Ultra-casual games have appeared on the market. The publisher of Homa Games has analyzed their features in the material “The rise of ultra—casual games – a temporary trend or a new round of hyper-casual?” App2Top.ru publishes the translation.

Perfect Slices

Now most of the mobile charts are flooded with games of a separate subgenre of hyper-casual.

Someone called them “zen games”, someone called them “soul games” (satisfying games); we at Homa Games call them ultra-casual. Ultra—casual games are the newest stage in the development of hyper-casual games, and they are designed to reach an even wider audience of people who have not played games before. There are already enough such games on the market to talk about the emergence of a new subgenre.

What are ultra-casual games?

These can be the most diverse games. What unites them is the following: in them the player performs repetitive actions, which, oddly enough, do not cause boredom, but satisfaction. The task in such games is to use various materials (liquids, paints, wood or even slime) to reach new levels.

Such an easy gameplay can be mastered by anyone. Ultra-casual entertains users, helps to relieve stress, opening access to new beautiful colors, realistic textures and materials. These games try to visually satisfy, as well as give a sense of belonging.

As we have already noted, ultra-casuals are very simple and repetitive. This makes them related to ordinary children’s toys. They expanded the concept of “casual games” more than hyper-casual did.

I Peel GoodFeatures of ultra-casual games:

- low CPI;

- on average, lower retention than hyper-casual (ultra-casual games lack depth and variety to engage and retain the player for a long time);

- high advertising indicators;

- rich opportunities for micro-feedback;

- rich opportunities for inserting rewarded video ads.

For example, ultra-casual games lack content and deep gameplay. This hits the RV. Instead, the authors of the ultra-casual bet on meta, which is often unrelated to core gameplay. In the meta ultra – casual is often put:

- shops with all kinds of cosmetics (can be unlocked via RV);

- keys for rooms and chests;

- gifts (also unlocked via RV);

- money multipliers.

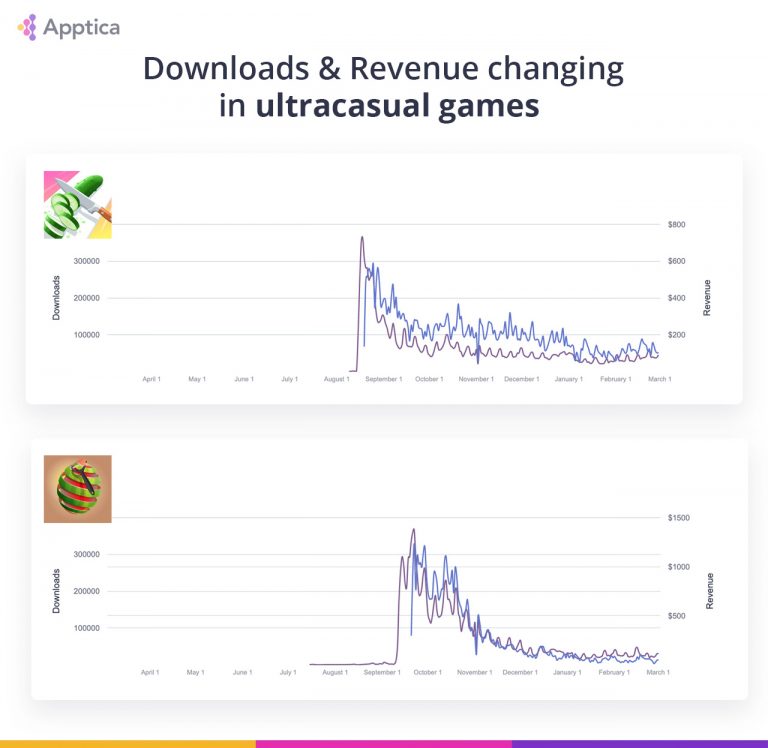

Ultra-casual games earn less from the attracted user. But they can reach a large audience and scale more easily. This means that by reaching the top of the charts, they will attract more organic users. And it is precisely these users who play the main role when it comes to the profitability of the entire project as a whole.

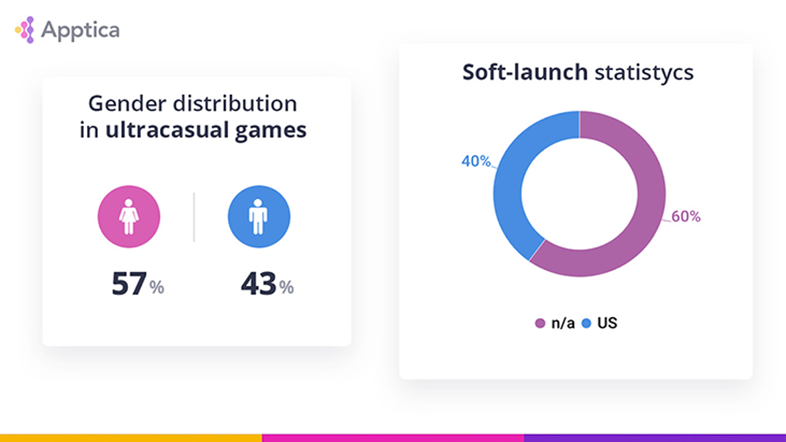

According to analysts, publishers are more likely to release a casual game in the softphone than a hyper- or ultra-casual one. Only half of all the ultra-casual games published in the USA were softlonch. Of the ultra-casual games in the USA, only half have passed the softlonch. The rest of us got involved right away. This is because ultra-casual games have a shorter development and testing period, and they are published faster, which allows you to save more money.

Since ultra-casual games have simple and pleasant gameplay, they always have users who do not consider themselves gamers. This is shown by the chart of the gender distribution of the audience. Female players dominate. (In casual games, the average sex ratio is 50/50; in midcore and hardcore — 70% of men and 30% of women).

(There is no separate category of “ultra-casual” in the App Store, so we have collected data on the most popular games that fit this definition. The data is collected in 35 countries and 25 largest advertising networks.)

How and why ultra-casual games appeared

The first reason. At the beginning of 2018, part of the market was sure that a hyper-casual game should not have a specific theme. The developers were afraid that if they chose an unsuccessful theme, their game would not be equally interesting to male and female audiences. They say, because of this, the game will not achieve the maximum performance for the selected gameplay. That’s why at that time hyper-casual games were mostly filled with abstract shapes and drawings.

Nevertheless, the middle of 2018 was marked by a lack of good ideas for arcades and puzzles, as well as an increase in CPI. Therefore, by the end of 2018 – the beginning of 2019, playable characters (people and cars) began to be added to hyper—casual games. One of these games was Tiny Cars. Subsequently, Run Race 3D appeared, which clearly demonstrated that players like to identify themselves with the characters. The same topic was continued aquapark.io and a number of other games.

Run Race 3D

Soon, full-fledged universes began to be prescribed for hypercausals. Games like Train Taxi (whose authors were inspired by Gobble Dash) convinced the market that this idea works. Soon the balls and cubes were replaced with more related characters to the players. Different types of gameplay were also made thematic, and they proved their success.

Although themed games may repel a part of the potential audience, they are able to attract another part to which a certain topic is close. That is, games should focus on topics that are understandable to people of different cultures. (But it’s worth remembering that user tastes can change thanks to completely new mechanics and themes.)

Since developers and publishers were looking for new ideas for games that would have a low CPI, there was a trend for truly “ultra-casual” games. And it all started with games like Perfect Slices. This title is a perfect example of ultra—casual with a very simple gameplay that inspired the industry to create similar games. Another example is Pancake Art with its stunning visual effects. It is able to entertain the player with elementary gameplay. The user is focused not on the game itself, but on getting positive emotions from simple actions like drawing and a certain topic (food).

Lion Studios went even further by releasing I Peel Good, as did Homa Games with Breakfast!. In both games, it’s not the gameplay that matters, but the theme and visual perception. At this stage, ultra-casual has become an ideal subgenre for creating games with a low CPI.

The second reason. The number of hyper-casual games continued to grow every month, but there was no proportional increase in the audience. Users downloaded more and more games, but spent less and less time on each one.

The less time spent in the game, the lower its LTV. This requires games to reduce CPI and increase the number of ad impressions. Ultra-casual games have become the answer to the changed market conditions.

The income of such games is less dependent on retention. To get the maximum benefit, publishers and developers have enough of the small amount of time that users spend in the game.

Conclusion

The trend for ultra-casual games will last until:

- the subgenre is able to attract “non-gamers”;

- these games won’t get too deep.

With ultra-casuals, it is easier to achieve a low CPI, and it takes less time to develop them. So it’s definitely worth working in this subgenre. But we must remember that such games will cease to be profitable if they reach the audience ceiling, stop offering new topics or will not be able to visually influence mobile players further due to technological limitations.