InvestGame analysts have calculated the volume of investments, public offerings and M&A transactions in the gaming market over the past nine months. Spoiler alert: they are equal to $20.5 billion.

Important: InvestGame tracked transactions related to gaming developers, publishers, platforms, technology companies, cybersport organizations, software owners, retailers, outsourcers, etc. Gambling entertainment (casinos, etc.) were not included in the statistics.

Also, experts reviewed only completed and publicly announced transactions. For example, InvestGame did not take into account the takeover of ZeniMax Media by Microsoft, because it has not yet ended.

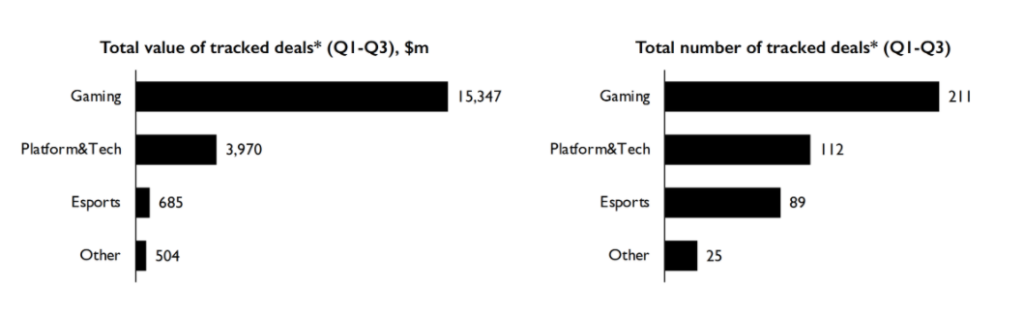

Basica total of 437 transactions were conducted this year.

- 211 of them were directly related to games, 112 — to platforms and technologies, 89 — to esports, 25 — to other areas of the gaming business;

- about $15.35 billion was spent on gaming companies, $3.97 billion on platforms and technologies, $685 million on esports companies, and $504 million on the rest;

- the most popular type of transactions is private investment. 254 agreements were made in this format. Then there are M&A — 132 deals. In third place — public placements, which took place 51 pieces;

- at the same time, the most money was left for public offerings — $9.2 billion. M&A is still in second place – $6.6 billion. The last are private investments — $4.6 billion;

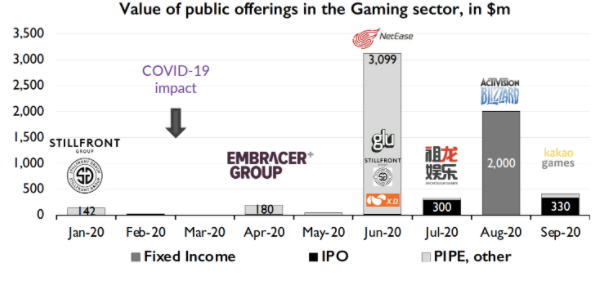

- Due to the impact of the COVID-19 pandemic, market activity dropped significantly in May, and transactions were suspended. However, after a month the activity returned to the previous level;

InvestmentThe most active investors in 2020 are Play Ventures, Galaxy EOS VC, Bitkraft Ventures, Sisu Game Ventures and Makers Fund.

- In total, they concluded 51% of all transactions;

- game developers and publishers have invested $2.7 billion in the market, making 100 transactions in three quarters of 2020. 90% of the total investment volume in the late stages and corporate rounds was in the USA;

- most often, in the early stages, they invested in mobile — 34 deals worth $ 103 million. Least of all — VR/AR (four deals worth $ 6 million);

Acquisitionsmobile is also a leader in M&A transactions – a little more than 40 of them were carried out.

- But the most profitable M&A in games concerned PCs and consoles, because revenue from these agreements amounted to $10.5 billion compared to $4.6 billion for mobile;

- The most active buyer is the Chinese colossus Tencent. Swedish Embracer Group and Stillfront Group are slightly behind him;IPO

in the period from January to May, activity on public markets practically stopped due to the pandemic.

- The situation began to return to normal in June, when several Asian companies (Archosaur Games and Kakao Games) held an IPO;

- One of the most high—profile IPOs over the past nine months was Unity‘s September one. But it is not reflected in the general statistics of the report of gaming companies because, from the point of view of InvestGame, this developer belongs to technology platforms, and not to the gaming segment.

Also on the topic:

- DFC Intelligence: Console market leaders have grown by 43% during the pandemicSensor Tower summed up the results of the first half of the year in mobile gaming

- Newzoo: in 2020, the esports market will earn $950.3 million.

- This is $150 million less than expectedIs there any news?

Share it with us, write to press@app2top.ru