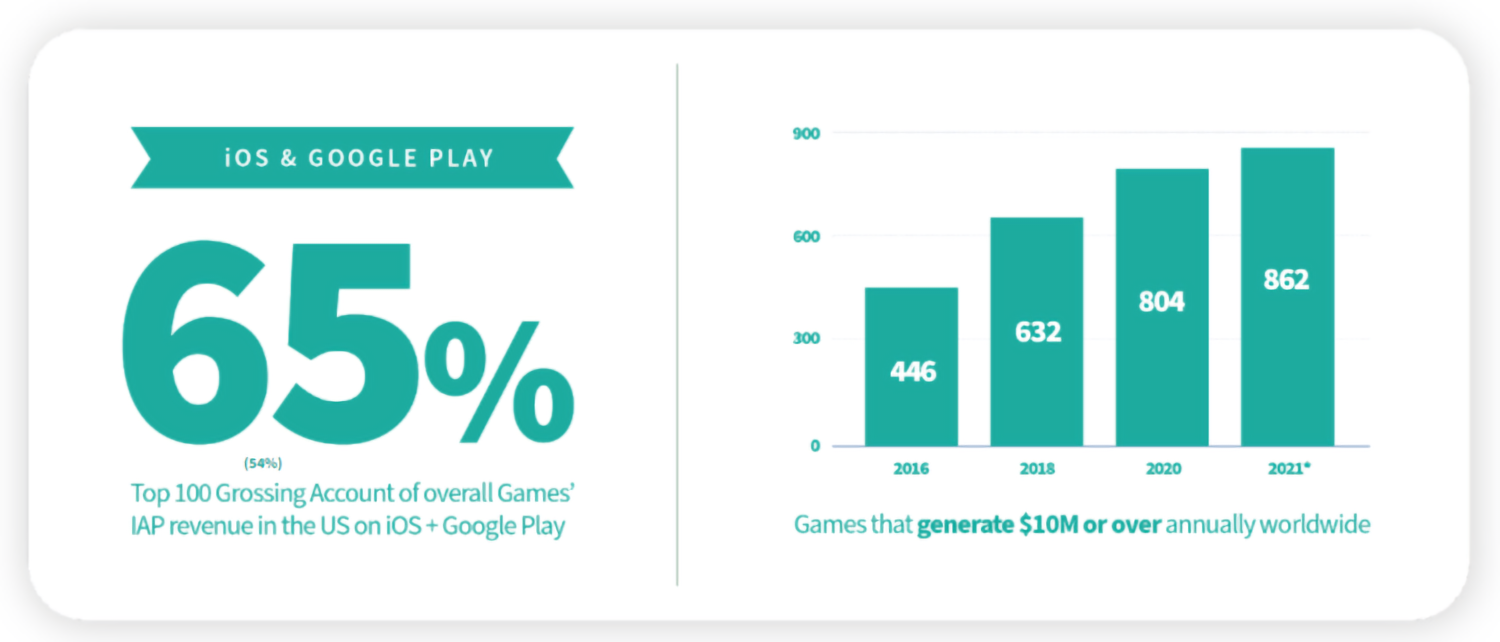

- Titles from the top 100 provided 65% of the total revenue of the US mobile market.

- At the same time, the number of games that earned over $10 million continued to grow and reached 862.