On the eve of the Game Developers Conference 2022 (to be held from March 21 to 25), the organizers published an annual study on the state of the gaming industry. The survey was attended by 2,700 developers who spoke about their preferred platforms, game promotion, remote work and their attitude to NFT.

Popularity of platforms

- PC remains the most popular development platform — 63% of respondents choose it to develop their current projects.

- PlayStation 5 and Xbox Series X|S are in almost equal position — 31% and 29%, respectively. Parity is also observed in the mobile segment — 30% of developers make games for iOS and Android.

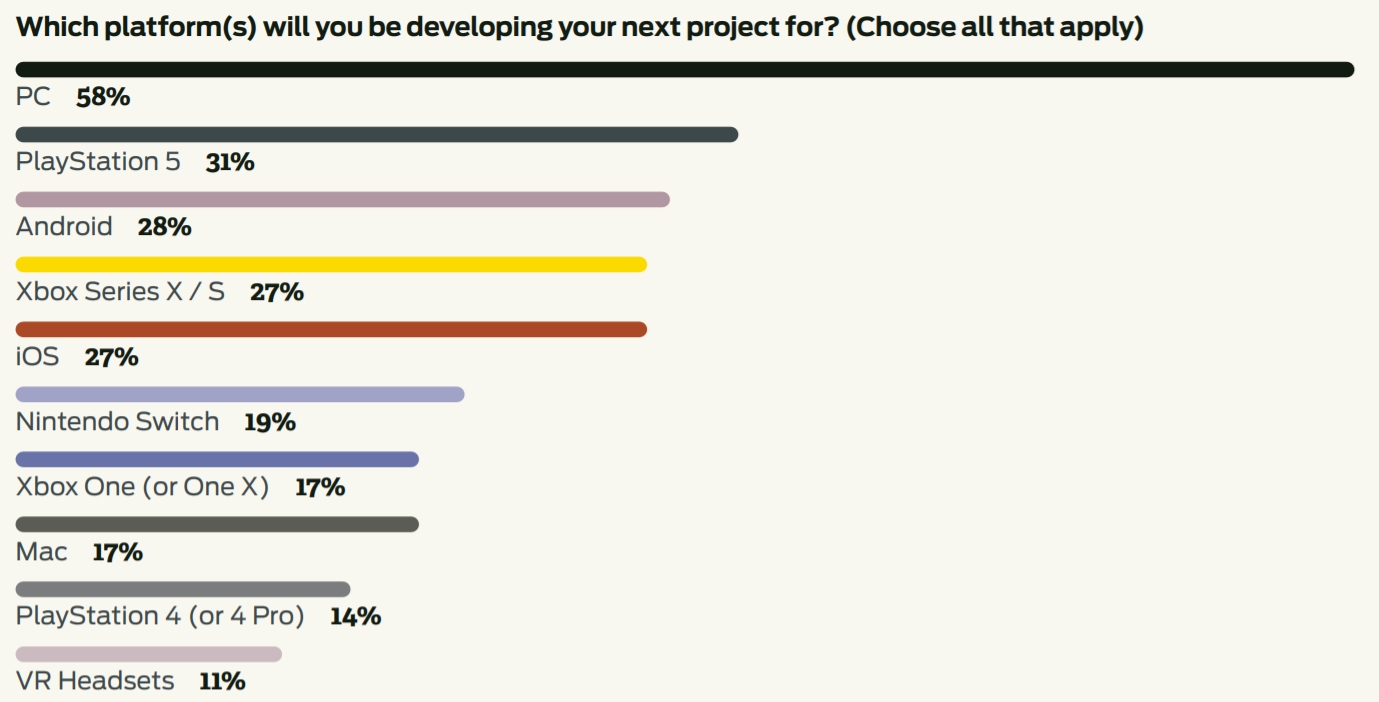

- The picture changes a little in the case of choosing a platform for future games. PC still leads with 58%, followed by PlayStation 5 (31%), Android (28%), Xbox Series X|S (27%) and iOS (27%).

For which platforms will developers make their next games

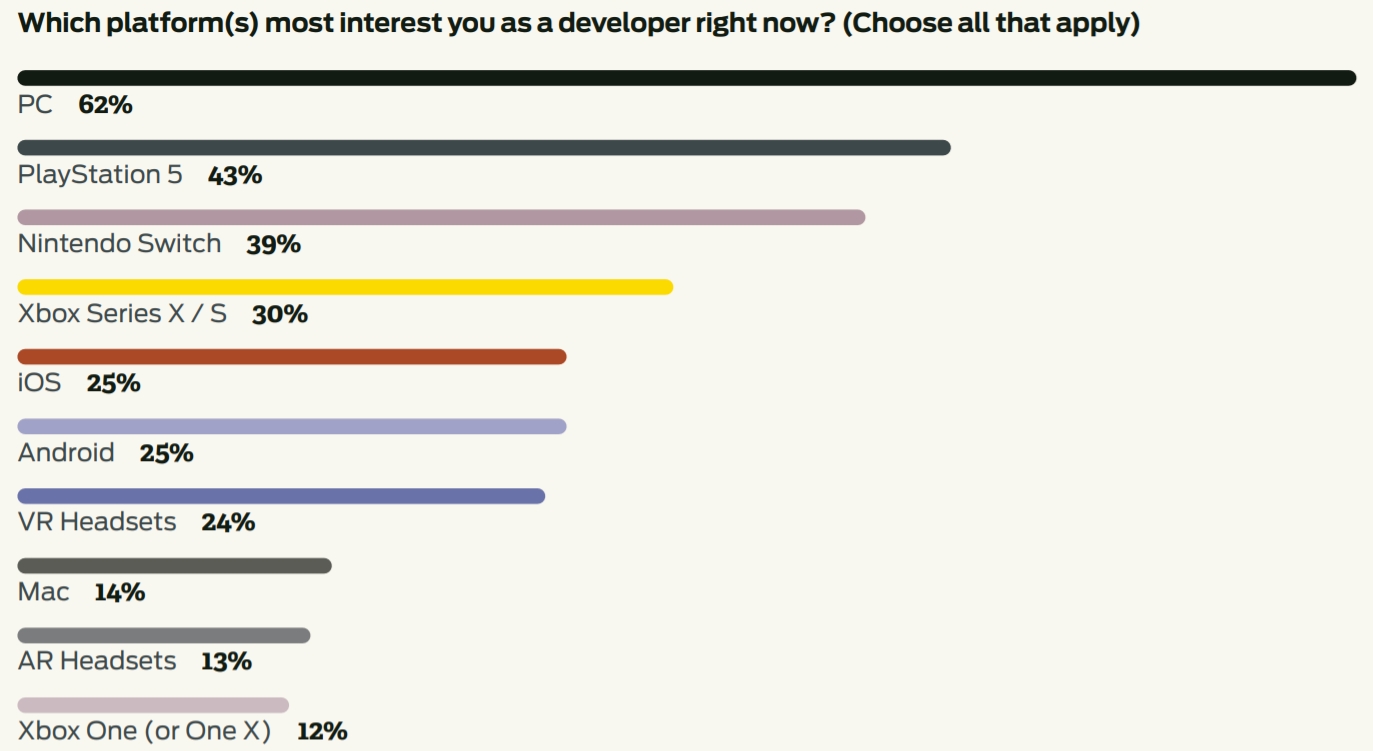

- At the same time, interest in the PC as a platform continues to grow. Over the year, it has grown from 58% to 62%. If we talk about consoles, most developers are interested in creating games for PS 5 (43%), Nintendo Switch (39%) and Xbox Series X|S (30%).

Which platforms are developers most interested in right now

- If you look at the interest in platforms in retrospect, you can see that since 2013, the popularity of the PC has grown from 48% to 63%. But the desire of developers to make mobile titles has almost halved — from 55% in 2013 to 30% in 2022.

- The popularity of VR has also noticeably decreased. In the middle of the tenth, in just two years, interest in creating games for virtual reality helmets soared from 7% to 24%. However, by 2022, it has rolled back — only 10% of respondents choose VR as a platform.

VR and AR platforms that developers are interested in

Marketing

- Social networks remain the most popular channel for promoting games. 25% of respondents invest moderate funds in marketing on sites like Twitter and Facebook.

- A lot of developers promote games through YouTube videos, forums and email marketing – the share of each of these channels was 24%. Another 22% of respondents use the press and bloggers (22%), communication with users in Discord and Slack (21%), as well as Twitch streamers (20%).

- Some developers have started investing in Snapchat and TikTok. However, 71% of respondents still do not invest in promotion through short videos.

Attitude to new devices, high-profile events and trends

- The reaction to the Steam Deck among developers is still ambiguous. 36% of respondents believe that the device will become a viable platform in the long term. However, 47% of developers are not yet sure about the future of the portable gadget from Valve.

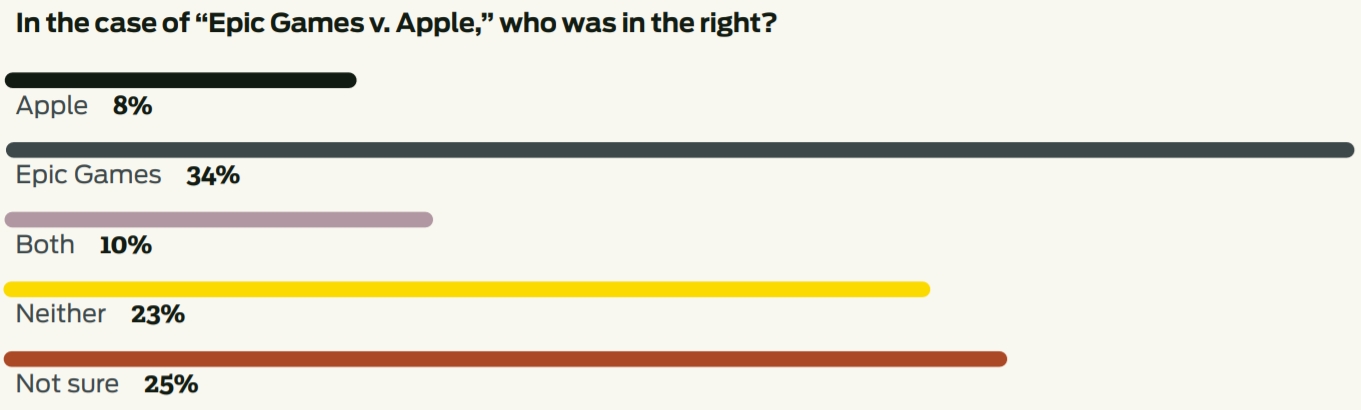

- Speaking about the lawsuit between Apple and Epic Games, more than a third of developers sided with the authors of Fortnite. The company from Cupertino is supported by only 8% of respondents.

Who was right in Apple’s case against Epic Games, according to the developers

- Developers are in no hurry to create content for UGC platforms. 83% of respondents noted that they do not participate in the metaverse in any way. The remaining respondents are almost equally ready to make content for Roblox (5%), Minecraft (4%), Fortnite (3%), Dreams (3%) and Core (2%).

- Speaking of companies that have announced their ambitions in the field of metaverses, developers believe most in the success of Epic Games (17%), Meta (8%), Microsoft (8%), Roblox (6%) and Google (5%).

- Despite the growing interest in cryptocurrencies and NFT, most game developers are skeptical about this phenomenon. Over 70% are not interested in this area at all. The share of developers who already use NFT or cryptocurrencies was only 1%.

Attitude to Cryptocurrencies and NFT

- More and more developers are ready to add tools to their games that increase their accessibility for people with sensory, motor or other disabilities. However, their share is still not high enough — only 39%.

Work format

- The pandemic has not had a negative effect on most studios. 50% of respondents noted that their companies, on the contrary, have expanded their staff over the past year. Only 13% of respondents told about the cuts.

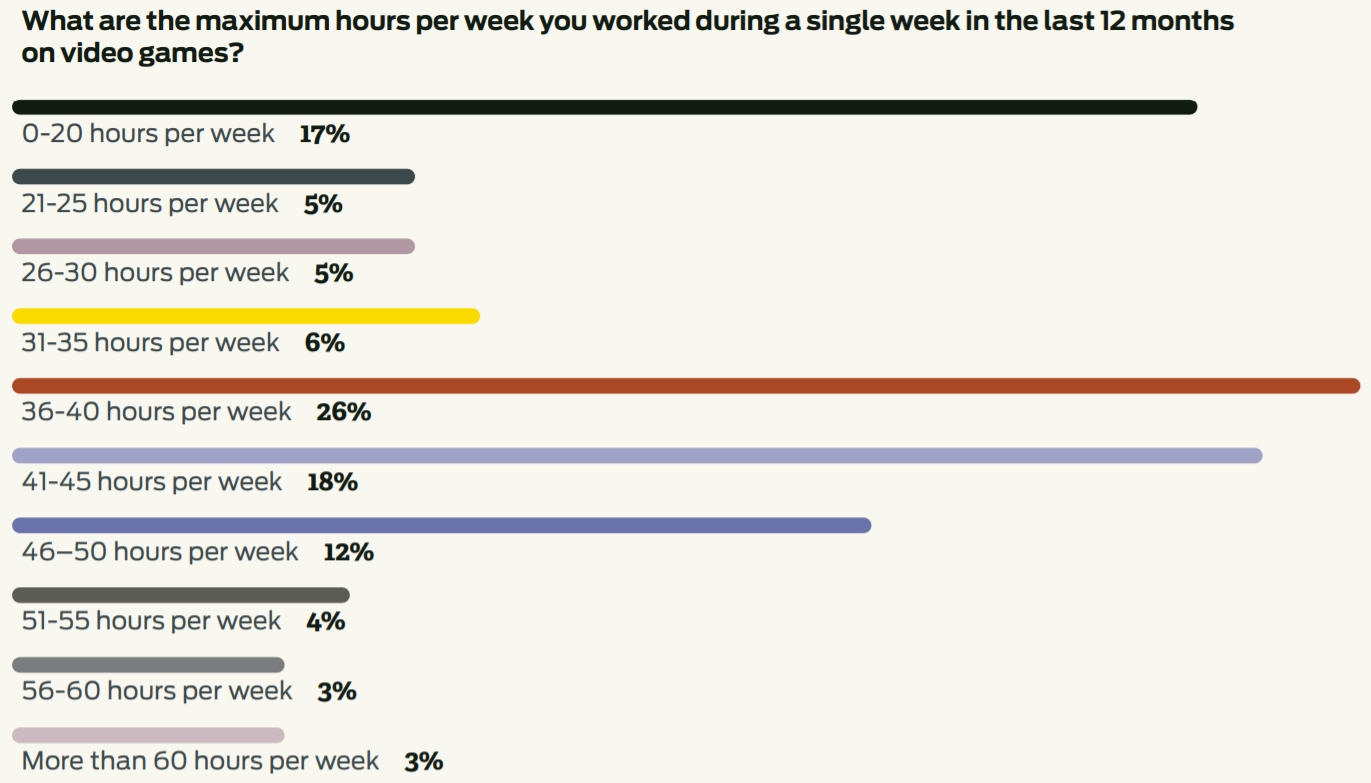

- For the first time, the share of developers who work 40 hours a week or less has reached 60%. In the previous two years, it held at 55%.

- Overtime has decreased compared to previous years, but crunches are still a problem in the gaming industry. 44% of respondents noted that they had to work over 40 hours a week at least once. Of these, 3% of respondents had a maximum working week of more than 60 hours.

Maximum number of working hours per week

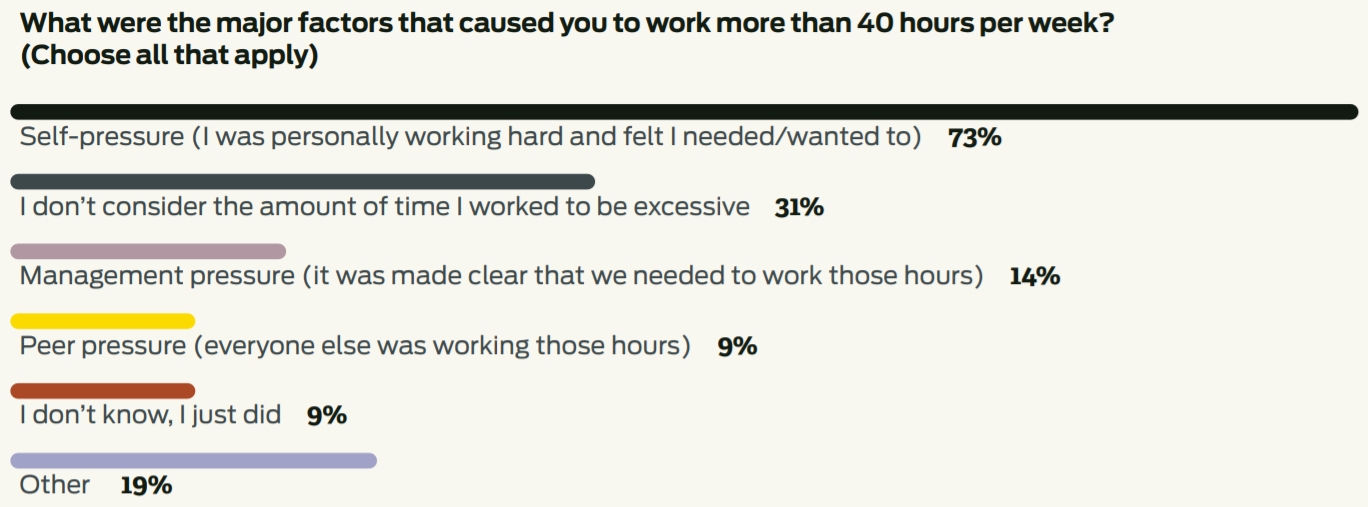

- 73% of developers recycled because they felt they had to or wanted to do it themselves. 14% of respondents noted that crunches occurred due to pressure from management. Another 9% worked overtime because their colleagues did so.

Reasons why developers recycle

- 32% of developers admitted that they had completely switched to remote work. Among other answers, the most popular was the remote model with the ability to visit the office — 29%.

- Another 4% of respondents said that their company had completely canceled remote work, and 3% noted that they had never stopped going to the office since the beginning of the pandemic.

How do studios treat remote work and work in the office